Morningstar has published the sixth edition of Global Investor Experience study 2020 which surveyed 26 markets around the globe on six parameters listed below:

- Simplified and Non-Simplified Prospectus

- Fee Disclosure

- Portfolio Holding Disclosure

- Portfolio Manager Name and Compensation Disclosure

- Sales Disclosure

- Environmental, Social and Governance, or ESG, and Stewardship Disclosure

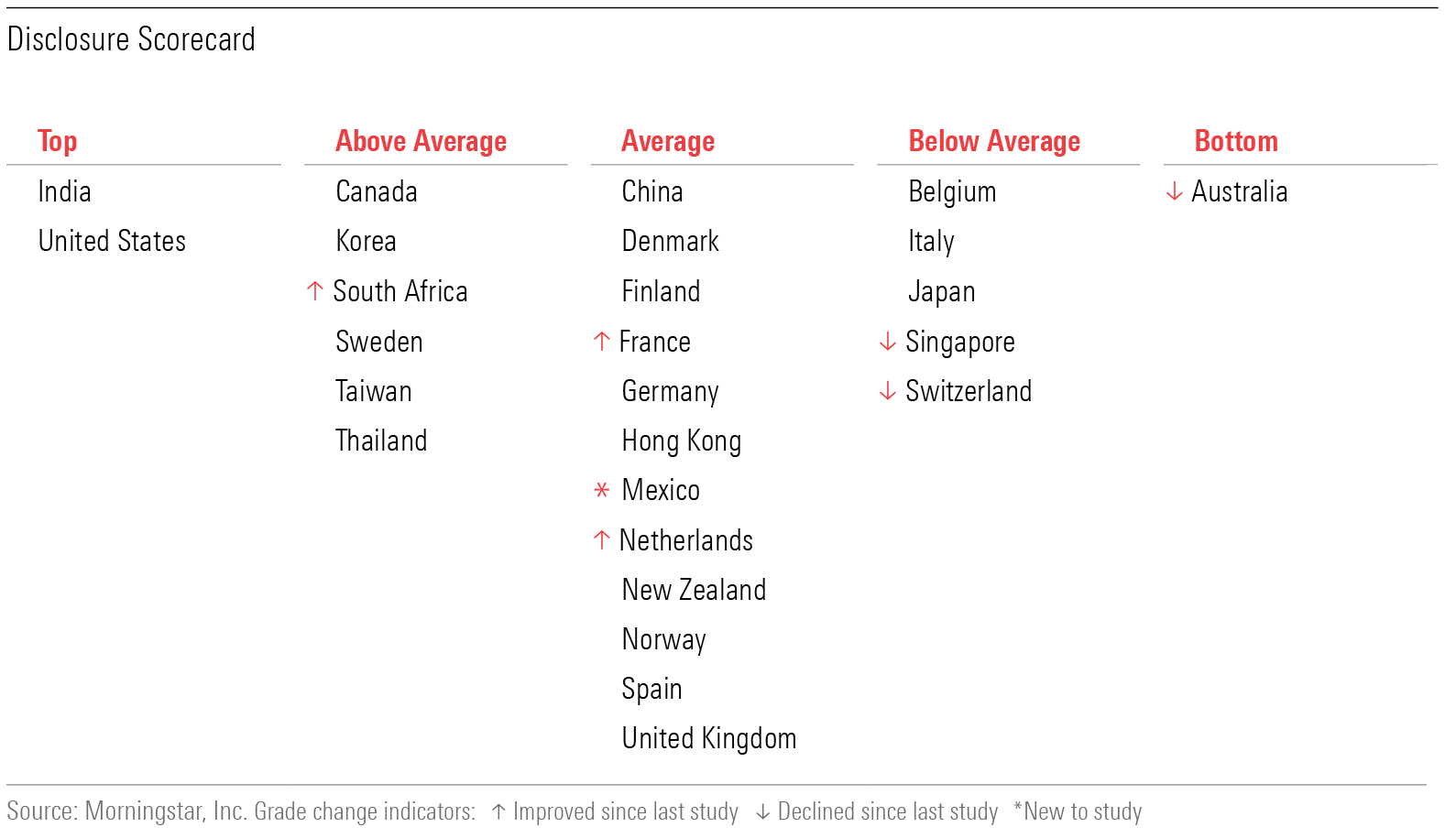

The study reflects Morningstar's views about what makes a good experience for fund investors. Based on evaluating these six parameters, the study has assigned Top, Above Average, Average, Below Average, and Bottom grades to 26 fund markets.

India has scored the top grade due to its robust disclosure on monthly portfolio holdings disclosure, portfolio management disclosure, and specifications for the simplified prospectus, portfolio manager names, fund ownership, and compensation.

Grades assigned to 26 countries for disclosure

The study notes that India could work to improve the level of detail provided by fund firms in discussions of performance and risk within fund literature.

Key takeaways from Indian market:

- India has the amongst the best portfolio disclosures globally, with monthly portfolio disclosures. This has been further strengthened with the fortnightly portfolio disclosures for fixed income funds.

- Indian funds have the shortest lag in the release of portfolio holdings data making it easier for investors to have access to the latest portfolio information at the earliest.

- Other disclosures through a simplified prospectus like the Key Information Memorandum, or KIM, and factsheets, make it easy for Indian investors to access information like expense ratios, fund manager name and experience, historical returns over different time periods and comparison with relevant benchmarks.

- Other information such as manager’s investments in funds and fund manager compensation are useful disclosures. India is amongst the few countries that mandate these disclosures.

- Material risk for funds is another important disclosure, currently most funds declare all standard risks rather than only those material for a fund. The enhanced riskometer will help enhance the risk disclosures, but asset managers should look to highlight the material risks each fund is specifically exposed to in fund documents.

- Managers commentary on performance is a useful highlight for investors to understand the drivers of performance. India can improve on this front as most performance commentary is usually generic.

- While uptake of ESG is still in the nascent stage from an Indian context, regulations around ESG investing will help avoid greenwashing by funds. Worldwide, much environmental, social, and governance regulation is in the pipeline that should provide more-standardized disclosure to inform investors' understanding and comparison of products. This should help prevent greenwashing—or using ESG claims in fund marketing without ESG principles truly guiding investment decisions.

Key takeaways from other markets:

- Sweden stood out for having an Above Average grade, scoring highly on most dimensions and being a front-runner in the disclosure of ESG and Stewardship.

- Australia is the only one where portfolio holdings disclosure is not required. Australia stands alone as having clearly the feeblest disclosure regime among the 26 markets in this study. Thus, Australia got the lowest grade.

- Mexico is the only market in this study that requires weekly portfolio disclosure of material positions. Mexico and India set the bar for monthly disclosure of full portfolio holdings.

- Despite the revamped scoring system via the addition of questions around Sales Disclosure and ESG and Stewardship Disclosure, four countries that performed poorly in previous iterations of the disclosure section of this study—Japan, Italy, Belgium, and Australia—continued to score poorly relative to other markets in this chapter.

- Singapore and Switzerland were downgraded to Below Average in this study, joining Belgium, Italy, and Japan. A common through line for these countries is that they do not disclose named portfolio manager ownership in the fund, do not provide a monetary illustration of fees in the simplified prospectus, and have less frequent required disclosure of full portfolio holdings than the global best practice. In addition, Italy, Japan, and Singapore have made little progress in introducing ESG and Stewardship Disclosure to their markets, which is now formally scored in this study.

Download the report here.

Disclosure is the third and final chapter in the 2020 Global Investor Experience Study. Previous chapters focus on Fees and Expenses and Regulation and Taxation.