Market euphoria is a nice thing to experience. But always dig deeper to see what it is standing upon. Rajat Sharma of Sana Securities does just that. While he is not fleeing equity, he is definitely not getting carried away by the euphoria.

Here he presents his case.

A bull market or a badly behaved bull?

I would not be wary of a bull market that was riding on the back of a strong economy, where interest rates remained stable or even rose, but the market move upwards.

What I see is a massive fiscal stimulus by the U.S. Federal Reserve, accompanied by falling interest rates. A mad liquidity driven equity market rush. The Reserve Bank of India maintaining low interest rates with assurances of easy monetary policy until things get back to “normal”.

And reality?

Mass unemployment. India was battling unemployment which got exacerbated during the pandemic. This won’t be revived overnight.

The loan repayment moratorium ended in August 2020. We are unsure about the true impact of that since borrowers could restructure their loans and pay back in a time frame that stretches to 24 months. It will be interesting to see how corporate balance sheets shape up, particularly of NBFCs in the space of consumer lending. It does not need a deep analysis to comprehend that a lot of the debt issued by banks and financial institutions will go bad.

That thing called NPAs.

Before the pandemic unravelled, banks in India were reporting all-time high NPAs. Smaller banks were merged with State Bank of India in the past, and six unhealthy public sector banks were more recently merged with four larger banks. The four - PNB, Canara Bank, Union Bank and Indian Bank – have problems of their own. Yet, there are bad apples around - IDBI Bank with gross NPA’s in excess of 27% is a case in point.

In the Union Budget of 2021-22, the government proposed the setting up of an Asset Reconstruction Company (ARC). This Bad Bank is to take over all the stressed and non-performing loans of existing banks and dispose them off to whoever may be interested in buying them at the best possible price.

Why do I feel this is just an optical feel-good legislation? Managing and selling bad loans at a good price is one of the core activities of a bank. Now we have a situation where banks will have more money to lend since bad loans are taken off, but the owner of these banks and the ARC remain the same – the Government of India.

Now we have online wallets and no dearth of technology to transact with, NBFCs to do the lending and borrowing and a new ‘bad bank’ to manage NPAs. Wonder what the traditional banks will be up to.

Alarming debt levels.

An even bigger problem is the rising debt level on the balance sheets of companies, particularly NBFCs which are facing tremendous redemption pressures. There was a reason why so many credit funds collapsed and why a big fund house- Franklin Templeton, India, was forced to shut six of its debt fund schemes freezing Rs 26,000 crore of investor money. Nobody wanted to buy that debt; there was no market for it.

If this is not a bad sign of corporate affairs, I wonder what is?

The valuation-earning dichotomy.

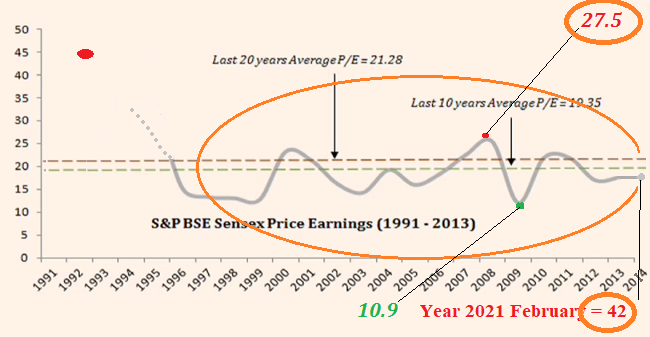

We are looking at all-time high valuations and extremely low corporate earnings. Until a few years ago, the long-term average for the trailing PE ratio on the Nifty was in the region of 19-22. Anything above was considered expensive. It climbed to 42.

Even if earnings were to improve a full 100% for each of the next four quarters, we will still be expensive at current stock prices (and trade above that healthy PE of 20). Stock prices must fall, and fall a lot, to make buying reasonable.

Also, keep in mind that 100% corporate earnings growth is not even a distant probability. Over the past three decades (1990 – 2021), the average corporate earnings growth has been in the region of 12-14%.

FIIs don’t stay forever.

Since July 2020, Foreign Institutional Investors purchased Indian equities worth Rs 1.57 lakh crore. While I am not in possession of the exact figures, I can safely say that FII holding in Indian companies has jumped significantly from a year ago, when it stood at 20.04% in the Nifty 500 companies.

I recently read a well-researched piece which found that FII holding had increased in 2 out of 3 Indian companies for the quarter ended December 2020.

If the past has taught us one thing, it is that FII money moves in and out rather quickly. The trend will reverse. FIIs will not be buying as aggressively forever. What then will support the Indian market?

Most of this liquidity comes from countries where interest rates are near zero, like the U.S. Any upward revision in interest rates in those countries, would impact flows. Redemption initiated by FIIs will surely cause a domino effect, particularly if this is coupled with any negative country specific news flow, such as bankruptcies in the NBFC space.

So, what am I doing?

Are there good companies out there? Of course.

Are some trading at reasonable prices? Of course.

Am I buying? No. Because I do not have the conviction to buy equity right now. When the euphoria subsides, my enthusiasm will intensify.

Meanwhile, I shall amuse myself watching the bulls play.

(Investment Always Involves Risk of Loss)