The outlook for the U.S. economy is now stronger than before the pandemic. We're projecting real GDP growth of 5.3% in 2021 and 4% growth in 2022.

- This aggressive growth is enabled by the historically large fiscal stimulus of 2020 and expected in 2021, along with mass vaccination allowing economic activity to return to normal.

- GDP growth slowed greatly in the fourth quarter of 2020 to 1% from its blistering 7.5% pace in the third quarter. The recovery paused owing to the pandemic's third wave. But this doesn't mean the recovery is wrapping up for good.

- The end of the pandemic in the U.S. is coming soon. Thanks to mass vaccination, we expect that herd immunity (the point at which the virus can be suppressed even while social contact and other behaviour returns to normal) will be reached by May 2021.

- We believe consumers are eager to spend, but their full range of options is limited by the continuing need to social distance, which hampers services spending. In fact, the deficit in consumer-services expenditure now accounts for the entire GDP gap compared with pre-pandemic levels. We expect real services consumption to snap back after mass vaccination, growing 6.7% for full-year 2021, driving a 6% increase in overall consumer expenditure. The job market should recover in tandem with consumer services, as the sector accounts for most of the lost jobs during the recession.

- Stimulus has caused private after-tax incomes to soar. Fiscal stimulus in 2020 reached a peacetime U.S. record, with a deficit/GDP of about 16%. This has already set the private sector up to spend eagerly in coming years, and another round of massive stimulus in 2021 should add to this.

- Most households' finances will emerge from the pandemic better than ever. This includes even lower-income households (on average). While lower-income households saw the worst job losses during the pandemic, they received unprecedented levels of government relief. In particular, thanks to boosts to unemployment benefits under the stimulus, the average laid-off low-income worker received far greater than 100% of his or her normal income in 2020.

More stimulus can do only so much for the long-run recovery. Productive capacity, not stimulus, is what drives the economy’s long-term potential GDP.

Some forecasters have taken their GDP expectations up to sky-high levels, based on President Joe Biden's $1.9 trillion stimulus plan.

We're more sceptical, as we think additional stimulus will have sharply diminishing returns in spurring demand. More importantly, stimulus is only effective in sustainably lifting up the economy if GDP is below its potential level, meaning there's still slack in the economy. We think the U.S. economy may be brushing up against its potential by 2022 or so, with labour markets getting quite tight by then. However, there's high uncertainty about where exactly potential GDP is, and this is the key driver of upside risk to our GDP forecast.

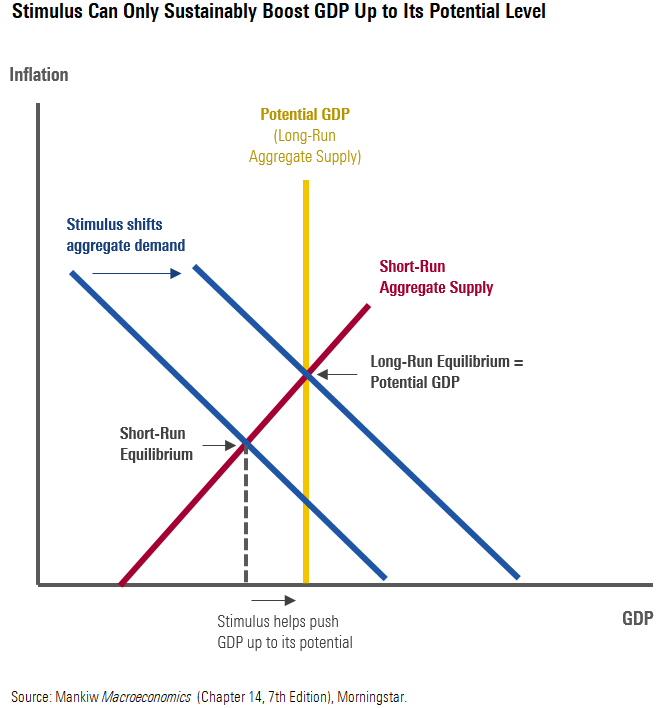

To start, we lay out a basic framework for how to understand GDP and its relationship to potential GDP. GDP is equal to the level where aggregate demand and aggregate supply are the same (in other words, in equilibrium).

- Aggregate demand is the total amount of goods and services that are purchased. This reflects the appetite for spending among the entities that shape the economy, as well as the influence of fiscal and monetary policy.

- Aggregate supply (short and long run), or the total amount of goods and services that firms are selling, reflects the production side of the economy.

In the short run, aggregate supply is flexible. This means that an increase in aggregate demand can temporarily cause GDP to increase.

In the long run, however, aggregate supply is inflexible and set at the level of potential GDP. Potential GDP is the long-run productive capacity of the economy (when workers and capital are fully employed). The difference between current GDP and potential GDP is referred to as the output gap.

If the economy is operating below potential GDP--if there is an output gap--then fiscal stimulus can be vital to the economy. This means there is slack in the economy, such as when unemployment is high and lots of factories are sitting idle. The chart above illustrates such a scenario. Fiscal stimulus acts by boosting aggregate demand, which pushes GDP higher until it reaches potential GDP.

However, fiscal stimulus can’t push GDP sustainably higher than its potential level. There is some ability to run higher than potential in the short run, but this causes the economy to overheat, resulting in higher inflation. GDP ultimately settles back down to its potential level.

Potential GDP is shown in the chart as a vertical line. This means that potential GDP is inflexible with respect to the level of aggregate demand. Therefore, if fiscal stimulus boosts aggregate demand, this has no effect on the long-run equilibrium for GDP. Potential GDP is driven by supply-side factors such as labour force growth or technological progress, which largely aren’t affected by fiscal stimulus.

How high is potential GDP? Unfortunately, no one knows exactly where potential GDP is for the U.S. (or any economy, for that matter). Potential GDP is a latent variable, meaning that it cannot be measured directly, only inferred. Typically, economists assume that the economy is operating at potential if inflation is low and stable, but there are no signs of large excess capacity in the economy, such as high unemployment.

The above is an excerpt from Why More Stimulus Can Do Only So Much for the U.S. Economy and 7 reasons why the US economy is set for take-off.