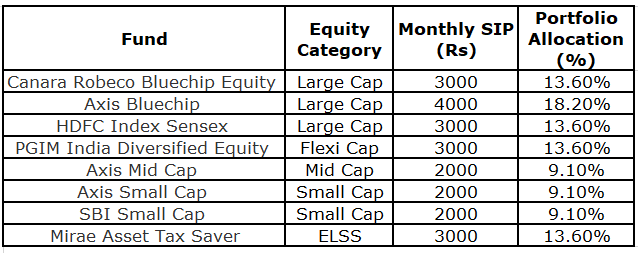

I am planning to start monthly SIPs: Rs 3,000 each in Canara Robeco Bluechip Equity, Mirae Asset Tax Saver, HDFC Index Sensex, PGIM India Diversified Equity / Rs 2,000 each in Axis Mid Cap, Axis Small Cap, SBI Small Cap / Rs 4,000 in Axis Bluechip.

Are these 8 funds sufficient for diversification?

I am 28 years old and have been investing in NPS since 2016, and that is my retirement kitty. I aspire to buy a house in 20 years (current cost- Rs. 1.cr). So how much would I need in 20 years?

Let me start my stating my observations and suggestions. To offer you a more comprehensive view, I have provided the graphical representation of the portfolio below.

Observations

- The portfolio you have designed is well diversified across 3 large-cap funds, 1 flexi-cap fund, 1 mid-cap fund, 2 small-cap funds and 1 ELSS.

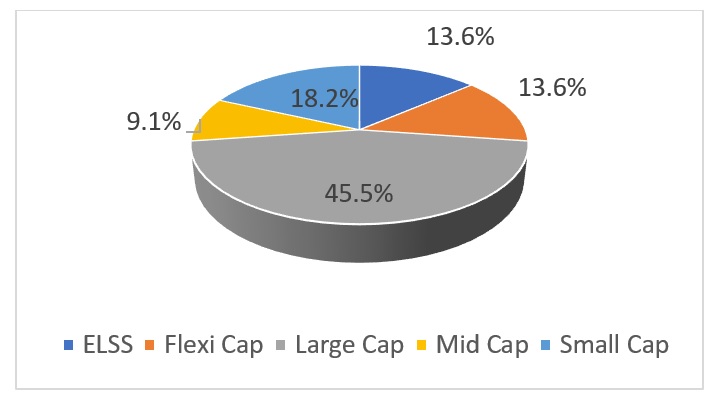

- Given your investment time horizon of 20 years, the allocation towards mid and small caps looks fair.

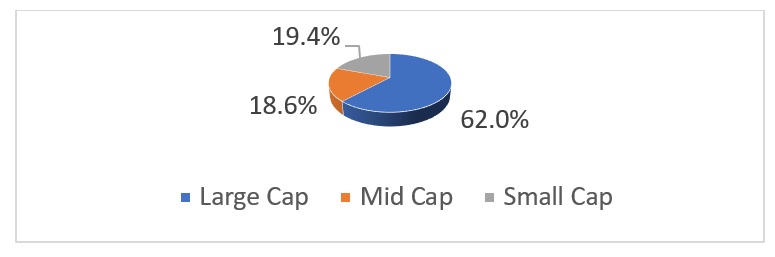

- The portfolio has a significant tilt towards growth and core stocks, but value is under owned. This skew is primarily due to the choice of funds. The investment mandate of most funds in the portfolio is tilted towards Growth and Growth at Reasonable Price (GARP) investing.

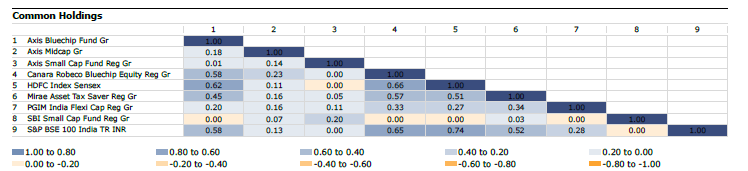

- Holding funds with high levels of commonality in their investment style and hence portfolio holdings, doesn’t necessarily aid in diversification. Plus, it is important to acknowledge that the market will go through cycles where different sectors/styles will come to the fore. Growth & Quality style has done well since 2018, but over the last couple of quarters this style has underperformed, while the more cyclical, value part of the market has done relatively better. By investing in funds with similar investing styles, the portfolio would be subject to a feast or famine tendency, where all funds do well at the same time and then go through patches of relative underperformance when the market cycle is not in favor. Thus, it is important to invest in funds with different investment styles so that you can have a fairly diversified portfolio.

Suggestions

- A monthly SIP of Rs 22,000/month for 20 years would result in a corpus of Rs 1.5cr at the end of 20 years, if we assume a return of 10% per annum. This is equal to the current cost of the flat. But the cost of the apartment would increase over this time. So not only do you have to invest regularly, but you must keep increasing it as often as possible.

- You have started investing early so you have time on your side. Your current monthly SIP is Rs 22,000. Increase it by at least 15% every year. It is important to invest as much as possible early on, which will truly help you compound your wealth over the longer term.

- While your portfolio is fine, introducing a fund with value bias would help aid greater diversification and build a portfolio that’s can do well over market cycles. Look to invest in funds such as HDFC Top 100 and ICICI Prudential Value Discovery.

Portfolio: Overview

Portfolio: Fund Category

Portfolio: Market cap of underlying holdings

Portfolio: Style of underlying holdings

Portfolio: Overlap between fund holdings

Registered readers can post their queries by accessing the Ask Morningstar tab. Our team will answer SELECT queries ONLY relating to mutual funds and portfolio planning.