The Coronavirus-induced meltdown unleashed havoc across world economies.

However, markets were swift to recover once lockdowns were rolled back and the arrival of vaccinations provided a further boost.

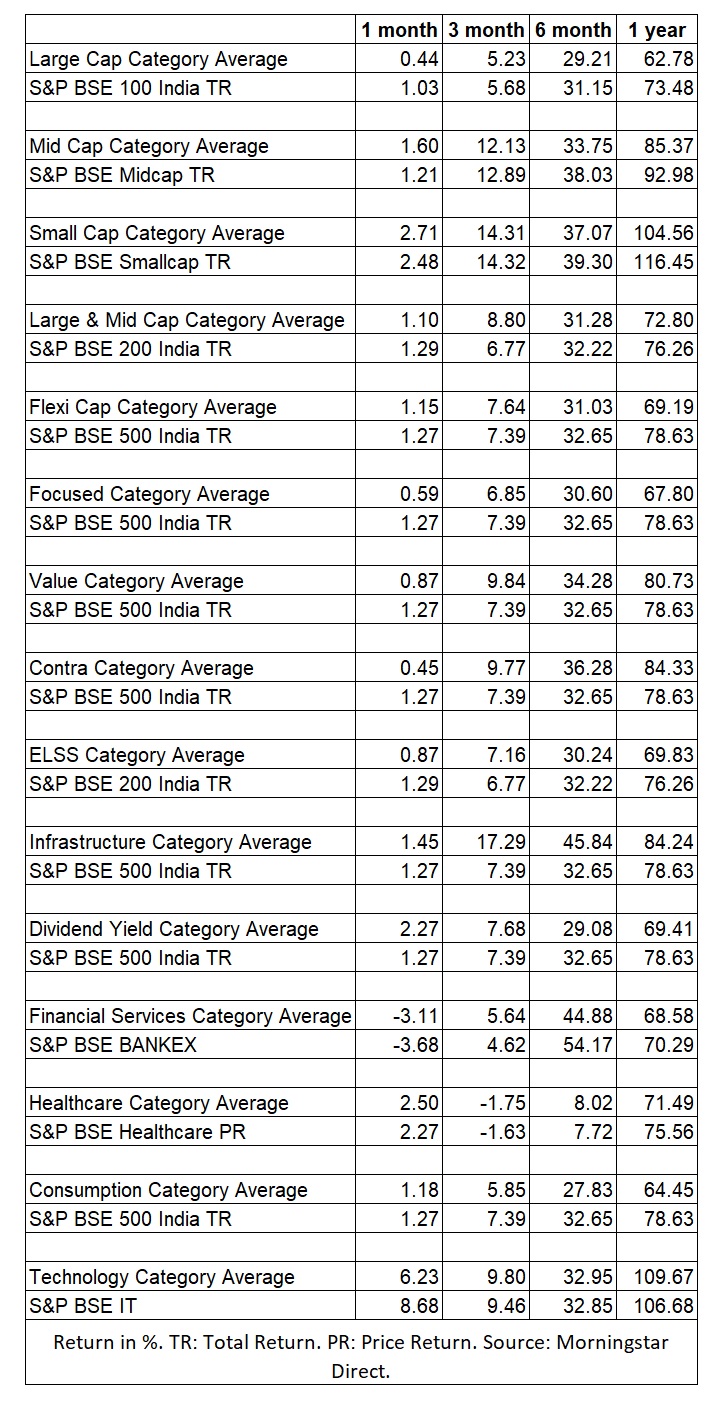

The recovery in markets has helped equity funds deliver stellar returns. Technology funds gained the most (6.23%) in March 2021 followed by small cap funds (2.71%).

Performance of equity fund categories

Tech funds

Technology sector funds continued to shine. In March 2021, tech funds delivered the highest return at 6.23% while the BSE IT index was up by 8.68%. Tech funds topped the chart over a one-year period too with 109.67% return. The BSE IT index jumped 106.68% last fiscal. The sector has been a major beneficiary of the work from home trend and increased adoption of technology. ICICI Prudential Technology Fund has delivered the highest return at 131.92% last fiscal, followed by Aditya BSL Digital India which yielded 119.50%.

Exchange Traded Funds (ETFs) which invest in U.S. based tech companies also performed well. Edelweiss US Technology Equity Fund of Fund delivered 90.45% last fiscal. However, in March 2021 the ETF was down -4.20%.

Small Cap

After technology, small caps occupied the second slot. In March 2021, small cap funds category delivered 2.71% while the BSE Small Cap TR Index was up by 2.48%. In the last fiscal, small cap funds delivered the second-highest return at 104.56% return while the index was up by 116.45%. The top performer Quant Small Cap has delivered a staggering 174.34% return last fiscal, followed by Kotak Small Cap Fund which delivered 127.77%.

Investing in small cap funds requires a longer time horizon (7-10 years) as these funds are susceptible to huge drawdowns during a downturn.

Healthcare

Healthcare funds delivered the third-highest return in March 2021 at 2.50%. The sector has been a major beneficiary in the pandemic. Healthcare category funds delivered 71.49% last fiscal. The top performer ICICI Prudential PHD Fund delivered 81.86%, followed by Mirae Asset Healthcare Fund which posted 77.20% return.

7 questions before you invest in a sector fund

Infrastructure

Recovery in infra-related stocks in the capital goods, metals, power, among other sectors has helped infrastructure funds. Infrastructure sector funds have delivered the highest return over a three-month (17.29%) and six-month (45.84%) period. Infrastructure funds typically take exposure to sectors such as construction, engineering, chemicals, metals, automobile ancillary, telecom and banks having exposure to these sectors. The BSE Metal Index has delivered the highest return last fiscal at 151.18%. The index contains companies involved in the manufacturing of steel, aluminum, coal and zinc. The BSE Capital Goods Index is up 92.14% last fiscal.

Want to ride the infrastructure theme?

Mid Cap

Mid cap funds have also yielded the third-highest return (85.37%) last fiscal. The top performer PGIM India Midcap Opportunities Fund delivered 117.44% return, followed by SBI Magnum Midcap which posted 105.85% return.

The S&P BSE Sensex has gained 69.82% last fiscal. Since the March 2020 low, the Sensex is up 95% as on April 1, 2021.