Government Securities, or G-Secs, are debt paper issued by the Reserve Bank of India, or RBI, on behalf of the Government of India or state governments.

Here I explained what a corporate bond is. When you buy a bond, you lend money to the company that issued the bond (issuer). In exchange, the company promises to return your money (principal) on a predetermined date (maturity date), and till it does so, it will pay you a specified rate of interest (coupon rate).

Now the same happens with the government.

When the government requires money, it issues bonds of various maturities. Debt funds, banks and financial institutions purchase these instruments. Besides debt funds, there are specific mutual funds that invest only in such instruments. These are called gilt funds. They are pure debt funds that have a minimum of 80% of the portfolio invested in G-Secs and State Development Loans (SDLs), the balance in cash and cash equivalents.

Why are G-Secs called gilts?

Gilts is the name given to bonds issued by the U.K. government through the Bank of England. They are called gilts because the original certificates issued by the British Government had gilded edges.

The term is used in the U.K. and other countries such as India and South Africa.

The first gilt issuance was in 1694 to King William III who needed to borrow 1.2 million pounds to fund a war against France.

The risk of G-Secs.

- Credit Risk: None. When a company issues a bond, it makes a legal commitment to pay interest on the principal and to return the principal. But what if the company runs into a cash-flow problem or stars incurring massive losses and cannot return your money. That is a credit risk. There is no question of the government defaulting on the repayment. G-Secs have a sovereign guarantee as the central and state governments issues these securities.

- Liquidity Risk: Low. A vibrant secondary market exists for trading such instruments.

- Interest Rate Risk: High. This is what makes the funds extremely volatile and can even given negative returns during shorter holding periods. Higher the duration of the fund/bond, greater the interest rate risk.

How to position it in your portfolio.

Retail investors are also permitted to purchase gilts, but it is wiser to take exposure via gilt funds.

Never let a gilt fund be a core holding. It should be a tactical bet. That means, investors should buy such funds when the interest rates are high, or it is inevitable that they are going to start falling in the near or immediate future.

If you are taking a tactical bet on gilt funds, you will have to be in a position to take a call on the interest rate movement. For instance in May 2019, the yield on the 10 year benchmark G-Sec security was 7.13%, just a year later in June 2020, the yield had fallen to 5.77%. Can you see the change in interest rates in just one year?

Interest rates go through cycles. The repo rate was 9% (July 2008) and fell to 4.75% (April 2009), climbed to 8.50% (October 2011), dropped to 5.15% (October 2019) and is now at 4%.

If you want to take positions based on the direction of interest rates, it is best that you depend on a financial adviser who will guide you as to when you must enter or exit.

You can read more on interest rates and bond prices here.

A final word by Kaustubh Belapurkar, director of fund research at Morningstar India.

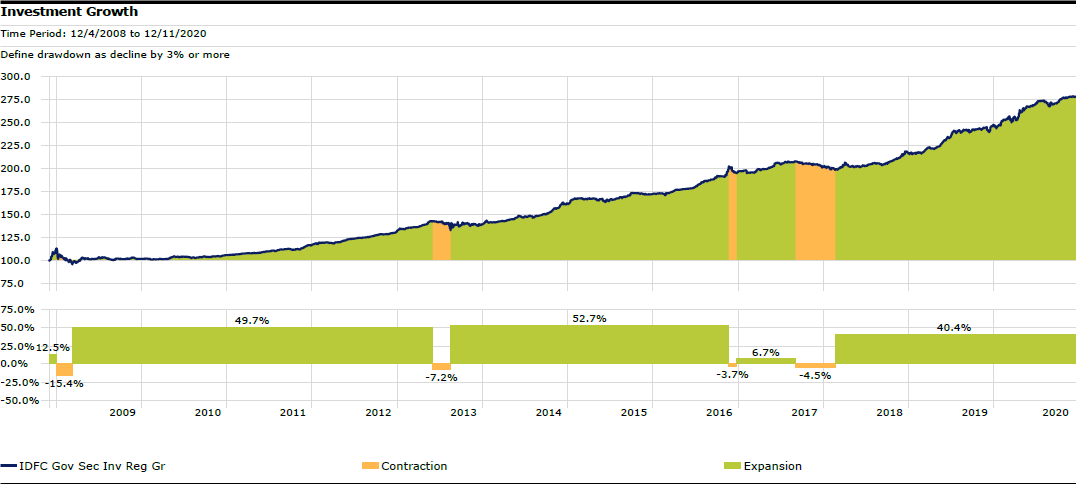

A fall in interest rates benefits such funds which run higher duration exposure. But should interest rates move up, there can be a significant negative mark to market (MTM) impact on the net asset value (NAV) of the fund. In fact, there have been periods of negative returns on gilt funds due to interest rates rising. The image below points to that.

Either you will need to be very tactical with your allocation timing your entry and exit yields appropriately, which is difficult. Else, if you as an investor are willing to hold your investment for a minimum period of 5 years, then you can consider gilt funds as a part of the portfolio. You need that time to ride out the interest rate cycle.

There are also some good options available in terms of funds that have a mandate for a run down maturity strategy or Gilt Index Funds/ ETFs which when held till maturity will limit the interest rate risk.

But either way, be prepared for volatility and don’t let it faze you.

(Click on the image to enlarge)