The total assets under management of open-end equity funds as of March 2021 stood at Rs 9.79 lakh crore, up by 8% over the last quarter and up almost 70% compared with March 2020. One of the major reasons for the big jump in the total assets over last year could be attributed to the strong market performance over the last one year. Open-end equity funds form approximately 33% of the total open-end fund universe.

Flows into the open-end equity funds were negative during the fourth quarter of fiscal-year 2020-21 to the tune of Rs 4,672 crore. While investors have been exiting equity funds since July 2020 on a consistent basis, the tide seemed to turn in March 2021 as the net flows in open-end equity funds were positive to the tune of Rs 9,115 crore. Looking at the data broadly, this was the third consecutive quarter in which the net flows in equity were negative.

In the fourth quarter of fiscal year 2020-21, thematic/sectoral funds garnered net inflows to the tune of Rs 4,230 crore. This was primarily on account of two new funds launched in this category (ICICI Prudential Business Cycle Fund and Invesco India ESG Equity Fund) that managed to garner Rs 4,750 crore all by themselves.

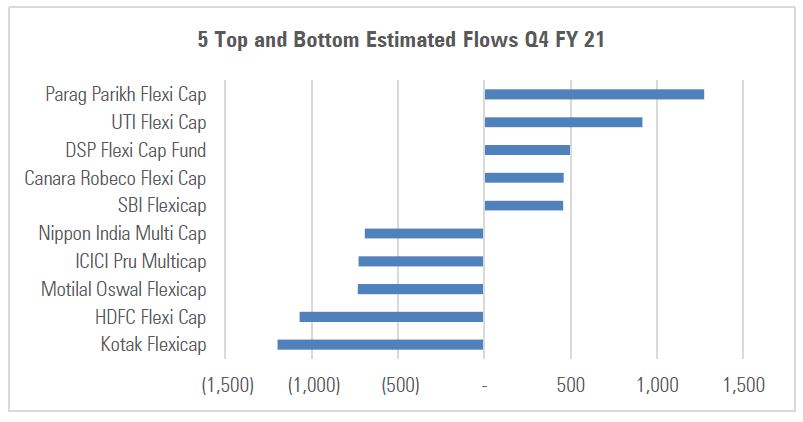

The four funds which received the highest inflows from Large, Mid, Small and Flexi Cap categories during March 2021 quarter were: Axis Bluechip (Rs 1,846 crore), Axis Midcap (Rs 1,098 crore), Kotak Small Cap (Rs 503 crore) and Parag Parikh Flexi Cap (Rs 1,273 crore).

Flows into equity subcategories

Large-Cap Funds

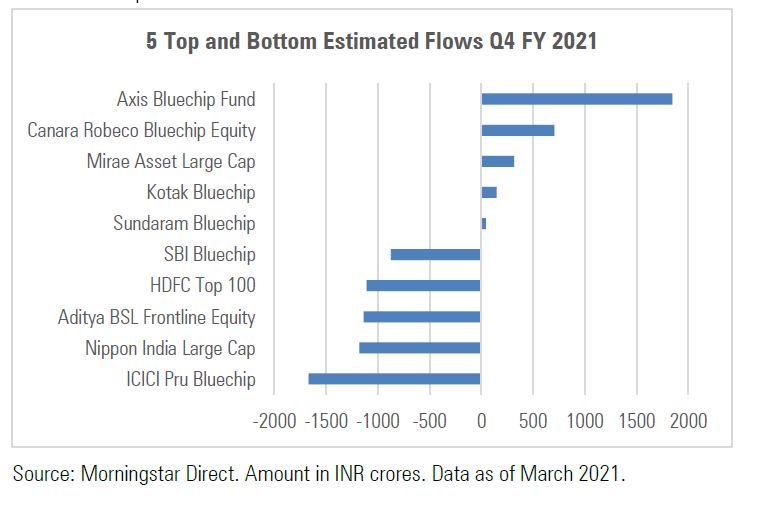

Axis Bluechip, Canara Robeco Bluechip Equity, and Mirae Asset Large Cap received the highest flows worth Rs 1,846 crore, Rs 704 crore, and Rs 316 crore, respectively, in fourth-quarter fiscal-year 2020-21. On the other hand, funds that saw the highest outflows in fourth-quarter fiscal-year 2020-21 were ICICI Prudential Bluechip (Rs 1,669 crore), Nippon India Large Cap (Rs 1,179 crore), and Aditya Birla Sunlife Frontline Equity (Rs 1,136 crore).

Mid Cap Funds

The funds that received the highest net inflows in fourth-quarter fiscal-year 2020-21 were Axis Midcap (Rs 1,098 crore), followed by Mirae Asset Midcap (Rs 514 crore) and Kotak Emerging Equity Scheme (Rs 441 crore). On the other hand, with net outflows of Rs 1,244 crore, HDFC Midcap Opportunities Fund recorded the highest net outflows during the quarter. This was followed by Franklin India Prima and Sundaram Midcap, which lost Rs 499 crore and Rs 422 crore, respectively.

Small Cap Funds

The biggest beneficiaries in the fourth quarter of fiscal-year 2020-21 were: Kotak Small Cap (Rs 503 crore), Axis Small Cap (Rs 415 crore), and Canara Robeco Small Cap (Rs 119 crore).

During the same period, HDFC Smallcap Fund witnessed the highest net outflows—Rs 833 crore, followed by Franklin India Smaller Companies and L&T Emerging Business, which saw around Rs 746 crore and Rs 742 crore eroded from their coffers, respectively.

Multi Cap & Flexi Cap

In September 2020, SEBI introduced new norms for asset-allocation rules for multi-cap funds. Now, multi-cap funds must invest a minimum of 75% in equity and equity-related instruments with a minimum 25% allocation each in large-, mid-, and small-cap stocks. SEBI also introduced a ‘flexi-cap category’ for mutual funds, which will be required to invest at least 65% of the corpus in equity but will have no restrictions on investing in large-, mid-, or small-cap stocks. Consequently, there was a readjustment of funds between the two categories, wherein few funds remained in the Multi Cap category, while several others moved to the Flexi Cap category.

During the fourth quarter of fiscal-year 2020-21, flexi-cap category witnessed the highest net outflows of funds amongst the open-end equity category, with outflows of Rs 9,045 crore. During the same period, multi-cap category witnessed the highest net inflows of funds amongst the open-end equity category, with net inflows of Rs 6,744 crore. As highlighted earlier, while the data shows outflows of Rs 9,045 crore from the Flexi Cap category and inflows of around Rs 6,744 crore into the Multi Cap category, it could be largely due to the adjustments for the category changes.

Morningstar calculates estimated net cash flows for global open-end funds and ETFs, an estimate of the money put in or withdrawn by fund investors, accounting for reinvestment of distributions. We use total net assets and returns as a basis of the calculation. Flows are computed monthly and daily, if the data affords it. The disclosure of daily net assets is at the discretion of the fund provider.