Morningstar India has released its Offshore Fund Spy Quarter Ended March 2021. Here are some key highlights from this study.

The India-focused offshore fund and ETF category has been witnessing consistent net outflows since February 2018.

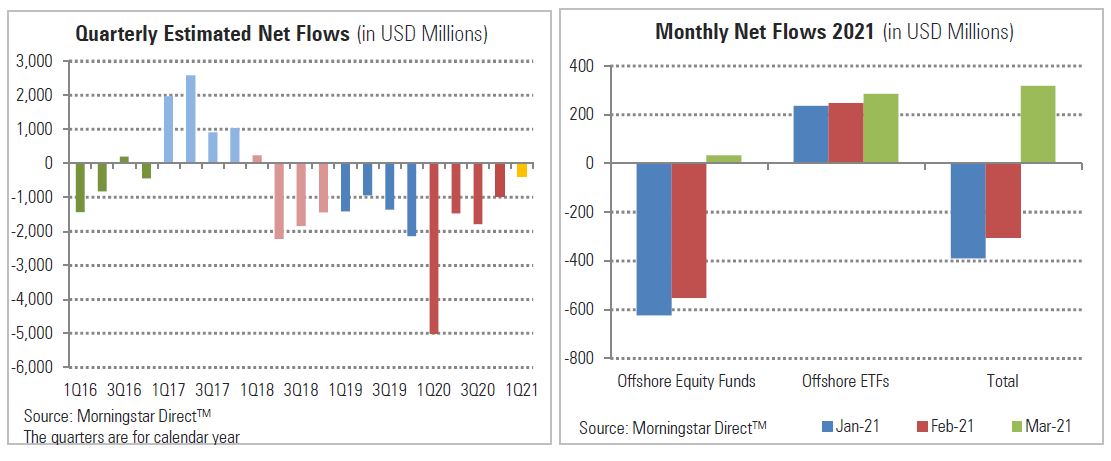

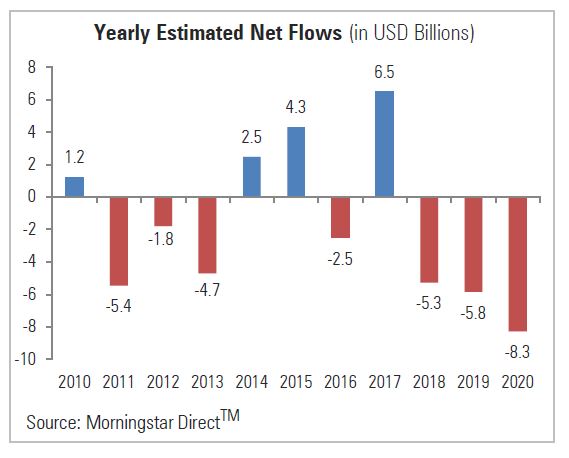

The intensity reached its peak in the March 2020 quarter, as almost $5 billion left its coffers. This was the highest quarterly net outflows that the category ever witnessed. In fact, the net outflows from the category touched its peak in 2020 when its lost $9.3 billion of net assets. This was noticeably higher than the net outflows from the category in 2018 ($5.3 billion) and 2019 ($5.9 billion). That said, the intensity of net outflows did show signs of moderation during the June, September, and December quarters of 2020.

This trend of moderating net outflows continued during the quarter ended March 2021 as well. Through the quarter, the category witnessed net outflows of $376 million, which was markedly lower than the net outflows of $986 million recorded during the quarter ended December 2020, and the net outflows of $1.8 billion during the September 2020 quarter. This was the 12th consecutive quarter of net outflows for the category. It should be noted that India-focused offshore funds and ETFs are some of the prominent investment vehicles through which foreign investors invest in Indian equity markets.

Quarterly Estimated Net Flows of India-Focused Offshore Equity Funds and India-Focused Offshore ETFs

Within the India-focused offshore funds and ETF category, the India-focused offshore fund segment witnessed net outflows of $1.1 billion during the quarter ended March 2021, which was lower than the net outflows of $1.9 billion in the previous quarter. However, this quarter was slightly different from the previous quarters. While the segment witnessed net outflows in the month of January and February, it received net inflows of $33.2 million in March. It is worth noting that, although marginal, this was the first monthly net inflows for the segment after 37 consecutive months of net outflows. While it would be too premature to consider this as a change in trend, it is positive, nonetheless.

On the other hand, like the previous quarter, India-focused offshore ETFs again witnessed a divergent trend compared with the India-focused offshore fund segment. While they received net inflows of $881.5 million during the December 2020 quarter, during the quarter ended March 2021, they received net inflows of $766.8 million. Hence, over the last two quarters, the segment received net inflows of $1.6 billion, which did indicate a change in trend for this segment.

Flows into India-focused offshore funds are generally considered to be long-term in nature, whereas flows into India focused offshore ETFs indicate flows of predominantly short term money. From February 2018 until March 2021, India focused offshore funds witnessed significantly higher net outflows (of $19 billion) compared with net outflows (of $2.7 billion) from the India-focused offshore ETF segment. The higher net outflows from India-focused offshore funds indicate that foreign investors with long-term investment horizons have been adopting a cautious stance toward India.

Although this is concerning, it is not entirely unexpected, given the country's COVID-19 situation, current economic landscape, and uncertainty over how soon India will be back on a growth trajectory. That said, Indian equities continue to attract foreign investments through direct equity as well as the ETF route.

The future trend of the flows in the India-focused offshore fund and ETF category would revolve around how India fares in its fight against the more intense second wave of the pandemic versus other comparable countries and how the government brings the country's economy back on track amid multiple hindrances.

Access the full report here.