The pandemic and work-from-home era have pushed many businesses to adopt technology. Naturally, this has immensely helped the information technology sector and tech firms.

As on June 22, 2021, the Technology sector funds category has delivered 113.54% over a one-year period, which is the highest among all categories.

Over a five-year trailing period too, the category has outperformed all other categories by delivering 23.81%.

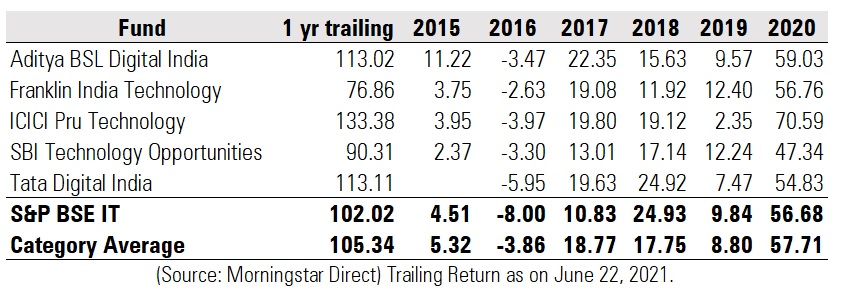

(The returns shown in the table are of regular plans.)

We asked fund managers about how they see the sector performing post-Covid, the current valuations and the opportunities for investors in this space.

Meeta Shetty, Fund Manager, Tata Mutual Fund

The pandemic has clearly given a push to an already growing digital spend within the sector. The demand scenario for the Information Technology (IT) services industry is far stronger than pre-Covid levels and there is a good visibility for the next couple of years. This is driven by the change we are seeing across industries where today all companies want to go digital and are spending heavily on cloud migration, digital transformation, analytics, and cyber security.

This strong demand should keep the sector in momentum for the next few years. On the supply side though, there are some cautions as the need for skilled employees has risen, which might lead to higher attrition and higher payout to employees. But with higher offshoring and the operating leverage from strong revenue growth, companies should be able to offset the impact to a large extent.

International Diversification

We enabled our fund to invest in overseas-listed stocks a couple of months back and now we can invest up to 20% of our fund in these stocks/ETFs. This diversification is adding an avenue to participate in the new-age tech companies, as we have limited choice in India as of now.

We have started adding a few names, and they contributed to ~3% of Tata Digital India Fund as of May 2021. These holdings have already started to add alpha to our portfolio. We expect to build it gradually over time. We wanted to look at a few themes to start with which included cloud, digital advertising and cybersecurity. So, we have added stocks which are a clear beneficiary of these themes. We have also added a cybersecurity Exchange Traded Fund (ETF) which gives us further diversification in the fast-growing cybersecurity companies listed globally.

Sorbh Gupta, Fund Manager – Equities, Quantum Mutual Fund

We had built position in this space early based on our estimate of demand pick up. The IT sector became important during this pandemic. From our interactions with the management, we understand that the order book is improving.

The demand has picked up and stock valuations have moved up. The cost for these companies might go up due to an increase in wages. We need to see if companies get pricing power. The unemployment rate in the U.S is at a record low. They don’t have local resources to deploy. So there will be demand for offshoring. The corporate profitability for U.S companies has improved. They will be spending on upgrading IT system.

Large companies have an advantage

The trend of spending on digital has got preponed due to the pandemic. Cost-cutting initiatives have also helped Indian IT companies. Vendor consolidation has helped the larger IT companies. We see this trend to sustain. In this environment, we prefer larger companies that are better placed vis-à-vis smaller companies. Whenever vendor consolidation happens, the larger companies tend to benefit.

Investment opportunities

In India, we have IT services companies. We don’t have pure-play IT product/technology/internet companies. Some players like Zomato, Policybazaar and others are in the offing. But they are few and far between. The valuations of these companies are too high. Some of these companies do not have great underlying earnings. The sector fancy is making them attractive.

Valuations

The valuations for the sector have moved to fair value. Some companies are trading above their fair value. We have to watch the earnings growth trajectory from here on. If earnings don’t improve, valuations will start to appear expensive. We had trimmed some exposure to IT in November-December 2020 when stocks moved up sharply. Our next move will depend on the earnings growth visibility from here on. We need to see if it is a three to four-year cycle or just a pent-up demand.

Kunal Sangoi, Fund Manager, Aditya Birla Sun Life Mutual Fund

The pandemic has impacted each and every business and sector. Though the magnitude of its impact across sectors is different, the biggest impact it has had is in technology adoption. The last year has changed the way we work, shop, consume content (news, web series, movies), educate, gaming, etc. With this massive surge in online activity, enterprises have to scale up their technology investments to match this online demand. Accelerated investments in technology for business resilience, cybersecurity, core transformation, cloud migration and consumer experience are driving growth for the sector. Past events like Y2K (2000), GFC (2008) were triggers of growth for the IT services industry. We see pandemic as the key inflection point in enterprise adoption of technology. The upgradation in technology is likely to sustain leading to the sector doing well even post-pandemic.

What should investors do?

Investors should continue to remain invested in IT funds despite the very strong returns across different time periods. We see technology as a structural growth sector and as highlighted earlier, the upcycle is likely to continue. This should lead to the continued positive performance of the sector, albeit the returns range may not be identical.