Your clients would have often heard about the virtues of a Systematic Investment Plan (SIP) for creating long-term wealth.

In this post, we will explore Systematic Withdrawal Plan (SWP), which is exactly the opposite of SIP. SWP is a useful tool through which your clients can get a regular stream of cash flows at a pre-determined time and amount.

Suppose your client has accumulated Rs 50 lakh in an equity fund over a 15-year period. If your client withdraws the entire money at one go, she would lose out on further market appreciation (equity funds) or gains from coupon interest, reinvestment income and capital gains (debt funds). Moreover, your client would pay a sizeable capital gains tax on this amount.

Instead of a lumpsum withdrawal, the benefit of SWP is that not only do your clients get regular cash flows but they also earn interest on principal and participate in the future market growth (equity fund). Your clients can choose to invest the entire corpus in a debt fund if they are not comfortable with equity market volatility.

Let us illustrate this with an example.

Suppose your client has accumulated savings worth Rs 10 lakh. Now, she wishes to withdraw Rs 5,000 every month to pay electricity and grocery bill. She invested Rs 10 lakh lump sum in IDFC Flexi Cap Fund in September 2005 (since the inception of the fund) and started withdrawing Rs 5,000 every month immediately.

How much is left after withdrawing?

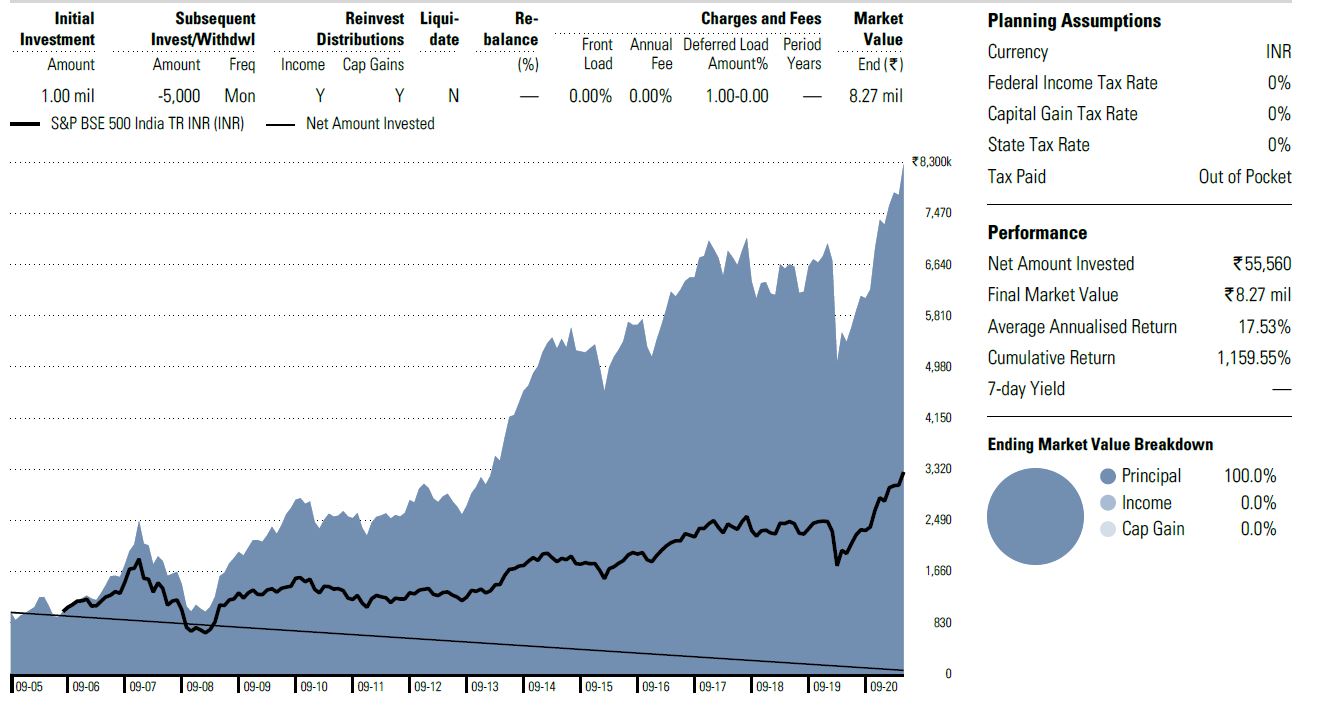

From September 2005 till May 5, 2021, the client withdrew Rs 9.44 lakh. The remaining principal in the fund is Rs 55,560 (Rs 10 lakh – Rs 9,44,440). This means the client has almost recovered principal and the investment over 15.9 years has grown to Rs 82.70 lakh. (see image below) This is after accounting for exit load and entry load (abolished since April 2009). This means that the money has grown at a compound annual growth rate of 17.53%. (Investment period: 09-28-2005 to 05-31-2021)

(Source:

Morningstar Adviser Workstation

)

What if the withdrawal amount is increased?

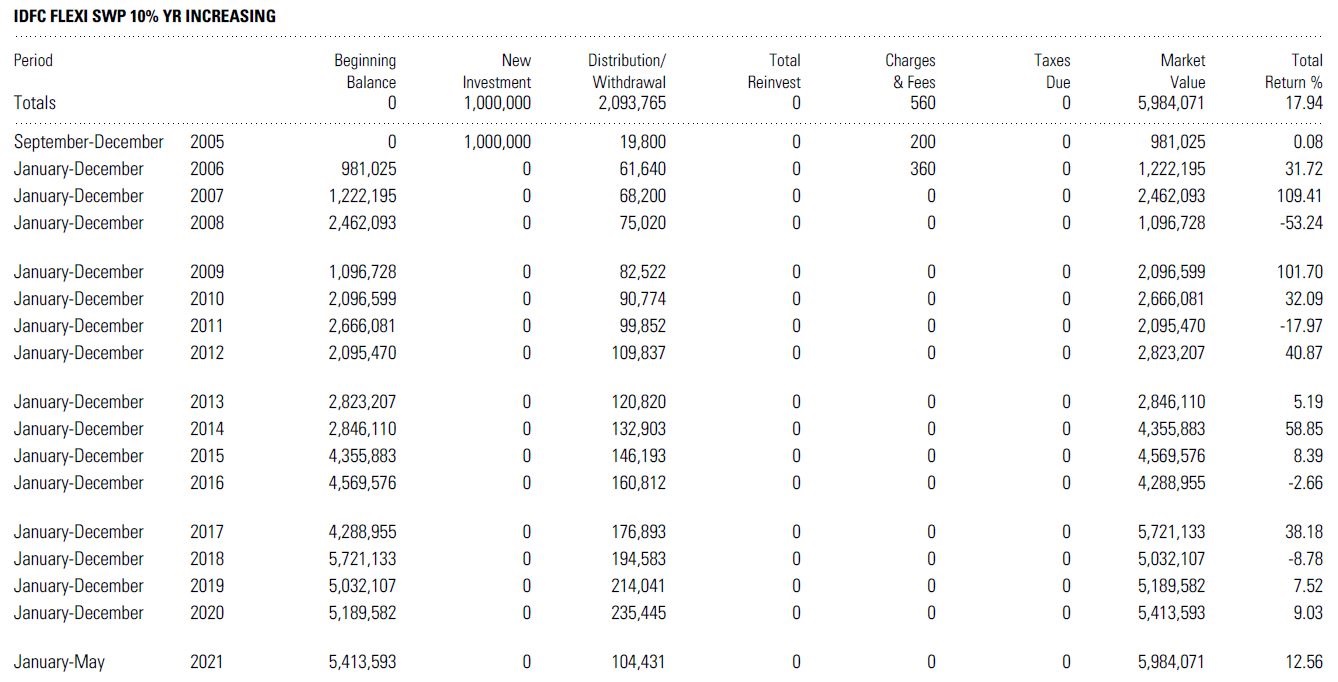

Let us assume that your client had increased the SWP withdrawal amount of Rs 5,000 by 10% every year to keep up with inflation. In this case, your client would have withdrawn Rs 20.93 lakh over 15.9 years, which is more than the original capital of Rs 10 lakh. In this case, the portfolio value would be Rs 59.84 lakh after withdrawing Rs 20.93 lakh. (Investment period (09-28-2005 to 05-31-2021) (Click on the image to enlarge.)

(Source:

Morningstar Adviser Workstation

)

SWP from debt fund

If your client had invested the same corpus Rs 10 lakh in Aditya Birla Corporate Bond Fund for the same time period considered above and withdrew Rs 10,000 monthly, the corpus would have been depleted by August 2019. From September 2005 till August 2019, your client has withdrawn Rs 16.66 lakh. The client has earned 8.50% CAGR on her investment. (Click on image to enlarge)

Investment in Balanced Fund

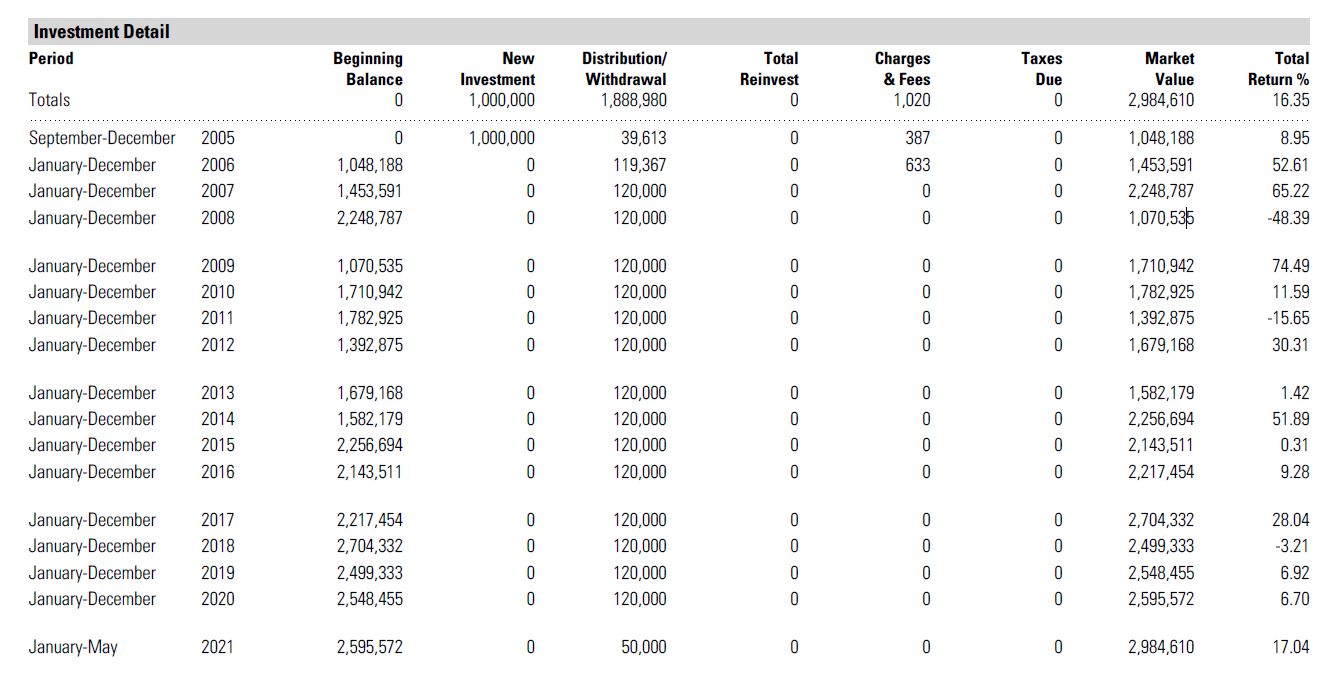

If your client had invested Rs 10 lakh and withdrew Rs 10,000 monthly from HDFC Balanced Fund, she would have earned 16.35% CAGR over the same period (09-28-2005 to 05-31-2021). The client had withdrawn Rs 18.88 lakh over this period. The final fund value would be Rs 29.84 lakh.

What are the risks?

SWP may not work to your advantage when your client invests the entire corpus lump sum in an equity fund and the market crashes suddenly or is on a downward trajectory. The principal would have fallen to the extent of the market fall and to the extent of the underlying securities. Further, withdrawing at regular intervals when the market is trending downwards will deplete the corpus. That said, equity markets tend to recover from such shocks as is evident by many past market cycles. The principal will grow if your client remains invested for the long run.

For retirees, SWP from debt funds is recommended for those who do not wish to see volatility in their portfolios.

Withdraw Wisely

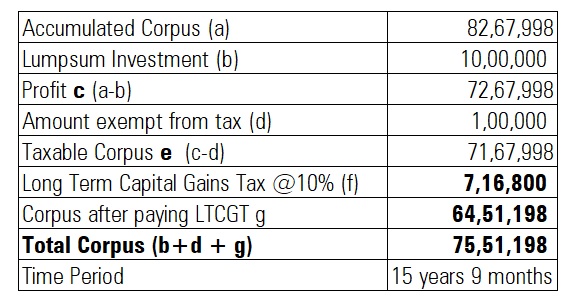

SWP is a tax-efficient way to withdraw your client’s money instead of redeeming lumpsum. Capital gains that exceed Rs 1 lakh are taxed at 10%. Suppose the client withdraws the entire Rs 82.70 lakh at one go, she will have to pay a tax of Rs 7.16 lakh. If your client doesn’t need the entire money immediately, they can see the magic of compounding by withdrawing Rs 1 lakh from the capital gains and let the money grow.

(Investment period (09-28-2005 to 05-31-2021)

Tax and Exit Load

Do note that short-term capital gains tax of 15% is levied in equity funds when you withdraw via SWP before one year. Also, an exit load of 1% (depending on the fund) is levied on purchases that are redeemed within one year. In debt funds, your client has to pay short-term capital gains tax at the slab rate for redeeming before three years and at 20% with indexation benefit after three years which becomes long-term capital gains.

Smart things to know about SWP

- SWP can be set up weekly, fortnightly, monthly and quarterly.

- Money withdrawn through SWP can be reinvested in another fund.

- Your clients can cancel or modify your SWP anytime.

- There is no extra charge for SWP, besides exit load.

- Your clients need to have a certain minimum balance in the fund.

To understand how you can help your clients plan their cash flow requirements smartly, request a demo today.