In our previous posts, we looked at how to analyse a fund’s risk measures, filtering top-performing funds, performance of 39 scheme categories and using Returns Calculator tool. In this post, we will explore how to use the Fund Compare Tool on Morningstar.in.

You can find this tool under the Mutual Funds tab on the homepage > Compare Funds.

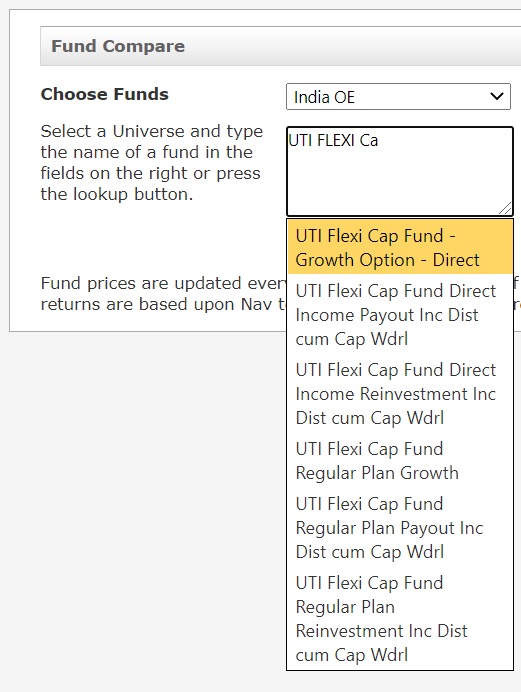

Type the name of the fund you wish to search in the box shown below and you will get a list of options from that fund which include direct, regular, dividend reinvestment, dividend payout, and so on. Each fund will typically have 6 plans.

You can find information on up to five funds from any category through this tool.

You can see a host of information like star rating, trailing return, annual return, Sharpe Ratio, Standard Deviation, R Square, Alpha, Beta, of funds under this tool.

We have explained what these terms mean in these posts:

What is Standard Deviation and how to interpret it

How to use the Fund Risk Measure Tool

Asset Allocation: In this section, you can see how much exposure the fund has towards equity, bonds and cash. Typically, equity funds will have high exposure to equity while balanced funds will spread the allocation between debt and equity.

Sector Weightings: This section shows the exposure towards different sectors bucketed under cyclical, sensitive and defensive themes. For instance, healthcare and utilities fall under the defensive theme. Financial services and real estate come under the cyclical theme. This shows which sectors/themes the fund manager is bullish on. Do note that financial services could have high exposure in most funds because this sector has 41% weightage in BSE Sensex. Information Technology (18.92%) and Oil & Gas (11.68%) have the second and third largest weightage in Sensex.

World Regions: This section gives you information about the exposure fund has in companies which are listed outside India. The exposure is listed under different geographies like Europe, Americas and Greater Asia. Funds that typically invest in domestic equities will not have any exposure in other geographies and hence the information under this will be blank. This is a useful section for analysing international fund of funds and those funds that invest a portion in international equities.

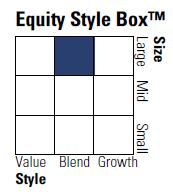

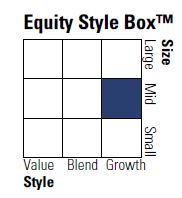

Morningstar Equity Style Box: It is a nine-square grid that provides a graphical representation of the "investment style" of a mutual fund. It classifies securities according to market capitalization (the vertical axis) and growth and value factors (the horizontal axis). Fixed income funds are classified according to credit quality (the vertical axis) and sensitivity to changes in interest rates (the horizontal axis). The Morningstar Style Box helps investors construct portfolios based on the characteristics-the style factors of all the stocks and funds that the portfolio includes.

The below style box shows that the fund invests in predominantly large cap stocks with a value and growth tilt.

This style box shows that the fund invests in a mix of mid and small caps with a growth tilt.

You also get information on the minimum investment the fund accepts and the total expense ratio of the fund in this section.