Morningstar India offers a host of tools to analyse the performance and holdings of mutual funds.

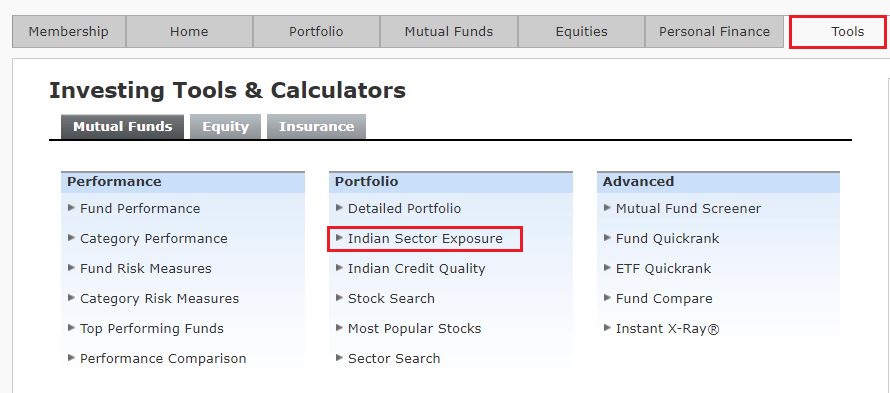

In this post, we will explore Sector Exposure Tool available on Morningstar.in. This feature can be accessed from the homepage from the Tools navigation tab > Mutual Funds> Indian Sector Exposure.

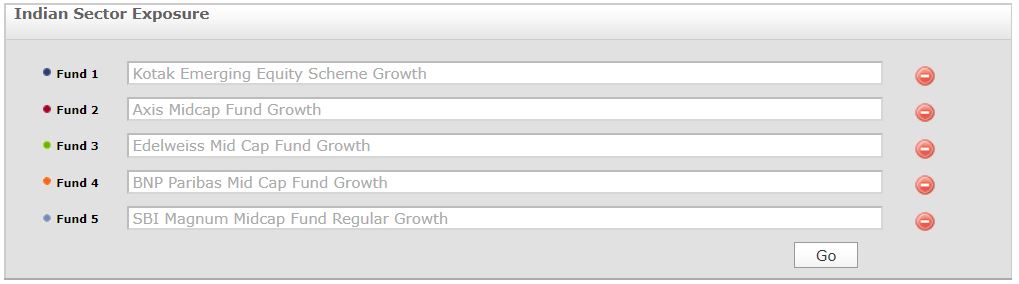

We looked at the sector exposures of the five top-performing Mid Cap Funds over a ten-year period as on July 2, 2021. These are Kotak Emerging Equity (19.37%), Axis Midcap (19.33%), Edelweiss Mid Cap (19.18%), BNP Paribas Mid Cap (18.56%) and SBI Magnum Mid Cap (18.40%). (Compound annual growth return of regular plans)

Type the name of the fund in the search box shown below and hit Go.

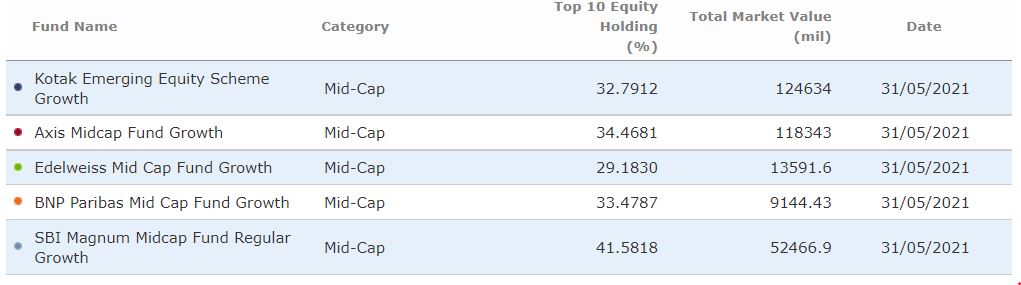

In the Portfolio Summary section, you get to see the percentage of top 10 Equity Holdings of each fund and its total market value as of last month-end.

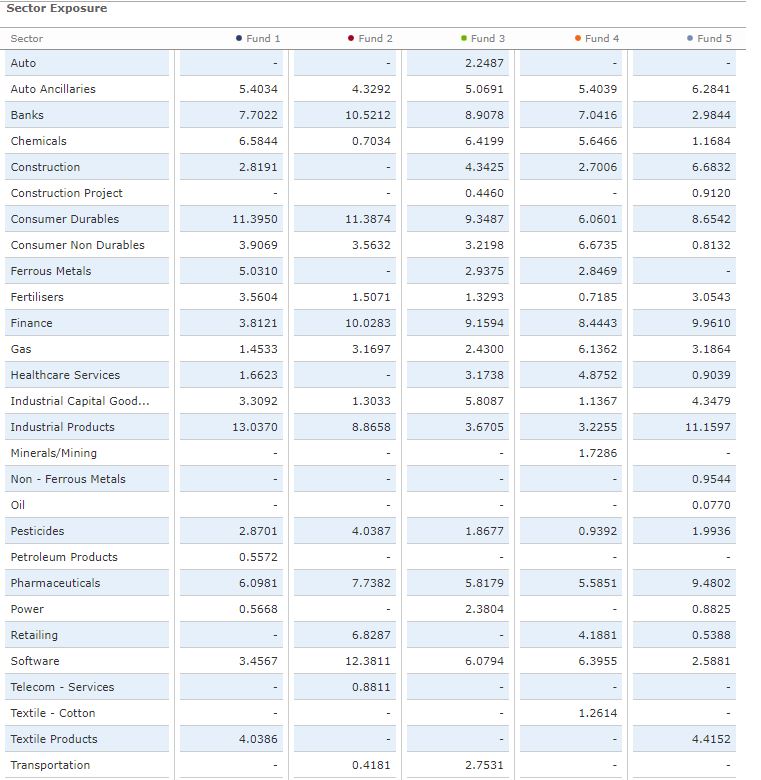

Just right below this section, you will see the percentage of a portfolio’s weightage in each sector. This will show which sectors, the fund manager is bullish on and the sectors he/she is avoiding. (Click on the image to expand)

- Fund 1: Kotak Emerging Equity

- Fund 2: Axis Midcap

- Fund 3: Edelweiss Mid Cap

- Fund 4: BNP Paribas Mid Cap

- Fund 5: SBI Magnum Midcap

As we can see from the above table, Kotak Emerging Equity has the highest exposure to Industrial Products (13.03%) and the least exposure to Petroleum Products (0.55%). Of the total 28 sectors, Kotak Emerging Equity has exposure in 19 sectors.

Axis Midcap has comparatively concentrated exposure. Of the total 28 sectors, it has invested in 16 sectors. The fund has the highest exposure (12.38%) to software and the least exposure to Transportation at 0.41%. (as on May 2021)

An analysis of the exposure of five funds towards different sectors shows that these funds have the least exposure towards sectors/themes like auto, construction projects, minerals/mining, oil, non - ferrous metals, oil and telecom services. The sector/theme exposures of any fund change as per the conviction/view of the fund manager.