The coronavirus pandemic has led to a marked increase in investor interest and fund launches for sustainable funds globally. While the Indian sustainable fund market is still in its nascency, we witnessed a similar trend, too.

Here’s an update on the Environmental, Social and Governance (ESG) space.

Assets continue to grow

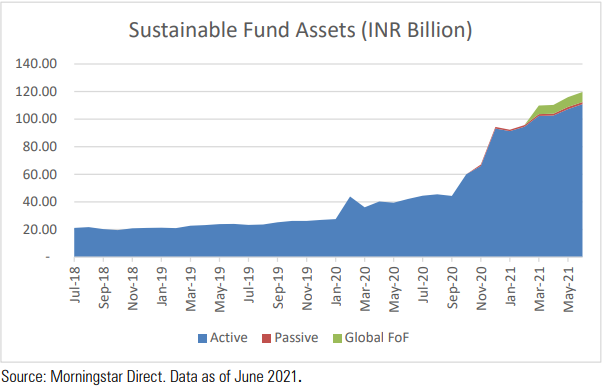

At the end of June 2021, assets invested in Indian sustainable funds identified by Morningstar reached a record Rs 119.7 billion, significantly up from Rs 42.1 billion at the same time a year ago. For perspective, a 27% increase compared with December 31, 2020, and a 184% increase compared with June 30, 2020.

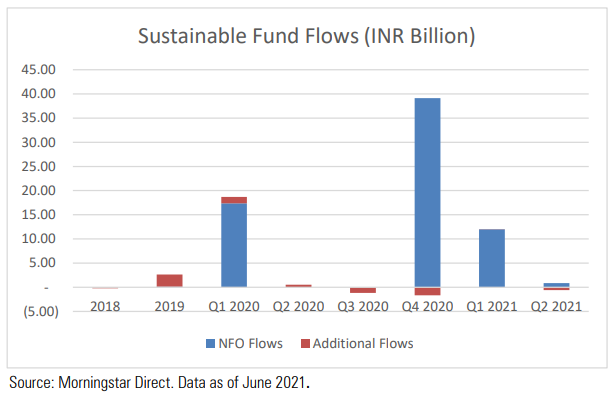

Flows in the first half of 2021 were lower at Rs 12.3 billion as compared with the second half of 2020, which witnessed a significant number of new sustainable fund launches and had flows of Rs 36.3 billion.

Estimated flows in second-quarter 2021 were significantly lower at Rs 260 million, as compared with flows in the previous two quarters—Rs 12 billion in first-quarter 2021 and Rs 37.5 billion in fourth-quarter 2020.

While the initial fund launches have attracted significant interest and flows, we are yet to witness continuing flows come through in sustainable funds post launch.

Where the money is

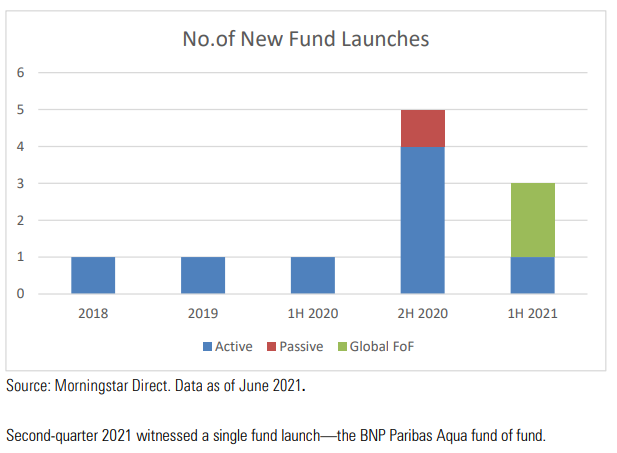

Through Morningstar's sustainable attribute framework, we identified 6 funds that were launched in the year to December 31, 2020, with as many as 5 launches in the last quarter of 2020. The first half of 2021 witnessed 3 sustainable fund launches, including 2 feeders into global sustainable funds.

Indian investors currently have access to 11 India domiciled sustainable funds: 8 active, 1 passive (ETF and fund of fund), and 2 feeders into global sustainable funds.

While still nascent, with only 11 sustainable funds, the market is quite concentrated. The top 5 sustainable funds account for 86.5% of the overall sustainable assets.

Active funds account for 93.5% of the overall sustainable fund assets under management.

The only passive fund is Mirae Asset ESG Sector Leaders ETF.

The largest funds by way of assets

- SBI Magnum Equity ESG

- Axis ESG Equity

- ICICI Prudential ESG

- Kotak ESG Opportunities

- Aditya Birla ESG

Morningstar Sustainability Rating

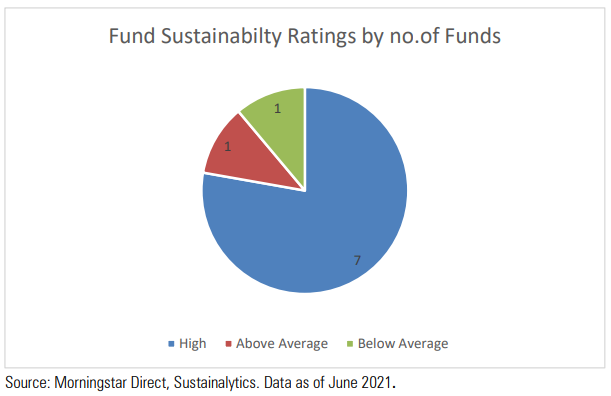

This rating is intended as a measure of portfolio ESG risk relative to global category peers. Using individual company data from global ESG research leader Sustainalytics. Morningstar rates the degree of ESG risk found within a fund by looking to the fund's holdings over the trailing 12 months and rolling up individual holdings' ESG risk ratings with emphasis placed on more recent holdings information. The Sustainalytics ESG Risk Rating measures the degree to which a company's economic value may be at risk driven by ESG issues. In order for a fund to receive a Morningstar Sustainability Rating, there must be ESG risk scores on at least two thirds (66.7%) of holdings. An investment does not have to be deemed sustainable under the identification framework for Morningstar to provide a Sustainability Rating.

Domestic Indian equity sustainable funds rate well on the Sustainability Ratings within their global category (Indian equity): 7 funds rated as High (5 globes), 1 as Above Average (4 globes), and 1 as Below Average (2 globes). Consequently, 84.7% of the overall sustainable funds by assets have a Sustainability Rating of High (5 globes).

Looking at the industry

Sustainable fund investing is still relatively a new concept for Indian investors and could take some time for awareness to build for flows to come into existing sustainable funds.

Majority of the flows in sustainable funds in India have come in during the new fund offering (NFO) stage, with incremental flows in existing sustainable funds post NFO being limited. There was only a single NFO during second-quarter 2021, while the previous quarter witnessed two & five fund launches, thus the greater flows during these quarters.

Worth noting is that most domestic ESG funds have been launched in the last 8-9 months.

You can download the report here.