Most of us are limited by our circumstances. We were not born into wealth, and neither do we earn mind-boggling salaries. But that can be countered if we have sensible money practices.

Without much ado, let me get into it. The simplicity of it may surprise you, but I hope it will encourage you to get cracking.

Step 1: Get over your savings inertia.

Saving regularly is an uphill battle. We must do it. We should do it. So why do we struggle to do it?

The discipline in spending, saving, and investing – all will come only if you know why you are doing it. No investing cliché will do it for you. Saving has such negative connotation to it because it is associated with sacrifice. But what is the sacrifice for? Find that driver. Once you know what you want to spend your money on, then you can cut costs mercilessly on the things you don't care about, and invest with a focus.

Investing is NOT an end in itself. You invest for a purpose. That purpose will drive you. So ask yourself, what is it that I want my money to do for me? What is it that I really would love to have?

It could be anything. It may just be accumulating gadgets, building a fabulous home, or just that you don’t want to retire poor. There is no right and wrong. There is no good and bad. There is no normal and absurd. Just be true and honest to yourself. Someone else’s pleasures may not bring you happiness. What fulfils them may not be your cup of tea.

If you are struggling here, I sincerely request you to read Why does saving suck?

Step 2: Start NOW! There is a massive cost to delay.

Don’t fall for the spiel that you will start investing when you have some “decent money”. All money is decent, however miniscule. Every single day that you delay investing, you're actually losing money.

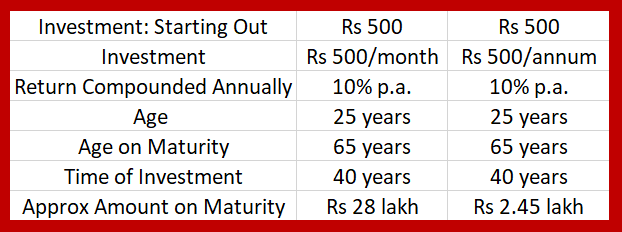

You can make a difference with as little as Rs 500. Here’s how much you can earn, and how one decade makes the world of a difference even with every other parameter constant.

Step 3: There’s power in consistency. You need to be at it.

You don’t get fit by exercising only when you feel like it. You don’t build a skill by studying and practicing it only when you are in the mood. You don’t get rich by being lax with regular contributions. See the difference a monthly contribution makes, as against an annual contribution.

You can use this Compound Interest Calculator to play around with scenarios.

Step 4: Saving is not enough.

You need to start investing. No one became wealthy investing in fixed deposits or parking all their cash in a savings bank account. Every young investor must invest in equity. It can be intimidating, but very rewarding.

Equity mutual funds are the best way to invest for long-term, consistent growth because they allow you to spread your investment among many companies. It offers diversification, you can start with small amounts, and you can opt for a systematic investment plan (SIP), that allows you to invest small amounts every single month or quarter.

The most prudent way to start off is by investing in large-cap funds which will lay the foundation for a solid portfolio. You can build on it as you go along. Please read 3 funds for beginners to understand what a large-cap fund is and which are the recommended ones.

Step 5: Roll the dice on single stocks later.

Don’t let direct stock picks be your initial investments. Individual equities can misfire and leave a bad taste in the mouth, and a hole in the pocket. If you push forward with equity funds, you will have a basic grounding in seeing your investment value fluctuate as the market moves in either direction. It will give you a sense of how comfortable you are with volatility. You stand a real chance of benefiting from these experiences.

You may feel stocks are fine as you can afford to lose small amounts of money when you are young as you have ample time to recover. But those small amounts, if invested wisely, can add up to serious money over a young investor's time horizon; wasting even a few of those early years with misguided experimentation can have a decent-sized opportunity cost.

Venture into direct stocks only after you have a foundation in place. By foundation, I mean SIPs in equity funds, an Emergency Fund, and you have conquered your battle with debt.

(PS: If you have a goal that is much closer at hand, such as buying a car or a bike or taking a holiday, this money shouldn't be in stocks at all.)

Larissa Fernand is Senior Editor at Morningstar India. You can follow her on Twitter.