In the arena of risk rating, Sustainalytics is one of the oldest, largest and most influential players. It provides data on 40,000 companies with ratings on 13,000 of them spanned across 172 countries.

At the core of the research is the understanding that material ESG issues play a central role in a risk-based approach to valuations. Wilco van Heteren, Executive Director - ESG Research, Sustainalytics, breaks it down.

What we consider to be Material ESG issues.

- Environmental and social impact of products and services

- Human rights

- Data privacy and security

- Business ethics

- Bribery and corruption

- Access to basic services

- Community relations

- Emissions, effluents, waste

- Carbon - own operations

- Carbon – products and services

- Human rights – supply chain

- Human capital

- Land use and biodiversity

- Land use and biodiversity – supply chain

- Occupational health and safety

- ESG integration – financials

- Product governance

- Resilience

- Resource use

- Resource use – supply chain

These 20 material ESG issues exist for all the industries and sub-industries. We pick the relevant ones accordingly. For a typical sub-industry, we might select 8 to 10 material issues, for some only 5 and for others, 15.

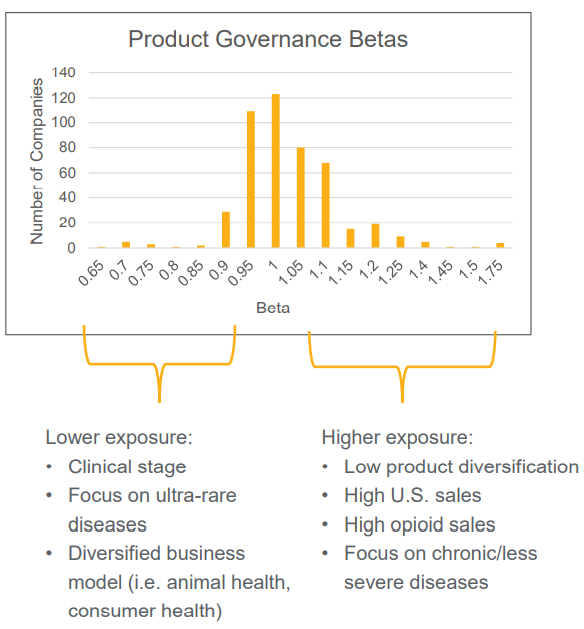

So while we have exposure scores at the sub-industry level, we can also tweak those sub-industry scores to company level scores. And we do that by applying betas. Similar to traditional investment models, we have averages for large group of companies, and we have deviations from the average by applying a beta factor.

Let's say we are looking at Fiat. We have certain exposure scores for the entire sub-industry, we further tweak those to better account for Fiat's specific circumstances. And we do that by applying betas. A beta can be determined by looking at company specific business and product lines, which might be different from the vast majority within one sub-industry. Financial strength, geographic exposure, where a company's assets are located, where the revenues come from, track record of incidents and controversies – all these are important to further fine tune the level of risk exposure.

How we assess companies on Material ESG issues.

ESG analysis complements conventional analysis. There are two dimensions that we look at.

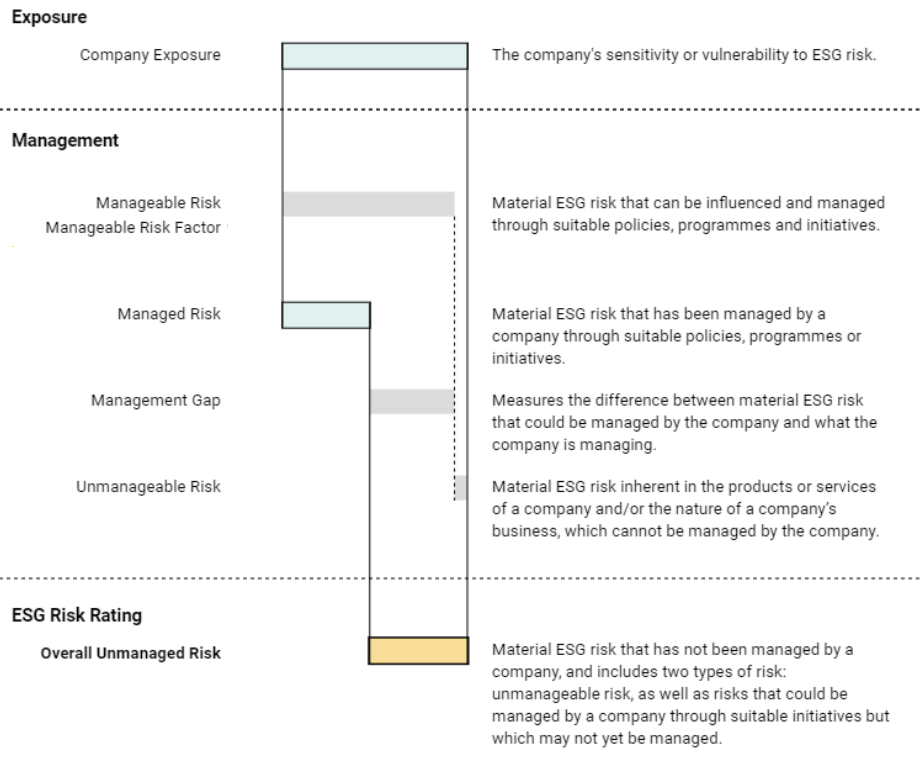

- Exposure: The degree to which a company’s enterprise value is vulnerable to material ESG issues. In other words, the extent to which these issues pose a risk to the company.

- Management: A company’s preparedness and track record in managing its exposure to material ESG issues through an assessment of policies, programmes, management systems and controversies.

Click on images in this article to enlarge for visual clarity

An oil and gas company for instance, will always be exposed to carbon risk, and perhaps not all of that risk is completely manageable. So we have to identify that portion of risk that can actually be managed by the company. What is left at the very end at the bottom of this graphic is unmanaged risk.

Explaining the above in the pharma industry.

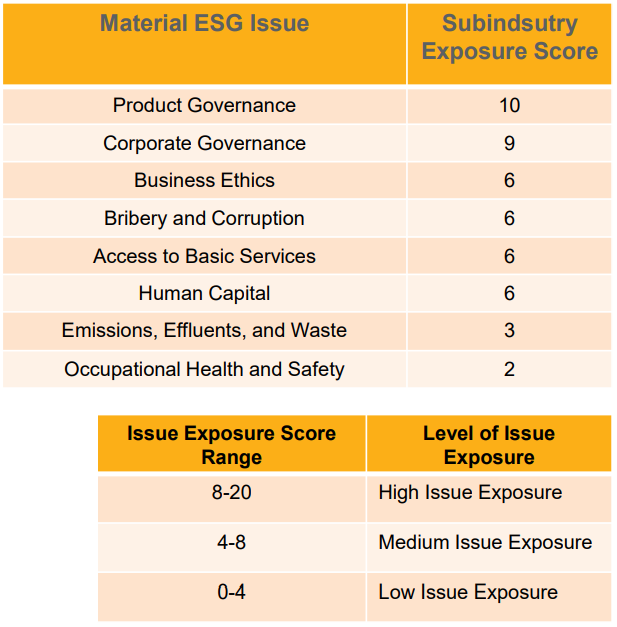

We select 8 material issues for the pharmaceutical industry.

A failure on Product Governance can have deep societal impact, and therefore imposes a high level of risk to the companies. We've seen lots of controversies indicating that pharmaceuticals face higher risk in terms of governing their products well.

Corporate Governance is a special kind of material issue across the entire universe, we attach an exposure score of 9 out of 10 to this specific issue.

Bribery and Corruption, and Business Ethics, are not only in relation to product governance but also marketing.

There are also some regional components. If we look at the U.S., there's a regulatory environment that is maybe less predictable and a little bit unstable. And that's also why we use those betas to tweak exposure scores for U.S. companies on specific material issues.

There are anti-competitive practices, and quality and safety are issues that very often pop up in our controversy analysis. They play a significant role in determining the risk exposure level for product governance. Let's say the revenue model applied involves lots of intermediaries vulnerable to bribes. What we found in our analysis is that on average, around 3% of normalised income of pharmaceuticals across the U.S. is actually either reserved or paid in terms of fines and settlements that relate to anti-competitive practices and bribery. That's quite a lot of money.

This shows how we define beta factors to adjust the exposure score that we apply to the entire pharmaceuticals industry. For instance, we lower the exposure score for companies operating in clinical stages. But, increase it for companies operating in relation to more common diseases, because there those marketing practices and bribery risk are more at stake.

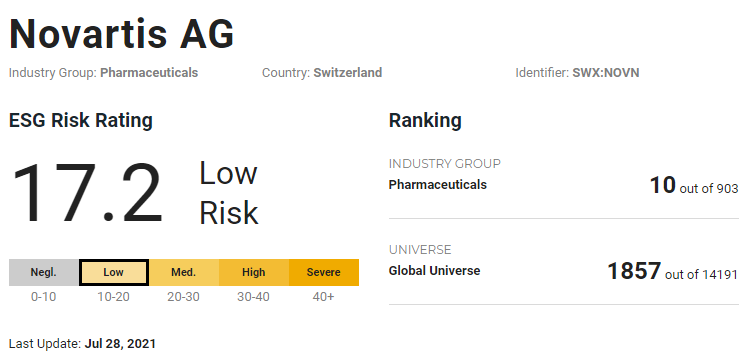

Take Pfizer, for example. It moved from High Risk to Medium Risk. This positive momentum was driven by improvements in the management dimension (2019) but limited by the recently announced Department of Justice (DOJ) and SEC probes into bribery and corruption in China and Russia (November 2020). After famously increasing prices in 2017 and 2018, Pfizer has limited increases to 10%, taken some steps towards drug price transparency, and focused on branded, specialty drugs with its spin-off of Upjohn.

You can get a glimpse as to how it compares with others.

This is a sketchy and basic explanation on how we translate the concept of ESG risk into ratings, and how we rate companies on ESG risk. You can read more on the Sustainalytics website.