I know that debt funds are for Emergency Funds. Can I do an SIP in such funds? Why are SIPs only recommended for equity funds and not debt funds.

Technically, an investor can opt for a Systematic Investment Plan, or SIP, into any fund of her choice. The issue is, how sensible is it from an investment perspective?

SIPs encourage discipline and consistency. No matter how you feel about the market or the economy, the investments are made. Your savings are invested regularly.

Then there is the convenience factor. The entire process is automated which makes investing so much less stressful and time consuming.

On a fixed day, every single month, a pre-determined amount is debited from your bank account and invested in the fund of your choice. It eliminates the typical tendency to try and time the market, which is pretty much an impossibility.

There is another aspect to consider, and we shall discuss that here.

Are SIPs better suited to particular funds?

As investments are made regularly, the SIP mode enables investors to average out the cost of their investments. This benefits investors in falling markets as they would then be buying more units for the same amount invested, when compared to the price before the fall. This helps investors when markets rise subsequently, with a SIP investment making better gains compared to a lumpsum investment (for the same total principal amount) invested at the beginning of the period.

For example, consider Investor A who invests a lumpsum of Rs 1,000 in January when an equity fund’s NAV is 20, and Investor B who invests Rs 500 each in January and February in the same fund. Now suppose the market fell sharply by February end resulting in the fund NAV dropping to Rs 10, and then recover amazingly resulting in the NAV rising to Rs 30 by March end.

In this case, total corpus of Investor A (lumpsum investor) would be at Rs 1,500 March-end, while that of Investor B (invested Rs 500 each in January, February, March) would be Rs 2,250.

This is why an SIP works best when investing into a volatile asset class.

Equities, due to sharp increases and falls, can potentially offer subsequent purchase prices lower than current price, benefitting investors. Typically, debt funds are not as volatile as equity funds.

Moreover, the NAVs of most debt funds tend to move upwards steadily (except for longer duration funds which are relatively more volatile but much less volatile than equities). Hence, lumpsum investment makes more sense for debt investments, than investing the same corpus in a staggered manner through a SIP.

Debt is much less volatile.

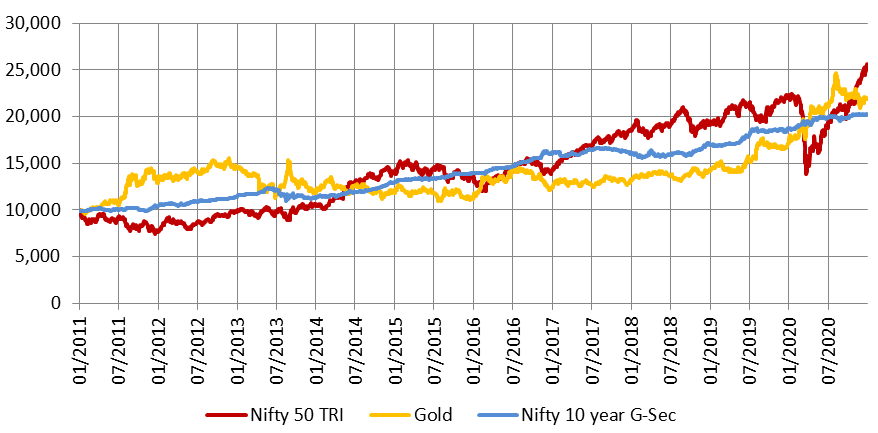

The chart shows the growth of Rs 10,000 investment in equity (represented by Nifty 50 TRI), fixed income (represented by Nifty 10-year Benchmark G-Sec Index) and gold over the 10 years ended December 31, 2020. The charts below highlight the volatility of equity investments and the price declines (relatively sharper than fixed-income) that occur at various points in time, benefitting SIP investing. However, fixed-income tends to increase in a much more stable manner, offering potentially lower benefits for SIP investing.

So should you do an SIP into a debt fund?

Mutual funds offer a gamut of funds in the fixed-income space with varied risk-return profiles, to suit different needs of investors. While selecting funds, one should consider the investment horizon and the acceptable level of risk in line with the investor’s risk appetite. Funds investing into higher duration and/or lower-rated securities, subject an investor to interest rate risk and/or credit risk.

For a corpus currently available on hand, SIP as an investment strategy makes no sense when it comes to overnight funds, liquid funds or money market funds. However, investors looking to invest future income can consider investing into such funds in line with their recommended asset allocation. Some fixed income funds can be volatile due to changes in interest rate (yields) and credit spreads. Longer the duration of a debt fund, higher is the price volatility of the fund due to change in bond yields. You can consider an SIP into such funds.

On a slightly different note, a debt SIP can be a viable alternative to a Recurring Deposit.

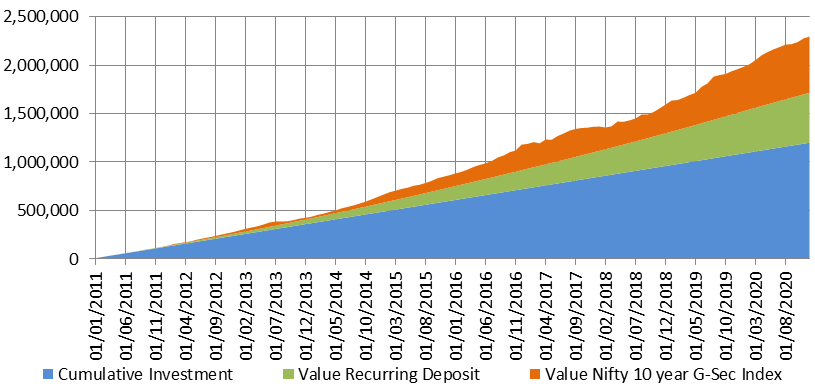

The chart shows the growth of Rs 10,000 monthly SIP in Nifty 10-year Benchmark G-Sec Index over 10 years ended December 31, 2020. And the same amount invested in a bank recurring deposit, using the data of SBI quarterly fixed deposit rates.

The annualised XIRR of monthly recurring deposits was 7% compared to 7.7% XIRR for the Nifty 10-year Benchmark G-Sec Index.

Additionally, debt funds are tax-efficient if held for over 3 years, with the gains being taxed at 20% (excluding cess and surcharge) after indexation of purchase price. The indexation of cost results in the net tax to be paid on gains to be less than 20%. On the other hand, interest earned on recurring deposits is taxed at the marginal rate and does not offer any indexation benefit.

Both charts are sourced from Mirae Asset.