On October 5, 2021, rating agency Moody’s changed the outlook on the Government of India's ratings to stable from negative and affirmed the country's foreign-currency and local-currency long-term issuer ratings and the local-currency senior unsecured rating at Baa3.

The rating agency noted that downside risks from negative feedback between the real economy and financial system are receding. “With higher capital cushions and greater liquidity, banks and non-bank financial institutions pose a much lesser risk to the sovereign than Moody's previously anticipated. And while risks stemming from a high debt burden and weak debt affordability remain, Moody's expects that the economic environment will allow for a gradual reduction of the general government fiscal deficit over the next few years, preventing further deterioration of the sovereign credit profile,” noted the agency.

Recently, HDFC Mutual Fund made a case for investing in Credit Risk Funds based on the positive green shoots witnessed in the economy and overall credit ratings following this upgrade. “For India, since overseas borrowing costs are tied to its rating and the agencies’ outlook on our nation, this upgrade could help in lowering borrowing costs for the government as well as the corporate sector. Hence, with the credit outlook improving, one could consider allocation to credit risk funds,” stated the fund house.

According to CRISIL, the credit ratio (number of upgrades to downgrades) continued to increase in the first half of fiscal 2022, with 488 upgrades and 165 downgrades. The credit ratio was at a decadal low of 0.54 (lowest in more than a decade) in the first half of 2020, which is now at 2.96.

Credit Risk Funds, which invest 65% of net assets in below highest rated securities, had started facing the heat even before the pandemic due to sporadic credit events and other headwinds facing the economy.

Franklin Templeton’s decision to shut down six debt schemes in April 2020 made investors exit the category in hordes. Of the total Rs 27,333 crore AUM of six Franklin Templeton debt funds, the fund house has distributed 88% or Rs 23,999 crore to investors as of October 2021.

Given the challenges faced by the economy, the category witnessed 21 consecutive months of net outflows from April 2019 till December 2020 to the tune of Rs 56,317 crore. As a result, the assets in this category fell sharply from Rs 80,756 crore to Rs 25,385 crore in April 2021. As of September 2021, there are eight segregated funds in this category. In total, there are 26 segregated portfolios, including eight funds from the Credit Risk category.

Net outflows from this category have subsided and the category is seeing a gradual revival. From the past five consecutive months (May 2021 till October 2021), Credit Risk Funds have seen cumulative net inflows worth Rs 1,504 crore.

Performance

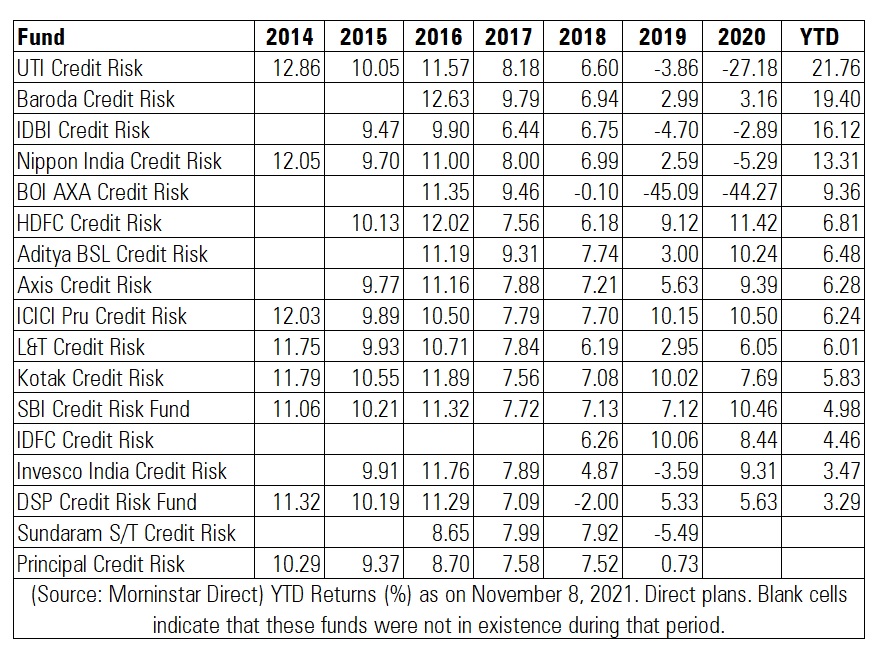

Credit Risk Funds delivered double-digit returns in 2014, 2015 and 2016. These funds started facing the heat from 2018 onwards with the onset of the IL&FS crisis. It is worth noting that some funds saw drawdowns of more than 50% in 2020.

With the economy showing signs of revival, these funds have yielded 8.92% category average YTD as of November 8, 2021. Some funds like UTI Credit Risk, Nippon India Credit Risk, IDBI Credit Risk, Nippon India Credit Risk and Baroda Credit Risk have yielded double-digit returns. Advisers attribute the double-digit returns YTD in these funds due to accrual in funds that had taken a haircut.

What should investors do?

With these positive indicators, is it time to enter Credit Risk Funds at this juncture?

Dev Ashish, Founder, StableInvestor, says that if one is considering investing in this category, he recommends investors to go for funds that are running lower duration. “There is of course a risk of interest rates rising. If that happens, the credit risk funds with comparatively high portfolio duration may get hurt a bit more than those with lower portfolio duration. So even within the credit risk space, schemes with lower duration are better placed for time being.”

Dev says that investors who have a low-risk appetite should simply avoid this category. For others who have a higher risk appetite and larger portfolios, he recommends that Credit Risk Funds should still not form a core part of their debt portfolio. Instead, the exposure should be limited to 10-25%. And investors should opt for funds that have a good track record. “While picking funds in the category, stick to the well-managed funds (with comparatively lower maturity profile) with large assets under management from top few AMCs only. Don’t run after table-toppers or small AMC funds. Also, make sure that the fund portfolio isn’t concentrated too much (to a few instruments and/or issuers).”

Dev says that investors who have a low-risk appetite can avoid this category.

Dhaval Kapadia, Director – Portfolio Specialist, Morningstar Investment Advisers India, says that the best time to invest in Credit Risk Funds was 12 to 15 months ago when spreads had widened due to the FT issue. “Yields on Credit Risk Funds and other debt funds have dropped over the past 6 to 9 months due to high liquidity in the interbank market. The interest rate cycle seems to have bottomed out and given the expectations of an increase in rates over the next 6 to 12 months, it is advisable not to invest in these funds currently.” Rather, he recommends investors Banking and PSU Funds or Corporate Bond Funds at this juncture.

Bengaluru-based RIA Basavaraj Tonagatti says that debt funds should be used to diversify one’s portfolio from the volatility of equities and given the risk involved in this category, he recommends investors avoid such funds. “We all know the risk involved, I would avoid such tactical call especially in the debt portfolio. The reason is, we invest in debt when our time horizon is short or to diversify the risk of investing in equity. Hence, in both cases, the primary purpose of investing in debt is not to maximize high returns on risky bets like credit risk funds. Hence, my suggestion is to avoid such categories of funds.”

To sum up, advisers recommend that debt funds should be looked at from the perspective of asset allocation to cushion one’s portfolio in the event of market crashes and build a corpus for meeting short-term goals. If one is willing to take the risk, keep the allocation to Credit Risk Funds minimal.