Following the stellar listing of Zomato (up 96% from issue price) and Nykaa (up 90% from issue price), Paytm IPO was eagerly awaited by investors who were looking for making listing gains. However, the 27% drop on the listing day has disappointed retail investors who got the allotment.

Some handles on Twitter are even recommending investors to avoid investing in schemes that were anchor investors in Paytm. The IPO was subscribed by four fund houses (18 schemes) as anchor investors who collectively hold 52.34 lakh shares. Shares held by anchor investors are locked in till December 14, 2021.

Given the scepticism surrounding mutual fund’s participation in Paytm IPO, we spoke to financial advisers to understand what they would advise investors.

Rushabh Desai, Founder of Rupee with Rushabh Investment Services, says that investors should avoid judging fund managers based on one blip and should look at the long term performance of the fund before taking a knee-jerk reaction.

“All of these funds are backed by experienced fund managers and management teams. Sometimes, investment calls can go right and wrong as well. I don't think investors should judge these funds based on just one stock. Investors should understand that they are betting on a basket of stocks. It is just day one of the IPO and I would like to wait and let the fund managers decide as they will know much better whether to hold on or to sell. Also, the allocation is in the range of just 1-2% this may not hamper the funds NAV in a big way in the long run. But whatever the long run outcome of the company this IPO price fall will be a big learning lesson to many investors and fund managers on their investment decisions given the craze of these IPOs and the valuations that they enjoy.”

Melvin Joseph of Finvin Financial Planners seconds Rushabh’s view. “We can't take such blanket ban on such funds. A fund manager is taking a calculated risk in investing in such stocks. Early-stage investment in a company has high chances of risk and success. It is through such investment that these funds are generating return to the investors. I will not avoid a fund just because their investment is not giving huge return in the short term.”

Shalab Bibhab of Bibhab Capital says that investors should have a long-term goal while investing in funds. “Though time is to value innovative companies and consider them for portfolio allocation, with all con calls and management interviews on valuation, revenue and margins seem to be out of context and irrelevant when these kinds of allocations are done. We invest in mutual funds for long term, so one decision like this by fund management would not let me take an extreme step. I would advise investors to stay put in these funds."

Kolkata-based MFD Anand Khetriwal points out that the size of the investment in Paytm IPO is negligible and fund managers have made successful exits in other IPOs. “If investors want to avoid funds that were anchor investors to Paytm, does that mean we should start investing in funds those invested in Zomato or Nyakaa? Nobody said anything when fund managers invested in other IPOs. We do not know with what thought process fund managers have bought these shares. Also, the percentage allocation in these portfolios is minuscule with regards to overall size - for e.g. – Rs 25 crore in HDFC Mid Cap Opportunities which has AUM of Rs 31,600 crore size does not make much difference. Secondly, all the fund managers have a long-term proven track record and are alpha generators.”

In the calendar year 2021, 73 firms have gone public so far. Of this, 23 were small and medium enterprises. Of the total 73 firms which have been listed so far, 21 IPOs were listed at discount to their offer price while 52 IPOs listed higher than the offer price.

If we see the history of IPOs, many companies like Reliance Power, Coffee Day Enterprises, ICICI Securities, Kalyan Jewellers, UTI AMC, ICICI Prudential Life, Indian Railway Finance Corporation, Suryoday Small Finance Bank, Fino Payments Bank Limited, MRP Agro Limited, CarTrade Tech Limited, Aditya Birla Sun Life AMC, among others have listed below their offer price.

On the other hand, many IPOs have delivered good returns on the listing day. In fact, many IPOs have gained handsomely since their listing in 2021 where a number of schemes are holding such stocks.

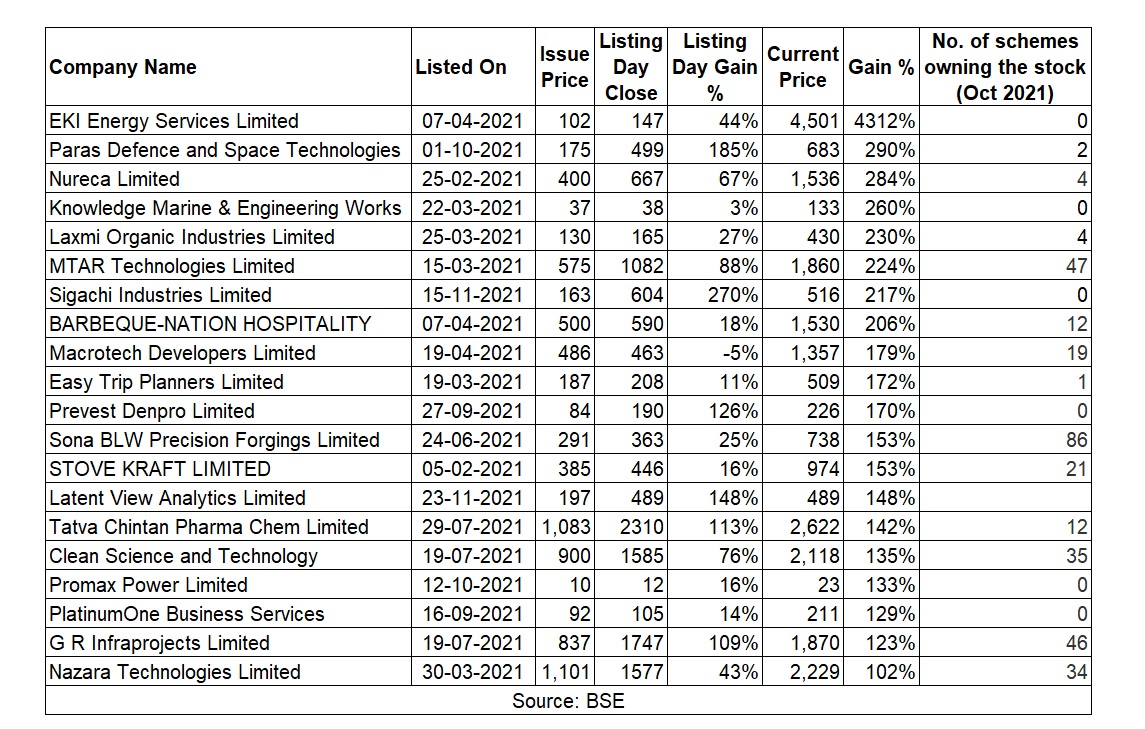

IPOs that have gained up to 4312% from issue price

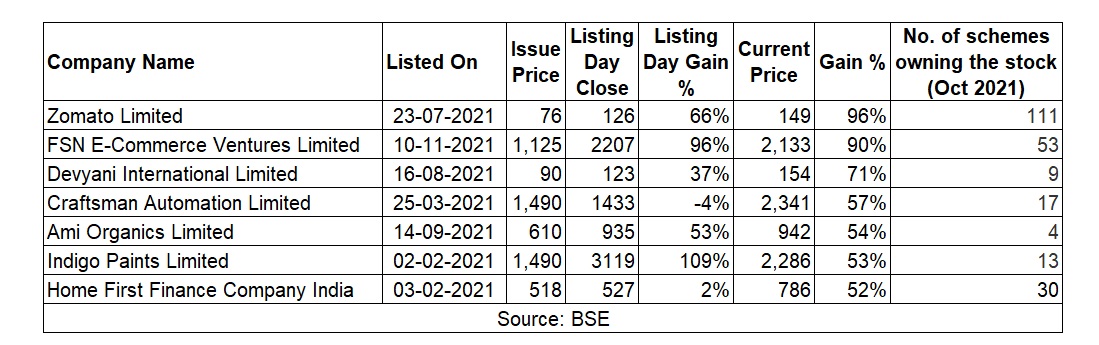

IPOs that have gained up to 96% from offer price

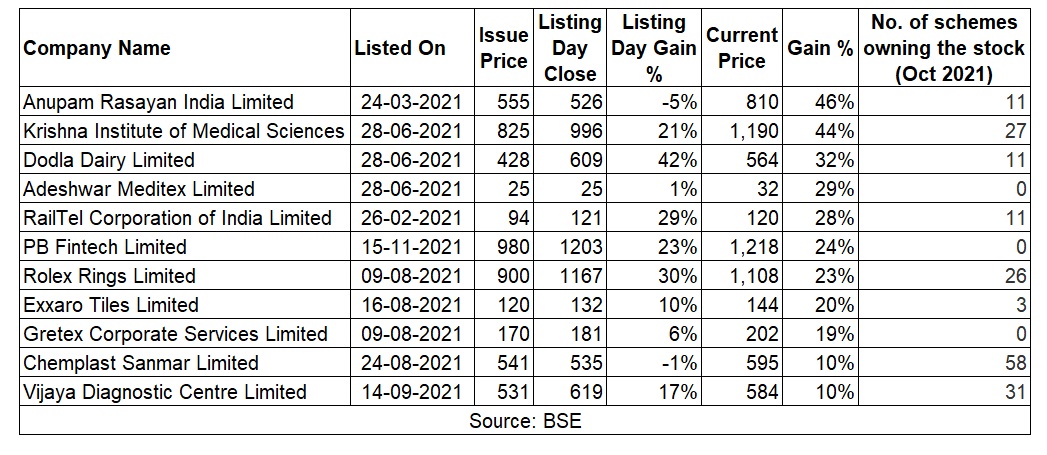

IPOs that have gained up to 46% from issue price

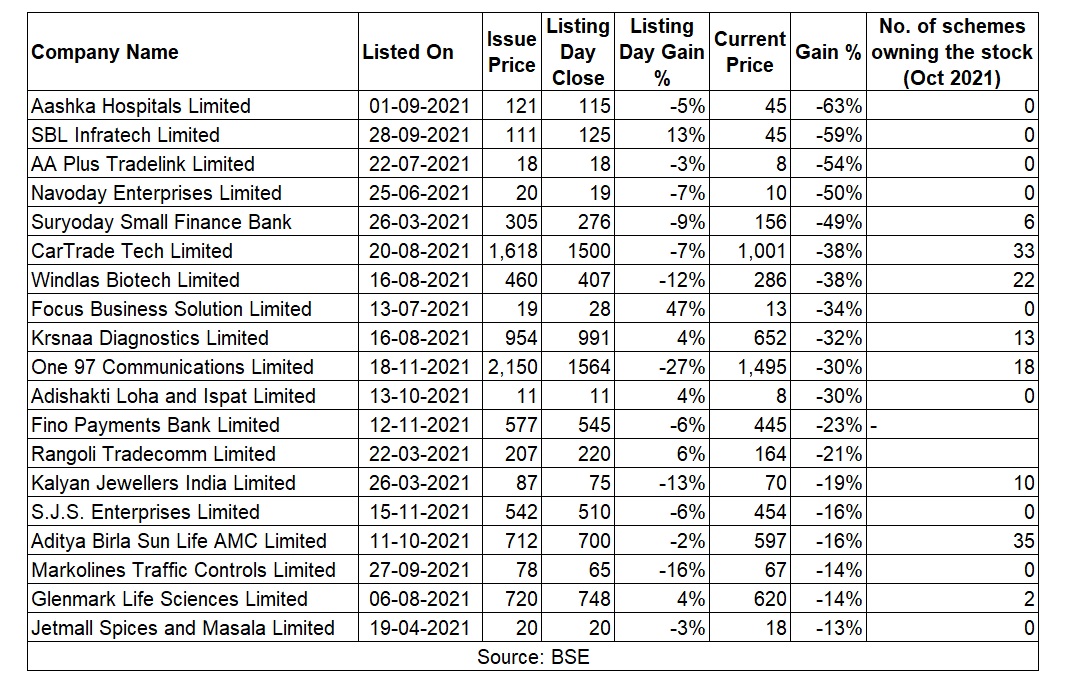

IPOs that have lost up to 63% from offer price