The National Pension Scheme, or NPS, is a very efficient way to create a retirement corpus. Backed by the government, it arguably has the lowest expense ratios, and offers a deduction under Section 80C.

However, investors get deterred by two features - Illiquidity (of Tier I Account) and Annutization at the time of withdrawal.

Sumit Ramani, co-founder of ProtectMeWell – a comprehensive insurance needs analyzer, looks at the concerns.

- Illiquidity of Tier 1 account until the age of 60 years

Tier 1 accounts are the most basic of the NPS accounts. In "normal" circumstances, the investment is locked-in until the age of 60. An individual opening an account at the age of 30 might find it daunting. But it would be nice to view it from a different perspective.

The lengthy time frame works wonderfully for your benefit, because when growing your savings, time is your friend. Your investment is put to work, it compounds, and feeds on itself to grow. What you can achieve with the mandatory lock-in is something you might never obtain if it was made easy for you to withdraw at any time.

Which brings us to the question of an early retirement. As FIRE (the acronym for Financial Independence, Retire Early) catches the fancy of many, this is a very genuine issue. Maybe an individual would want to retire at the age of 40. Well, my view of NPS remains unchanged. Yes, you would have to plan your finances in a way such that you can have a cashflow between the age of 40 and 60 years. But it does not take away from the fact that there is merit in having a portion of the retirement kitty locked-in, that can be accessed only at the age of 60 years.

Lastly, in case of exceptional scenarios like medical emergencies, children’s education/marriage, and house construction, the money can be withdrawn before the age of 60.

- Annuitization at the time of withdrawal post the age of 60

According to the current rule, 60% of the corpus can be withdrawn tax-free and the remaining 40% needs to be utilized to buy an annuity. So the entire lumpsum is not given to you at one go. And that is good. Let me explain.

What is Annuitization? It is the process of converting an investment into a series of periodic income payments known as annuities.

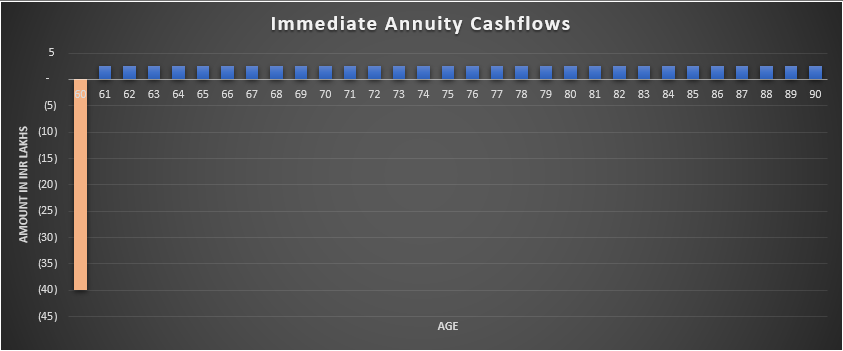

What is an annuity? The classic immediate annuity gives the policyholders a fixed income for life in exchange for a single premium. Put simply, it is the exact opposite of a loan. The difference is that there is no duration associated with an annuity. You get an income until you live. The longer you live the higher the IRR for you.

What is the IRR? The internal rate of return is a metric used in financial analysis to estimate the profitability of potential investments.

As an actuary, who has priced and designed annuity products, I would strongly recommend annuity products for their unique ability to hedge interest rate risk and longevity risk. Since annuity payouts remain constant for the lifetime, to hedge against inflation one can opt for annuities with increasing payouts.

A related deterrent is that the annuities are taxed. Let me explain with some figures. For a retirement corpus of Rs 1 crore, Rs 40 lakh would need to be annuitized. Going by current annuity rates, this would generate an annual income of Rs 2-2.5 lakh, which wouldn't attract tax by itself. Having said that, there could be other sources of income that would need to be factored in and might result in tax.

A final note.

This article has been written with the aim to broadly explain an otherwise complicated and technical topic for readers with little or no finance background. I sincerely suggest that to understand the finer details and to evaluate how this fits in with your financial plan, do avail of the services of a financial adviser.