Investors look at many parameters while shortlisting funds and one such filter is the track record of the fund manager. Some funds see churn of fund managers often while there are some funds that have been managed by the same fund manager for years.

Fund managers who have a long track record at the same fund house give an assurance to investors about the stability of the team and the performance.

We have compiled a list of India’s equity fund managers who have been managing the same scheme for ten years and above and their performance.

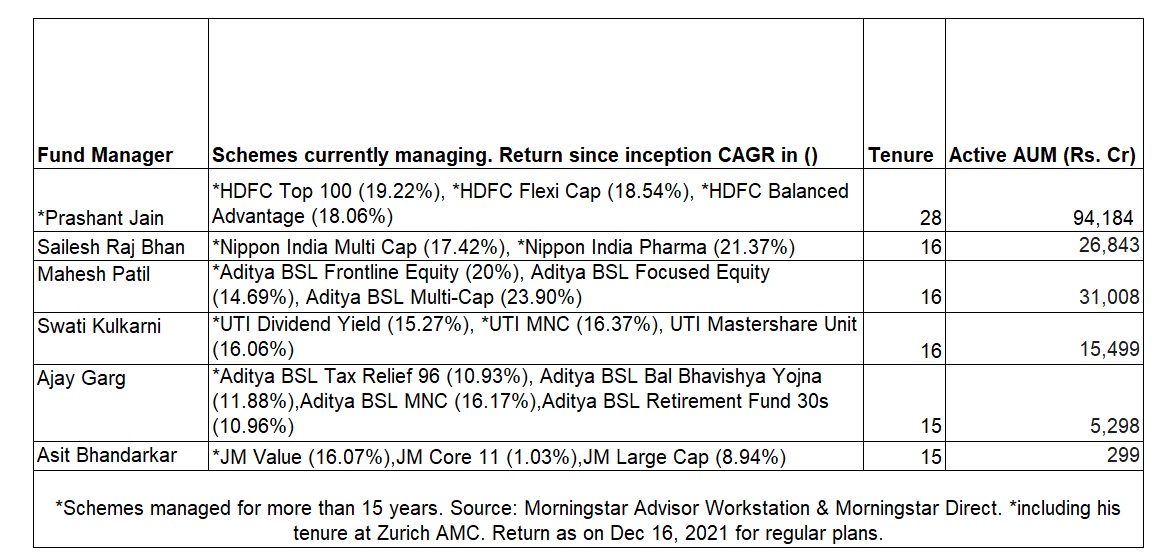

Funds that are being managed by the same fund manager for 15 years and more

(Click on the image to enlarge. Some of these funds are being co-managed by other fund managers. Trailing performance includes all funds currently being managed by the fund manager.)

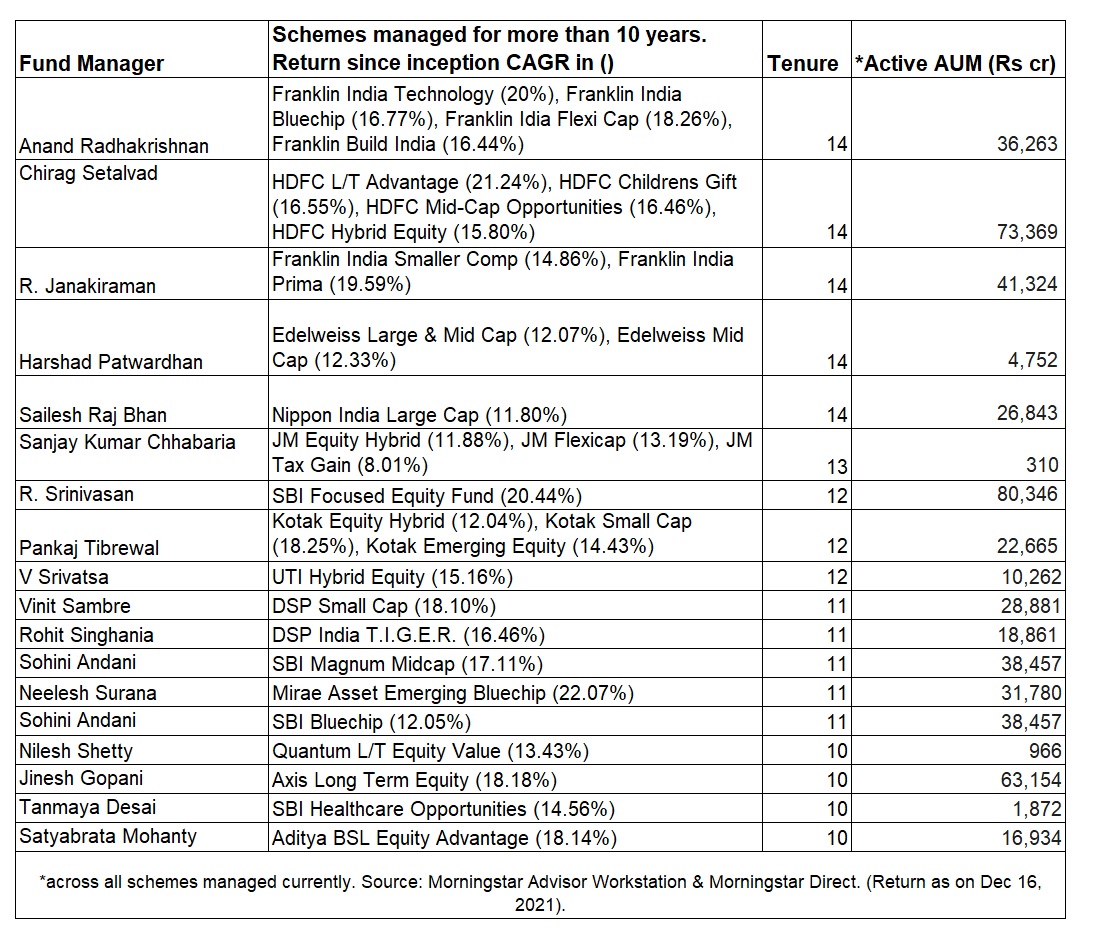

Funds that are being managed by the same fund manager for 10-15 years

(Click on the image to enlarge. Some of these funds are being co-managed by other fund managers.)

We spoke to a few financial advisers to find out how important is the tenure of a fund manager and how it helps a fund.

Shifali Satsangee, CEO, Funds Ve'daa, says that apart from the tenure, investors should look at a variety of other parameters while shortlisting funds. “One of the key variables we look at, apart from pedigree, process, price is that of the tenure the fund manager has been at the helm of managing the scheme. A long tenure indicates that the manager has seen various market cycles thereby providing him richer experience and insights into investing. It also builds investor confidence in the fund since it showcases a proven track record of the fund manager over a sufficiently long period of time. Having said that, it is one of the key components we look at in its entirety the others being performance delivered over a long period of time, consistency, strategy, statistical parameters, risk-reward ratios, being few of them.”

What happens when a veteran fund manager quits? Is the fund performance impacted?

Vinod Jain of Jain Privy Client believes that while the stability of the fund management team is very important while selecting funds, he points out that there is no concrete evidence of a fund performance getting negatively impacted in the long run due to fund manager change. He says that fund houses today have defined processes in place with institutionalised fund management.

“In case if a fund manager changes, we wait for the new person to take over and find the consistency of process is already in place. Changing funds involves capital gain and taxes. Thus, a knee-jerk reaction is not advisable when a fund manager leaves. Change in fund management may have impacted short term performances but here is no study to warrant that changes has impacted long term performance.”

Rushabh Desai, Founder, Rupee with Rushabh Investment Services, says that fund managers generally take 5-10 years to show their consistency and alpha. “We all know in today's competitive age employees keep changing jobs for a better opportunity. So while selecting a fund, it is the fund manager along with the AMC's senior investment committee team and their investment philosophy investors should look at. For any quality fund manager, it usually takes some time to prove the out-performance of his/her investment strategy. Thus, an ideal time horizon of 5 to 10 years should be given.”

Rushabh points out that while veteran fund managers bring a lot of experience to the table, they too are susceptible to bouts of underperformance. “The main benefit of betting on long-tenure managers is that they are seasoned and have seen many different market cycles. Thus, there are high chances they can bring consistent stability and out-performance in the fund returns but at the same time there is no guarantee, and it is important for investors to understand that their calls can go wrong. We have seen funds under-perform drastically several times managed by these long-tenure managers. I would like to bet on AMCs which has a combination of new and old blood delivering consistent out-performance on a 7 to 10 year rolling returns basis.”

There are 53 schemes where the same fund manager has been managing the scheme for over 10 years. Of this, in 11 schemes, the tenure of the fund manager has been 15 years and above. We have excluded debt funds from this study.