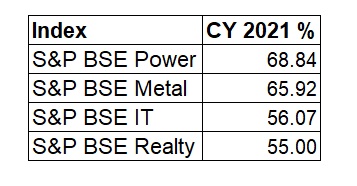

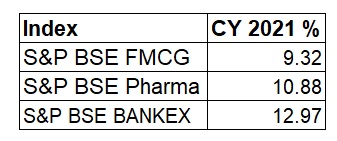

The S&P BSE Sensex TRI has recovered by 134% since its March 23, 2020, low as on January 7, 2022. In CY 2021, Sensex gained 23%. If we look at the sectoral indices, Power, Metal, IT, Realty were some of the best performing sectors. On the other hand, FMCG, Pharma, Banks, Financial Services, were among the indices that were laggards.

Indices that gained the most

Indices that lagged

Tightening of liquidity due to Fed tapering and rising Omicron cases have raised concerns about whether the rally would continue in 2022. We asked some leading fund managers which sectors/themes they are focusing on to generate alpha in 2022.

Atul Bhole, Senior Vice President & Fund Manager, DSP Investment Managers

For CY22, we are banking on domestic economy facing sectors like Financials, Auto and Cement. Companies in these sectors have gone through a lot of challenges in the past 12-18 months and have come out with substantial improvement in their cost structures, balance sheets and the sector dynamics has also improved favouring the bigger and efficient players. All of them would benefit from capex uptick, cyclical recovery and overall growth going forward. Due to the challenging times, stocks have also underperformed in this timeframe and hence available at attractive valuations while other part of the market has seen much higher re-rating.

- Financials: Larger financials would benefit from rising rates which is margin accretive as well as lower than long-cycle credit costs. Valuations are reasonable in absolute terms as well, especially when earning growth would be stronger. We also believe the concern of new age FinTechs disrupting incumbents’ business would also wane as incumbents’ technological capabilities become evident with profitable business model backing it while on the other hand, fintechs having to change business models to survive.

- Auto: Auto OEMs, especially four wheeler and commercial vehicle manufacturers shall also see good pick-up in volumes with overall buoyancy in white-collar employment, capex & manufacturing resurgence etc. and as pent-up demand gets fulfilled. Auto ancillaries aligned to these sub-categories would also do well.

- Cement: This sector has also seen consolidation and larger players are well-placed to benefit from rising demand & pricing. Government finances are in good shape and infrastructure push ahead of elections, pick-up in new real estate projects, manufacturing capex augurs very well for cement sector.

Rahul Singh, CIO - Equities, Tata Mutual Fund, Tata MF

- The banking sector looks reasonably valued and has not got its due, credit growth revival and risk from fintechs are key issues that should get more clarity in 2022.

- Capital goods and manufacturing look promising especially as company after company indicates a decade-high trajectory of order books and enquiries.

- Digital spends are here to stay but valuations reduce the scope for sectoral alpha in IT services. Having said that that the margin trajectory in 2022 can provide some upside surprise.

- Pharma seems to be biding its time as relative valuations are now reasonable and await a broader recovery in the pricing environment in the U.S.

- Healthcare is the new sunrise sector especially for those who have adopted digital proactively.

- Everyone on board with the need for tariff hikes is a structural positive for telecom.

Ashutosh Bhargava, Fund Manager and Head of Equity Research, Nippon India Mutual Fund

- Banks: Banks have massively underperformed since the onset of Covid in March 2020. Before Omicron wave, we saw economy rebounded faster than expectations. Banking has high gearing towards macro. We expect credit growth to recover to double digits led by both consumer credit and corporate capex. Most banks have well-provided balance sheets and we don’t think there is much risk of outsized NPAs or margin pressure versus what consensus is forecasting. Banks’ valuations are compelling in relation to the broader market, particularly when subsidiaries potential and other optionalities are considered.

- IT services: Sector has delivered above estimate earnings over the last 18 months. Management commentary remains extremely buoyant as many expect multiyear demand acceleration. We remain confident on growth as Indian companies are set to gain market share versus captives and global peers. Within defensive sectors, IT services remains our preferred sector. We think there are select risk-reward opportunities across sizes in this space.

- Capital goods/Infra: We are seeing signs of global capex cycle revival. We expect government capex followed by private capex revival to be the key growth engine for our economy as well. Strong national infrastructure pipeline, focus on localisation and coordinated execution of infrastructure projects will propel Government Capex. Improved capacity utilisation, strong commodities cycle, strong corporate and banks’ balance sheets, and reforms like Production Linked Incentives would aid corporate capex revival. Like IT, one needs to be selective here. We are finding 2022 is a year of normalisation where cyclical recovery will continue to hold shape with hopefully lesser supply-side or pandemic-driven distortions.

Vinay Paharia, CIO – Equities, Union AMC

- We are bullish on Information Technology, Telecommunication and Industrials sectors.

- We are overweight Industrial sector as we believe that there could be a cyclical improvement in the sector led by growth in private sector capex in the medium term.

- The IT sector has seen an upward shift in the demand curve on a structural basis post the onset of the Pandemic. This is likely to improve the earnings growth prospects for the next 3-to-5-year period.

- Telecom sector is expected to witness benefits of consolidation and a rise in demand due to increased data consumption by both consumers and enterprises.