Mutual funds launched a slew of funds in 2021 to cash in on the bull market frenzy.

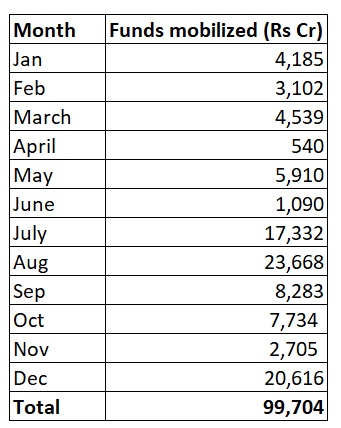

The mutual fund industry launched a total of 140 schemes that mopped up Rs 99,704 crore in 2021, shows data from Association of Mutual Funds in India. The collection was highest in August 2021 (23,668 crore), followed by December 2021 (Rs 20,616 crore).

“One of the reasons for the rush of NFOs is due to the sharp rally that we have seen post the crash witnessed in 2020. Also, fund houses are filling the product gap created post recategorization. We are seeing some unique fund launches in the recent past,” says Kaustubh Belapurkar, Director – Manager Research, Morningstar Investment Advisers India.

The S&P BSE Sensex is up 140% from its March 23, 2020 low, till January 17, 2021. In CY 2021, Sensex is up 23%.

Passive

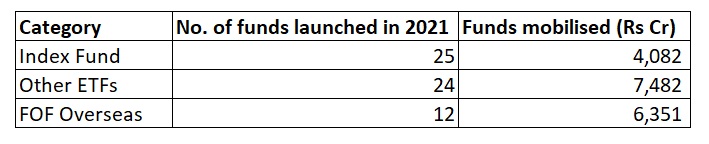

The maximum number of funds (25) were launched in the Index Fund category, which collected Rs 4,082 crore, followed by other ETFs (24), which collected Rs 7,482 crore.

International funds and sector/thematic funds also caught investors' fancy. The industry launched 12 overseas fund of funds which mopped up Rs 6,351 crore.

“The problem with thematic funds is that most investors get into such funds probably late when the theme has already played out. When you miss the bus, the experience is different from your expectations. Passive funds are a good way to take exposure to a theme/sector if you are unable to choose an active fund but one needs to understand the nuances of these sectors. One needs to tread carefully while investing in sectoral passive funds.

It is better to invest the predominant portion of your portfolio into actively managed funds and keep the exposure diversified passive funds minimal. If one needs to take exposure to sectoral passive funds limit your exposure to 5% and remain invested till the theme plays out,” adds Kaustubh.

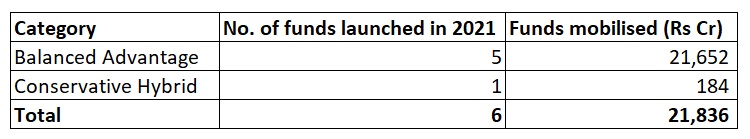

Hybrid

Hybrid funds collected the highest amount at Rs 21,836 crore through six new fund launches. Of this, Balanced Advantage Funds, which invest dynamically across equity and debt, collected Rs 21,652 crore. A large chunk of the inflows came in SBI Balanced Fund, which collected Rs 14,551 crore in August 2021.

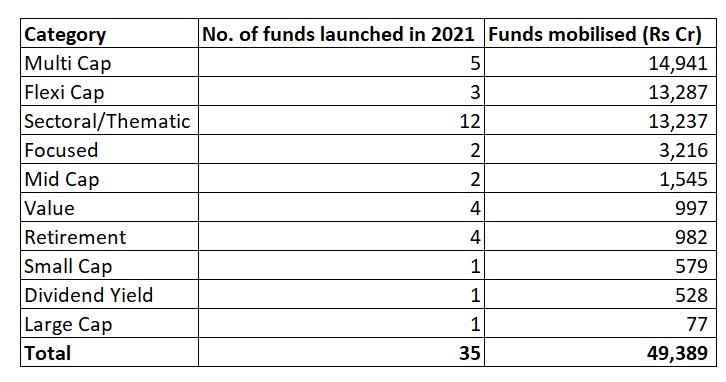

Equity

The industry launched 35 equity funds (excluding index funds, ETFs and hybrid), which collectively mopped up Rs 49,389, the highest among all categories. Multi Cap Funds collected Rs 14,941, the highest among equity category, followed by Flexi Cap Funds, which mopped up Rs 13,287 crore.

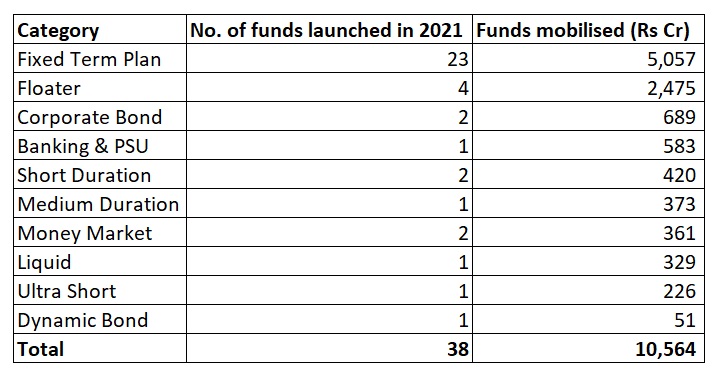

Debt Funds

There were 38 new fund launches in this category, which collected Rs 10,564 crore.

4 questions on your debt portfolio answered

Highest-grossing NFOs

- SBI Balanced Advantage Fund: Rs 14,551 crore

- ICICI Prudential Flexicap Fund: Rs 9,808 crore

- NJ Balanced Advantage Fund: Rs 5,216 crore

- Axis Multi Cap: Rs 4,779 crore

- ICICI Prudential Business Cycle Fund: Rs 4,185 crore

- Kotak Multicap Fund: Rs 3,510 crore

- UTI Focused Equity Fund: Rs 2,541 crore