Balanced Advantage Funds or Dynamic Asset Allocation Funds gained popularity due to their ability to tweak asset allocation in line with market valuations. Given their dynamic asset allocation, these funds are preferred during volatile markets which we are currently witnessing.

There are 23 Dynamic Asset Allocation Funds with assets under management worth Rs 1.69 lakh crore as of December 2021. Of these 23 schemes, 19 schemes received net inflows to the tune of Rs 56,512 crore while the remaining four schemes saw a cumulative net outflow of Rs 8,207 crore. As a result, this category received net inflows to the tune of Rs 48,305 crore in the calendar year 2021, which was higher than any equity fund category.

Should you invest in Dynamic Asset Allocation Funds?

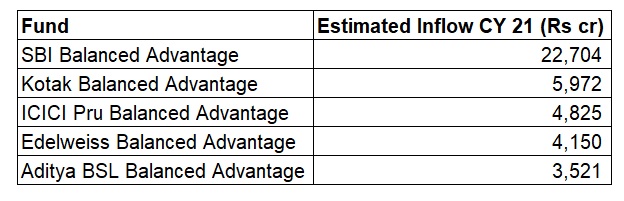

Here are five schemes that received the highest net inflows in 2021

SBI Balanced Advantage Fund

- Inception: August 2021

- Star rating: NA

- Analyst rating: NA

- Performance: 1.57% (since inception as of February 7, 2022)

- Equity holdings: 178

- % of assets in top 10 holdings: 37

- Top 5 holdings: ICICI Bank, Housing Development Finance Corporation, Tech Mahindra, Axis Bank, National Highways Infra Trust Units

- Fund managers: Dinesh Ahuja, Dinesh Balachandran, Mohit Jain

- Investment Style: Large Blend

Kotak Balanced Advantage Fund

- Inception: August 2018

- Star rating: 3 stars

- Analyst rating: NA

- Performance: 12.14% (2019), 13.64% (2020), 12.96% (2021)

- Equity holdings: 203

- % of assets in top 10 holdings: 35

- Top 5 holdings: ICICI Bank, Adani Ports & Special Economic Zone, Reliance Industries, Tata Consultancy Services, Infosys

- Fund managers: Harish Krishnan, Abhishek Bisen, Hiten Shah

- Investment Style: Large Blend

ICICI Prudential Balanced Advantage Fund

- Inception: December 2006

- Star rating: 4 stars

- Analyst rating: NA

- Performance: 10.79% (2019), 11.71% (2020), 15.14% (2021)

- Equity holdings: 110

- % of assets in top 10 holdings: 14

- Top 5 holdings: ICICI Bank, Reliance Industries, Infosys, HDFC Bank, Bharti Airtel

- Fund managers: Manish Banthia, Rajat Chandak, Priyanka Khandelwal

- Investment Style: Large Blend

Edelweiss Balanced Advantage Fund

- Inception: August 2009

- Star rating: 5 stars

- Analyst rating: NA

- Performance: 7.78% (2019), 22.64% (2020), 18.76% (2021)

- Equity holdings: 209

- % of assets in top 10 holdings: 29

- Top 5 holdings: HDFC Bank, ICICI Bank, Infosys, Reliance Industries, Tata Consultancy Services

- Fund managers: Bhavesh D Jain, Bharat Lahoti, Rahul Dedhia

- Investment Style: Large Blend

Aditya Birla Sun Life Balanced Advantage Fund

- Inception: April 2000

- Star rating: 3 stars

- Analyst rating: NA

- Performance: 8.12% (2019), 15.36% (2020), 13.41% (2021)

- Equity holdings: 145

- % of assets in top 10 holdings: 29

- Top 5 holdings: Reliance Industries, HDFC Bank, State Bank of India, ICICI Bank, Tata Steel

- Fund managers: Vineet Maloo, Mohit Sharma, Lovelish Solanki

- Investment Style: Large Blend

Data Source: Morningstar Direct. Equity holdings as of December 2021.