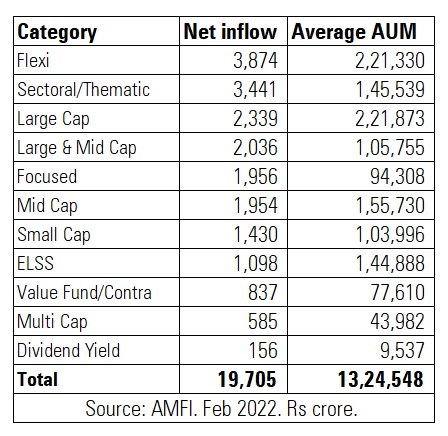

Equity Funds received inflows worth Rs 19,705 crore in February 2022, 32% higher as compared to Rs 14,888 crore received in January 2022. The Sensex fell by 3% in February 2022.

"Despite concerns over the growing oil prices and the conflicts between Russia and Ukraine, which have in turn impacted the commodities markets in India, the markets have been witnessing positive flows. The trend is indicative of the increasing investor interest and awareness around investing," said Kavitha Krishnan, Senior Analyst, Morningstar Investment Advisers India.

Flexi Cap Funds received the highest inflows at Rs 3,874 crore. There were two new fund launches in this category in February 2022 which mopped up Rs 1,276 crore.

The Hybrid category received inflows worth Rs 3,176 crore, the majority of which came in the Dynamic Asset Allocation category (Rs 2,118 crore).

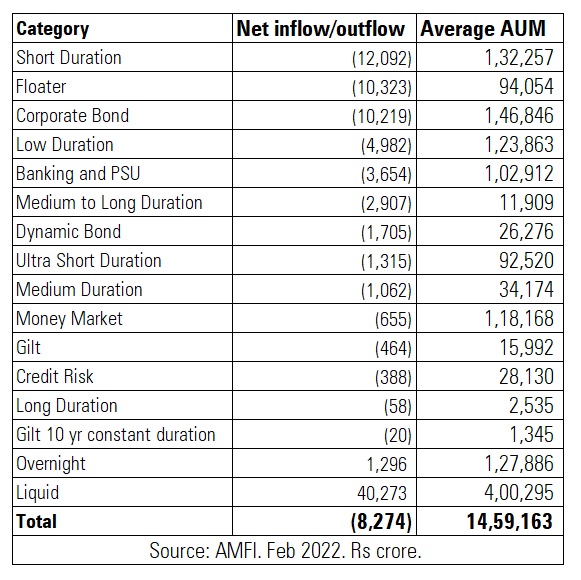

Fixed Income

The fixed income category saw net outflows of Rs - 8,274 crore in February 2022 on account of outflows from Short Duration, Floater, Corporate Bond and Low Duration categories.

N. S. Venkatesh, Chief Executive Officer, Association of Mutual Funds in India (AMFI), said that the outflow in Income/Debt Funds is a reflection of the current market dynamics, the ongoing interest rate scenario in the market and the geopolitical tensions between Russia and Ukraine.

Only Liquid and Overnight Funds categories collectively received net inflows worth Rs 41,569 crore.

Kavitha said that the central bank’s decision to maintain rates at a status quo and their relatively lower forecast around domestic growth seems to have dampened sentiments. "Single digit returns from debt funds have proved to be detrimental, especially considering bond yields over the long and medium term. A possible reason for the net outflows from most of the categories could also be attributed to investors preferring to redeem their debt investments in favour of investing in the equity markets, which after a strong rally, has witnessed some correction since November 2021, thus providing a good entry point."

“On the fixed income front, Fed action and policy normalization continued to weigh on short-term yields. Hence, the industry witnessed redemptions from Ultra Short and Short Term Funds mainly led by corporate investors,” said Aashwin Dugal, Co-Chief Business Officer, Nippon India Mutual Fund.

Key highlights from February 2022 data

- The average assets under management of the industry stood at Rs 38.56 lakh crore

- The number of folios or investor accounts has grown to 12.61 crore

- Systematic Investment Plan (SIP) contribution stood at Rs 11,437 crore with an AUM of Rs 5.49 lakh crore

- The number of SIP accounts stood all-time high at 5.17 crore in February 2022 compared to 5.04 crore in January 2022

- NFOs: 13 new funds collected Rs 3,513 crore

- Net inflows in Other Exchange Traded Funds (ETFs) stood at Rs 10,791 crore

- Index Funds received net inflows worth Rs 5,747 crore