Investors tend to jostle for saving tax at the fag end of the financial year which often results in picking up something that may not suit their financial goals and risk appetite. Thus, it is advisable to start planning on which financial instruments you wish to choose to save tax at the start of the financial year.

If you are considering investing in Equity Linked Savings Scheme (ELSS) which provides a deduction on investment of up to Rs 1.50 lakh under Section 80C, we have curated a list of the five largest funds by assets under management.

Do note that these are not a recommendation by Morningstar. The information provided here could help you understand the nuances of fund performance and portfolio to help you filter funds. In our previous post, we looked at how you should select an ELSS fund.

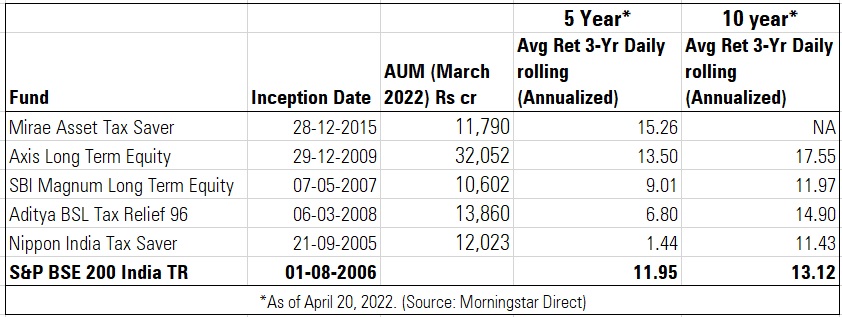

Here are the five largest ELSS funds by assets under management.

Of these five funds, Mirae Asset Tax Saver and Axis Long Term Equity Fund have outperformed the BSE 200 TRI over a five-year period as of April 20, 2022. Over a five-year period, the average 3-year daily rolling return of Mirae Asset Tax Saver stood at 15.26% while Axis Long Term Equity Fund returned 13.50% return versus 11.95% by BSE 200 TRI as of April 20, 2022. Over a ten-year period, Aditya Birla Sun Life Tax Relief 96 and Axis Long Term Equity outperformed S&P BSE 200. Do note that we have only considered the five largest funds in this study for performance and there are many other funds that have outperformed over this time period.

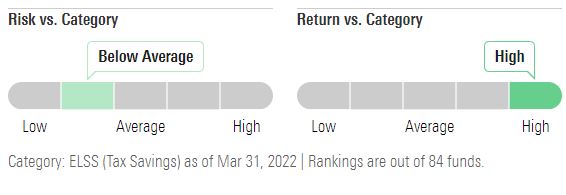

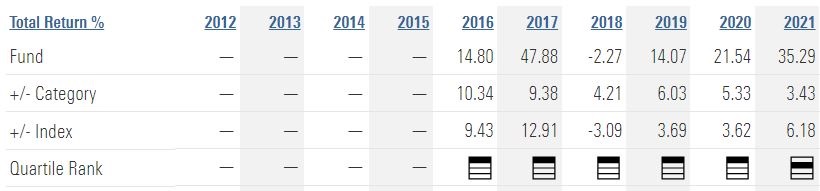

Axis Long Term Equity Fund

Launched in December 2009, the fund has outperformed its peer group and index in the calendar year 2018, 2019, and 2020. However, in CY 2021, the fund underperformed in comparison to the index and the peer group 2021 as the fund follows a growth investment style and value stocks did well in that year. The fund unperformed the category by -7.33% and -4.58% in comparison to the index in CY2021, which means the index (BSE 200 had delivered 29% in 2021). BSE 200 TRI Index is considered a benchmark for all these funds.

Since its inception, the fund has clocked 16.80% return as of April 28, 2022.

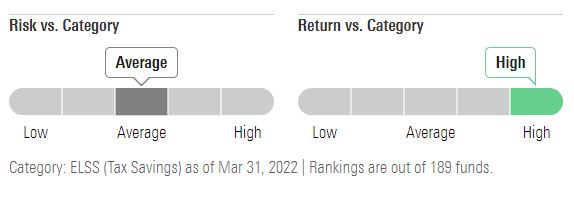

Morningstar Risk is an assessment of the variations in a fund’s monthly returns in comparison to similar funds. The greater the variation, the larger the risk score. Morningstar Return is an assessment of the fund’s excess return over a risk-free rate (the return of the 90-day treasury bill) in comparison to similar funds.

The fund clocked a high return with a below-average risk. Also, the fund witnessed a maximum drawdown of -23.29% versus -27.51% for the category.

Other Details

- Star Rating: 4 stars

- Analyst Rating: NA

- Investment Style: Large Growth

- Inception: April 2011

- Fund Manager: Jinesh Gopani

- *Upside Capture Ratio: 100 (Fund) versus 98 (category) – 10 year

- Downside Capture Ratio: 79 (Fund) versus 96 (category) – 10 year

- #Maximum Drawdown: -23.29% (fund), -27.51% (category), -28.57% (index)

- Equity Holdings: 39

- % Assets in Top 10 Holdings: 64

- Market Cap% : Large (87.33%), Mid (11.76%), Small (0.9%)

- Top 5 Holdings: Bajaj Finance, Tata Consultancy Services, Avenue Supermarts, Info Edge (India), Kotak Mahindra Bank

Aditya Birla Sun Life Tax Relief 96

It is one of the oldest ELSS funds in this category. The fund has underperformed the category and index over the last three consecutive calendar years – 2019, 2020, and 2021. The fund has clocked 10.36% CAGR since inception as of April 28, 2022.

Risk and Return - 10 years

Other Details

- Star Rating: 2 stars

- Analyst Rating: NA

- Investment Style: Large Growth

- Inception: March 2008

- Fund Manager: Atul Penkar, Dhaval Gala

- Upside Capture Ratio: 91 (Fund) versus 98 (category) – 10 year

- Downside Capture Ratio: 84 (Fund) versus 96 (category) – 10 year

- Maximum Drawdown: -23.65% (fund), 27.51% (category), -28.57% (index)

- Equity Holdings: 46

- % Assets in Top 10 Holdings: 55

- Market Cap% : Large (62.8%), Mid (30.31%), Small (6.89%)

- Top 5 Holdings: Reliance Industries, Honeywell Automation India, Housing Development Finance Corp, ICICI Bank

Nippon India Tax Saver

Launched in September 2005, the fund has underperformed the category and index in CY 2018-19-20. It made a comeback by making it to the top quartile in CY 2021 by outperforming its index by 8.48% and category by 5.73%.

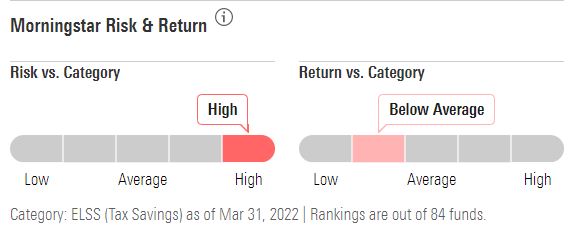

Risk and Return – 10 years

The above chart indicates that the fund has taken excess risk while the return has been below average over a ten-year period as of April 19, 2022. The fund’s 10-year standard deviation stands at 21.45 versus 17.28 for the category. The greater the standard deviation, the greater the fund’s volatility. Its drawdown has been -47.29% versus -27.51% for the category.

Since its inception, the fund has clocked 13.04% return as of April 28, 2022.

Other Details

- Star Rating: 1 star

- Investment Style: Large Growth

- Inception: September 2005

- Fund Manager: Kinjal Desai, Ashutosh Bhargava, Rupesh Patel

- Upside Capture Ratio: 116 (fund) versus 98 (category) – 10 year

- Downside Capture Ratio: 136 (fund) versus 96 (category) – 10 year

- Maximum Drawdown: -36.07% (fund), -27.51% (category), -28.57% (index)

- Equity Holdings: 61

- % Assets in Top 10 Holdings: 48

- Market Cap% : Large (86.88%), Mid (9.93%), Small (3.19%)

- Top 5 Holdings: Infosys, HDFC Bank, ICICI Bank, Reliance Industries, Axis Bank

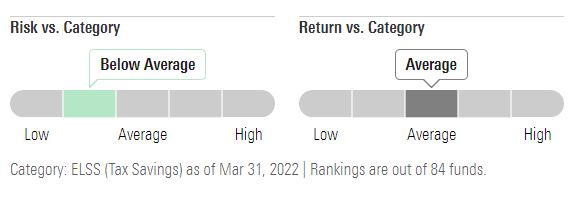

Mirae Asset Tax Saver Fund

Launched in December 2015, the fund has outperformed its index and the category in five calendar years (2016, 2017, 2019,2020, and 2021) except for 2018 when the fund was able to beat its peers but underperformed the benchmark BSE 200 TRI by -3.09%.

Risk and Return – 5 Years

The above chart shows that the fund has generated a higher return by taking an average risk. The fund’s downside capture ratio is 94 versus 99 for the category.

Other Details

- Star Rating: 5 stars

- Analyst Rating: Silver (Regular), Gold (Direct)

- Date of Analysis: January 2022

- Morningstar Analyst: Nehal Meshram

- Investment Style: Large Blend

- Inception: December 2015

- Fund Manager: Neelesh Surana

- Upside Capture Ratio: 105 (Fund) versus 94 (category) – 5 year

- Downside Capture Ratio: 94 (Fund) versus 99 (category) – 5 year

- Maximum Drawdown: -28.35% (fund), -27.51% (category), 28.57% (index)

- Equity Holdings: 68

- % Assets in Top 10 Holdings: 45

- Market Cap% : Large (82.45%), Mid (14.03%), Small (3.52%)

- Top 5 Holdings: Infosys, HDFC Bank, ICICI Bank, Reliance Industries, Axis Bank

SBI Magnum Long Term Equity Scheme

Launched in December 2015, the fund has underperformed its index and the category in CY 2016, 2017, 2018, and 2019. In CY 2020, the fund outperformed its category by 2.66% and the index by 0.95%.

Since its inception, the fund has clocked 11.15% return as of April 28, 2022.

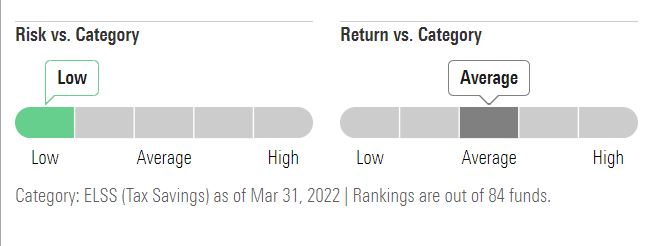

Risk and Return – 10 years

The fund’s risk has been below average while the return has been average.

Other Details

- Star Rating: 3 stars

- Analyst Rating: Neutral (Direct and Regular)

- Date of Analysis: February 2022

- Morningstar Analyst: Himanshu Srivastava

- Investment Style: Large Blend

- Inception: May 2007

- Fund Manager: Dinesh Balachandran

- Upside Capture Ratio: 96 (Fund) versus 98 (category) – 10 year

- Downside Capture Ratio: 98 (Fund) versus 96 (category) – 10 year

- Maximum Drawdown: -28.49% (fund), -27.51% (category), -28.57% (index)

- Equity Holdings: 58

- % Assets in Top 10 Holdings: 38

- Market Cap%: Large (71.9%), Mid (22.70%), Small (5.41%)

- Top 5 Holdings: ICICI Bank, Reliance Industries, Infosys, Larsen & Toubro, Tech Mahindra

* How to read upside/downside capture ratio

An upside capture ratio over 100 indicates a fund has generally outperformed the benchmark during periods of positive returns for the benchmark. Meanwhile, a downside capture ratio of less than 100 indicates that a fund has lost less than its benchmark in periods when the benchmark has been in the red.

What Upside and Downside Capture Ratios Mean

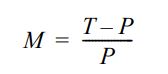

#Maximum Drawdown

The peak to trough decline during a specific record period of a fund, quoted as the percentage between the peak to the trough. It measures the largest single drop from peak to bottom, before a new peak is achieved. It is an indicator of downside risk over a specified time period. Maximum Drawdown is computed as follows:

M = maximum drawdown T = trough value P = peak value

For example, if a portfolio has an initial value of 5,00,000 that increases to 7,50,000 over a period of time, before dropping to 4,00,000. It then rebounds to 6,00,000, before dropping again to 3,50,000. Subsequently, it more than doubles to 8,00,000. Note that the drawdown started from 7,50,000. The maximum drawdown, in this case, is as follows:

350000 – 750000/750000 = 53.33%