'Will midcaps continue to outperform large caps?' is easily one of the hottest topics of discussion in the Indian investment world today. No meeting between an investment manager & an investment advisor is complete without a passionate discussion on this issue.

A focal point of this debate is often about valuation or more precisely about valuation discount of mid caps versus large caps. The conventional wisdom in our industry is that mid caps should trade at a discount to large caps. And as a corollary, when the discount narrows, it is time to favor large caps over mid caps. Many treat this as if it is some inviolable law of physics. We believe this misplaced faith in conventional wisdom is contrary to both theory and facts.

But before we deal with each of these, let us think through the key evidence presented to further this argument which is valuation of Sensex or Nifty 50 (as a proxy for large caps) and Nifty Free Float Midcap 100 index (as a proxy for midcaps). The problem with this comparison is that the composition of these indices differs materially. Moreover the complexion of these indices keep changing over a period of time. As a result the conclusion drawn from this can be meaningless or even misleading.

At the fundamental level, worth of any business is equal to its discounted future cash flows. So, value of a business (not its quoted price) is a function of growth and sustainability of its earnings stream, dividend payouts and the spread of return on equity over cost of equity. This is true for any business- whether it belongs to large cap universe or mid cap.

Another (often unstated) assumption that many make in this comparison of large cap and midcaps is that midcaps are of inferior quality. We dispute this assumption. We believe there are several high quality businesses which currently happen to be midcaps because their product/market is currently small in size. For instance, all the top players in the bearings sector (most are subsidiaries of world leading MNCs) are at present midcaps. To equate midcaps as a category with lower quality or higher risk might lead to missed opportunities.

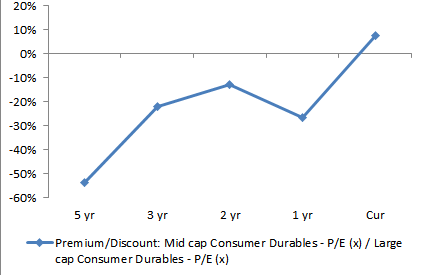

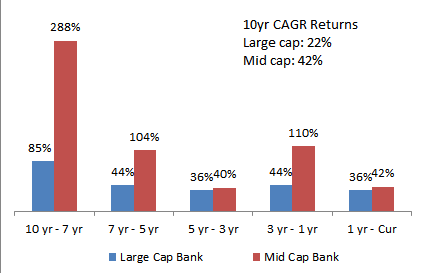

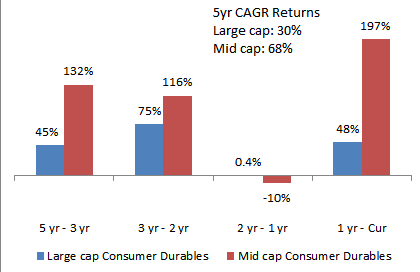

Now let's take a few examples to see whether conventional wisdom works in practice. The key is to compare a high quality large cap business with a high quality midcap business in the same sector (this we believe is the right approach). The charts clearly show how the discount of midcaps versus large caps continued to narrow and in fact turned into a premium.

In this note, we are not arguing that there is no evidence of exuberance leading to overvaluation in the small and midcap space. There are clearly pockets of liquidity driven excesses particularly in the small cap space. One way to identify them is to look at illiquidity measure by computing how long will it take for the position to be sold.

Our point is generalization of this widely held notion might lead to loss of opportunity. We believe a portfolio of high quality midcap businesses will continue to outperform a portfolio of high quality large caps in the medium to long term.

Discount turned into Premium

Mid caps outperformed large caps over most periods

Source: Bloomberg and internal research of Edelweiss Asset Management