We hear a lot of discussion about managing the investor expectations, but have you ever looked at the investor expectation is a risk? Can we really call it a risk? This point can be endlessly debated. However, here is a perspective why we prefer to call it a risk.

At the outset, we are assuming that the investor is investing the money in order to achieve a financial goal. That is the primary and most important assumption. If the investor were investing for any other reason, skip this discussion.

You see, there are various ways of looking at the risk. Academia considers volatility as a measure of risk. Possibility of default or delayed payment is another risk. And then there are various different types of risks discussed about. Some of these are discussed more, and some less. In certain discussions, uncertainty is considered as a risk, whereas some consider risk and uncertainty to be different.

We are looking at the risk from a very different angle from the one the academicians would do. We are starting with the objective of investment. And hence, consider this question: “What is the risk faced by an investor if the investment is made for achievement of a financial goal?”

If the objective is clearly defined, the only risk that matters is the risk of not being able to meet the goal. Isn’t this simple, and obvious? And yet, this is not discussed commonly. The investment advisor must build investors’ expectations around the risks and returns with respect to this objective.

So let us look at these two important aspects when it comes to the investors’ expectations from investments and investment advisors.

- Investors’ expectations of returns

- Investors’ expectations of risk

Investors’ expectations of returns

The other day, during a live chat show, someone asked me to suggest a good, safe mutual fund scheme that can give him annualized dividend of 24% year after year. This happened when the Sensex had crossed 31,000 for the first time in the history – it was trading at all time high.

In another instance, a mutual fund distribution firm circulated pamphlets to prospective investors with a provoking question, “Who wants to be a crorepati?”. According to the details mentioned in the pamphlet, one could become a crorepati by investing a small amount every month. Now, this is possible, as the old saying goes, “boond boond saagar banta hai.” That really is the power of small, but regular savings. However, one careful look at the said pamphlet and it was easy for an experienced eye to make out that we were in bullish times – the expectation was an investment return of 20% p.a. for the next twenty years.

Both the above instances highlight the stretched expectations of investors, especially during the bullish times.

It is difficult to meet these expectations, if not impossible. Anyone going with such high expectations has a lower probability of achieving the goal, since the probability of such high returns is low.

What has lower expectation of returns got to do with the investor achieving the financial goals? When the financial advisor is doing the calculations for how much money should the investor invest towards a particular goal, the lump sum or regular investment required, as the case may be, would dependent on the rate of return assumed. If the assumed rate of return is high, the amount required to be invested would be low and vice versa. So, if one starts with a higher expected rate of return, the accumulation may fall short of what is required for the goal.

Investors’ expectations of risk

Majority of people understand risk in some form or other. This is evident in the choice of investments by so many. Many investors would opt for investments that are not likely to lose principal value rather than those that may offer higher returns, but may lose once in a while.

It is not the risk, but very often one’s appetite for risk that one gets wrong. In bull markets, many turn aggressive and in bear markets they turn extra-cautious or ultra-conservative. This is not the risk appetite, but their perception of the risk, based entirely on the past returns and current mood. Such a view of the market returns has nothing to do with the future. It is just the future projection of the current mood.

Explain the risk to the investors. The risk is not only in terms of drop in the value of portfolio, but it may also be in the form of accumulation of less amount than what is required for the goal.

What should an investment advisor do?

Setting the right expectations. This sounds too simple, but it is not. Let us take the example of Nifty Total Return Index (Nifty TRI).

The index value for the said index is available on the website of National Stock Exchange (www.nseindia.com) from June 1999 onwards. The index data was taken till 31st March 2017.

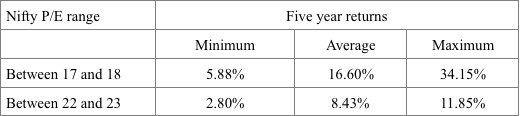

We looked at the Nifty TRI as well as the P/E ratio of the Nifty. Then we tabulated the five year returns and compared those to the P/E ratio on the starting date. Here is the summary of findings:

As can be seen from the above table, the returns delivered by Nifty TRI over a five-year period are quite different for the two levels of Nifty P/E. The data supports the obvious and logical relationship – if you invest at higher P/E ratio, the returns are going to be low.

It is exactly the same for debt mutual funds. If you look at the YTM of liquid funds, these have significantly dropped in the last six months or so and they are quite low as compared to the past returns from these funds.

As an advisor, it is important that you set the expectations right.

In Warren Buffett’s words: “I don’t look to jump over 7-foot bars: I look around for 1-foot bars that I can step over.”

It is always easy to achieve reasonable targets as compared to stretched ones. Starting with expectations of very high returns carries an even higher probability that the investor falls short of the targeted amount required for the goal. Please remember, the investments are made for achievement of certain financial goals and hence the risk is not having enough amounts at the time of the goal. Plan well and help your clients achieve financial goals of their lives.

The article was first published on www.networkfp.com