SEBI has reclassified cities which will be entitled to charge up to 30 basis additional expense in the total expense ratio (TER).

From April 1, 2018, inflows/assets from cities ranking 16th to 30th will not be entitled to get additional expenses of up to 30 basis point. “The additional TER for inflows from beyond top 15 cities (B15 cities) was allowed with an objective to increase penetration of mutual funds in B15 cities. Since more than five years have elapsed and on review, it is now decided that the additional TER of up to 30 basis points would be allowed for inflows from beyond top 30 cities instead of beyond top 15 cities,” states the SEBI circular.

This means, distributors operating from cities ranking 16th to 30th as per AMFI will no longer receive additional incentives. The cities ranking 16th to 30th are: Guwahati, Coimbatore, Ludhiana, Panaji, Indore, Patna, Rajkot, Bhubaneshwar, Nashik, Cochin, Jamshedpur, Varanasi, Bhopal, Ranchi and Raipur. Distributors whom Morningstar spoke to from these locations are not happy with SEBI’s move.

Identification of T-130”/B-30” is based on the investor pin code mentioned in the application or KYC form.

As on December 2017, 88% or Rs 18.71 lakh crore of industry’s assets are concentrated in top 30 cities. Of this, Mumbai alone contributes 38% of assets. A large pool of the assets coming from Mumbai are invested in debt and money market funds due to the institutional presence. In the top 15 cities, around 64% of assets are concentrated in non-equity oriented schemes. On the other hand, B-15 cities have a better asset mix. Around 60% of assets from B15 locations is in equity schemes.

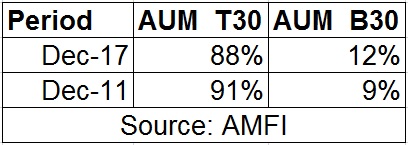

If you look at the trend over the last six years, the inflows from beyond 30 cities have steadily increased from 9% in December 2011 to 12% in December 2017.

Assets under management from top 30 & beyond top 30 cities

Close ended funds

Further, SEBI has also said that close ended funds will not be permitted to charge an additional 20 basis point expense in lieu of exit loads with immediate effect. SEBI had allowed fund houses to charge this additional 20 basis point expense from October 2012.