Smaller towns are gaining traction, both in terms of attracting new distribution talent and assets.

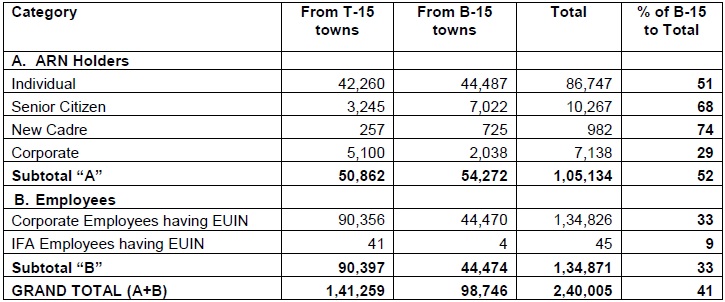

The latest data from Association of Mutual Funds in India, or AMFI, shows that of the 86,747 distributors in the individual category as on February 2018, 51% or 44,487 are from beyond 15, or B15 cities.

ARN data as on February 2018 (Source: AMFI)

Even in the senior citizens category, the number of AMFI Registration Number, or, ARN holders, from B 15 cities was more than that of top 15, or, T15. Of the 10,267 ARNs in this category, 68% or 7,022 operate from B 15 cities. Interestingly, the trend was similar in the new cadre of distributors category. Of the total 982 ARNs categorized as new cadre distributors, 74% or 982 belong to B 15 cities.

All in all, a total of 54,272 or 52% ARNs are registered in B 15 towns, including corporate ARNs. The industry has added 22,253 distributors in the last 14 months. Thus, the total distribution strength has increased from 82,881 in December 2016 to 1,05,134 in February 2018. This data excludes employee unique identity number, or EUIN, allotted to distributors staff engaged in mutual fund sales.

Experts attribute this to the growing popularity of mutual funds which has drawn new distributors to the industry. Also, from 2012, market regulator Securities and Exchange Board of India, or SEBI, has allowed fund houses to pay additional incentive to distributors in B15 cities. SEBI has tweaked this rule recently. From April 2018, distributors operating from cities ranking 16th to 30th as per AMFI will no longer receive additional incentives. Additional incentives coupled with the investor awareness programmes have acted as catalyst for the uptick in business from smaller towns.

The growth in number of distributors from smaller towns is reflected in the increasing inflows from these cities. The assets from B-15 towns in retail segment increased by Rs 1.09 lakh crore from Rs 2.13 lakh crore in February 2017 to Rs 3.23 lakh crore in February 2018, an increase of 51.5%. If we include other investor categories like high net worth individuals, or HNIs, and corporates, the total assets in B15 cities have gone up from Rs 3.07 lakh crore in February 2017 to Rs 4.35 lakh in February 2018, a growth of 41.7%. Moreover, B15 locations have a better balance of equity and non-equity assets. More than 60% of assets in B15 locations is in equity schemes.

The entire industry assets have grown from Rs 18.48 lakh crore in February 2017 to Rs 23.17 lakh crore in February 2018, a growth of 25%. Going ahead, fund experts believe that the B15 market will continue its growth momentum as more and more distributors start adopting technology to execute fund transactions.