It appears that fund managers don’t pass up the chance to wax eloquent about the virtues of closed-end funds.

Larissa Fernand, editor of Morningstar.in, and Himanshu Srivastava, senior fund analyst, decided to look into the veracity of their claims.

The argument in favour of closed-end funds is straightforward, and its persuasiveness rests on the fact that the fund managers can operate their assets at full capacity given the stability.

The closed-end structure allows them to work with a stable pool of capital. Huge inflows would lead to the issue of cash deployment, a problem if valuations are steep. Sudden outflows may result in the manager disposing off stocks he would rather hold. As a result, a fund manager in an open-end fund is sometimes forced to buy or sell securities at inopportune times. In a closed-end fund, since the investment horizon of the investor and fund manager are in sync, the fund manager will not have to contend with such a situation.

The stability of assets cannot be ignored, but on the flip side, when stocks are available at great bargains, there are no inflows which will allow the fund managers to pick them up, unless they sell some of their existing holdings.

During the Morningstar Investment Conference of 2014, two CIOs of fund houses believed that closed-end funds are actually not a very viable option.

One of them noted that in terms of performance, they have not done better than open-end funds. He boldly went on to point out that since open-end funds are the more visible part of the business and under constant scrutiny, they are probably managed by more experienced managers. His verdict: “I don't think it is right to say that the fund managers of closed-end funds have any advantage in managing those funds.”

Closed-end funds also operate on the reasoning that the structure ties up the investor so that he does not flee in panic should the market take a turn for the worse.

No arguing with that since behavioral alpha is the most important type of alpha. We are all aware of how investors flock to equity when the market is on an upturn and redeem in panic when it drops.

But, as the other CIO pointed out, the dimension of timing could have a significant impact on overall returns. “Because the launch and the closure of such funds are all pre-fixed, investors must be a bit more careful about that aspect,” he cautioned. A fund that collects money and invests when the market is on a roll will not be in a good place if redemption takes place a few years later during a market downturn.

And should you need the money for whatever reason, you would be in a soup. Your money is locked in during the tenure of the fund, which would be a couple of years. You do have the option of selling your units on the stock exchange. But even if you do get a buyer, the price would be at a significant discount to the Net Asset Value, or NAV.

So it’s clear that fund houses are not being fair and impartial when they promote closed-end funds as the financial equivalent of the “best thing since sliced bread”.

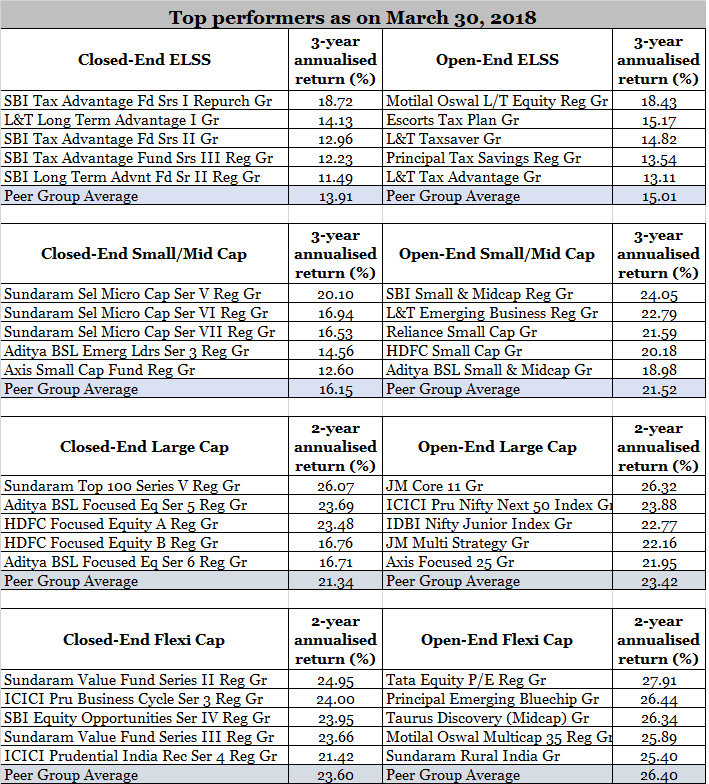

Since nothing speaks better than numbers, we checked to see if performance puts them in the bargain bin. Apparently, not.

Data Source: Morningstar Direct

Our suggestion

Invest in open-end funds after comprehending their investment philosophy. Ensure that they stick to their investment mandate. Look for track records, of the fund as well as the fund manager.

You could be getting into a closed-end fund when the market is in the doldrums. This sounds viable since your fund manager will pick up stocks trading way below their intrinsic value. But you bear the risk of assuming the market will be better placed when its redemption time.

All in all, you need to have a very articulate reason for investing in a closed-end fund, such as a unique strategy that appeals to you. Finally, do ensure that you would not need to access the money during the fund's tenure.