We think humans and machines can work well together – and solve this problem of ever-expanding investment choices. In fact, one of the things I’m most excited about is we will deliver on the promise we made last year, and the Morningstar Analyst Rating and Morningstar Quantitative Rating will combine into one single rating – the Morningstar Medalist Rating.

- Morningstar chief executive Kunal Kapoor, at the Morningstar Investment Conference in Chicago

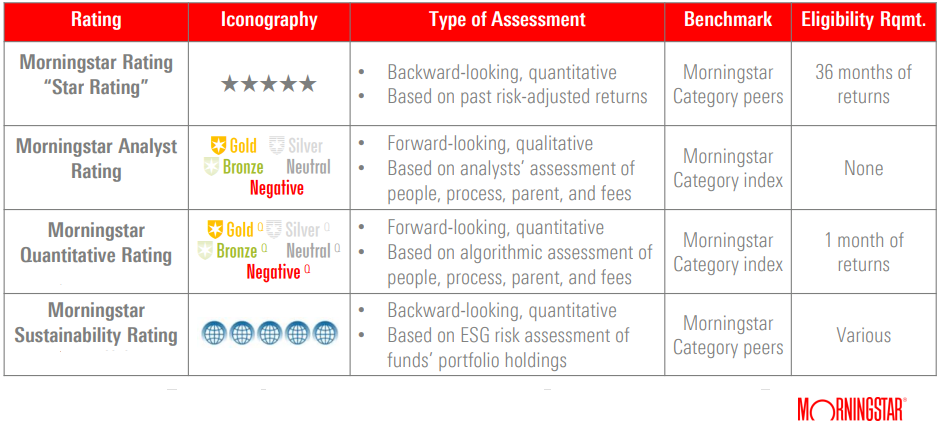

Historical suite of fund ratings (click on image to enlarge)

Morningstar has consolidated its two investment ratings – the Morningstar Analyst Rating™ and the Morningstar Quantitative Rating™ for funds – into a single rating: the Morningstar Medalist Rating™. A single rating system will combine the best of our qualitative and quantitative insights to create reliable ratings for investors, and better address a quickly-evolving world of investment products.

Previously, Morningstar conducted forward-looking assessments of managed investments in two ways: manager research analysts qualitatively assessed managed investments they cover, with those assessments culminating in an Analyst Rating of Gold, Silver, Bronze, Neutral or Negative.

But Morningstar also uses algorithmic techniques to assess managed investments that analysts do not cover. Those quantitative assessments underpin the Quantitative Rating, titled GoldQ, SilverQ, BronzeQ, NeutralQ, and NegativeQ.

By uniting the Analyst Rating and Quantitative Rating under the Medalist Rating banner, Morningstar has moved to a common ratings scale of Gold, Silver, Bronze, Neutral and Negative, removing the superscript "Q" designation from the ratings of managed investments assessed quantitatively.

Morningstar Medalist Rating: 3 questions answered

Medalist Rating Methodology

View Fund Ratings and Fund Reports