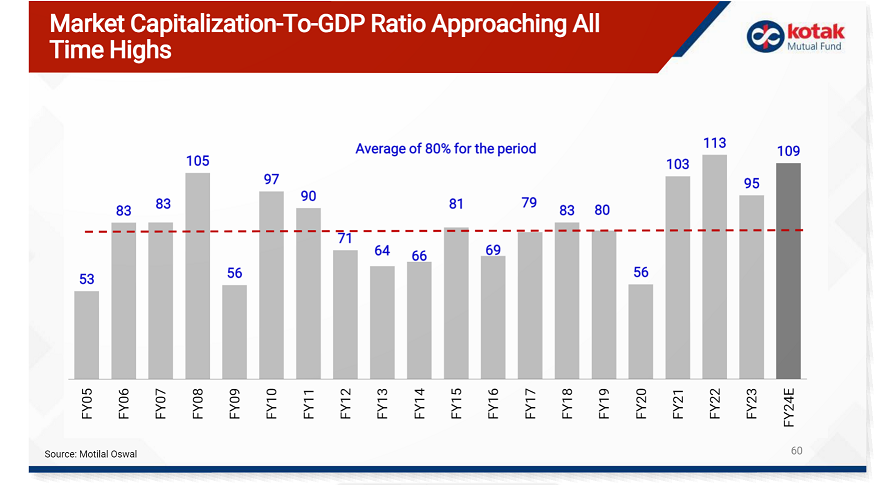

The Market Cap to GDP Ratio divides the total market cap of all publicly-traded stocks in a country by that country’s Gross Domestic Product.

It is used as a broad indication of assessing whether the country’s stock market is overvalued or undervalued, compared to a historical average.

In 2001, Buffett told Fortune magazine that this metric was "probably the best single measure of where valuations stand at any given moment." He said that the U.S. version of the indicator should have provided a "very strong warning signal" of a looming sell-off (referring to the dot com bubble).

Hence, this is also referred to as the "Buffett indicator."