In

A dive into flexi-cap funds, I looked at how funds in this category are far from uniform.

The following funds have been researched by Morningstar's analysts. They have been listed based on the date of the analysis, the latest given preference.

You can even view all the research here, which includes autogenerated reports on funds that analysts do not cover as of date.

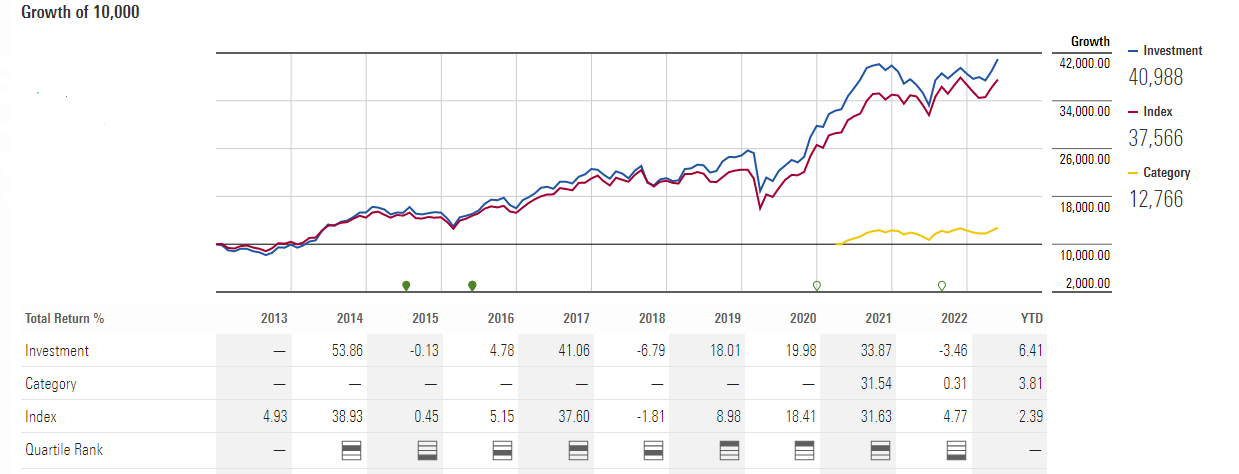

DSP Flexi Cap

- Date of Analysis: April 2023

- Star Rating: 3 stars

- Medalist Rating: Silver (Direct), Bronze (Regular)

- Fund Manager: Atul Bhole

- Top 3 stocks: HDFC Bank, Bajaj Finance, ICICI Bank

- View Portfolio

- Analyst: Melvyn Santarita

- Melvyn Santarita's note

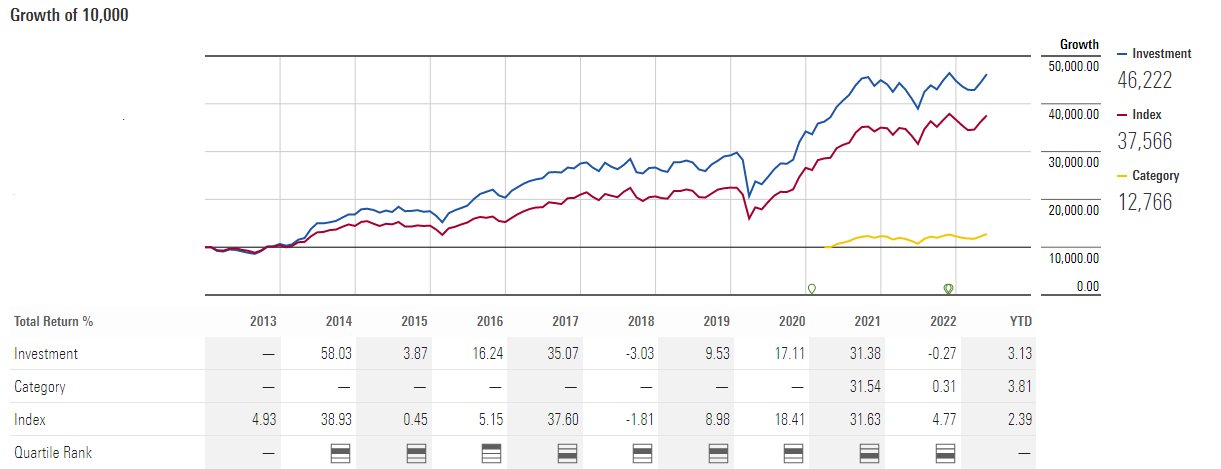

- Performance

The broader investment strategy entails investing in stocks from across market segments. Atul Bhole constructs the portfolio on three fundamental pillars: good quality companies, good management, and growth companies.

Bhole studies a company's growth prospects, expected cash flows, and other quantitative parameters with an overlay of qualitative aspects. The objective is to understand the businesses and how various events (regulatory changes, earnings results, and changes in the company’s fundamental attributes) will affect the stock price. He prefers businesses that have compounding characteristics with regards to sales as well as earnings and strong entry barriers. He does not like managements that enter into multiple businesses through one company. Firms that meet this criterion typically have an advantage in terms of cost, brand, franchise, or distribution. He believes such companies typically trade at a premium and does not mind paying more for such companies if the risk/reward profile is favourable.

Bhole's portfolio is 80% in line with his core beliefs and investment style, while the remaining 20% is tactical in nature. The tactical portion is not necessarily short-term trading opportunities; that portion doesn’t meet all the requirements and selection criteria but offers a good opportunity that can be capitalized upon if played well with a proper entry and exit strategy. Bhole employs a buy-and-hold approach towards the core portion of the portfolio.

Bhole has a clear understanding of how he wants to manage this fund and has consistently adhered to his process framework. Even during difficult phases where growth was out of favour, he hasn’t deviated from his style/framework, nor has he changed his approach to adapt and bring down benchmark risk. That said, when the growth style has been in favour, Bhole’s superior stock-picking skills and framework have shone. We therefore upgrade the Process Pillar rating to Above Average from Average.

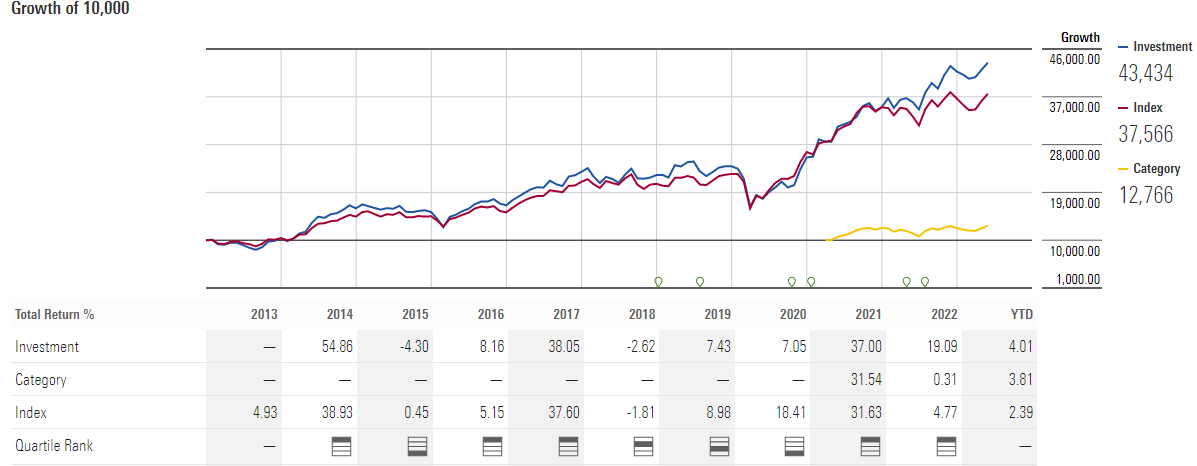

HDFC Flexi Cap

The process continues to be robust with research at its core. Roshi Jain adopts a hands-on approach to research, to get an in-depth understanding of the business and ferret out companies with robust business models, clean balance sheets, and competitive strengths. Though the bottom-up style is more prominent, top-down considerations aren't ignored either. Both relative and absolute valuation methods along with cash flow related metrics are used to pick stocks. The investment style can be broadly described as growth-at-a[1]reasonable-price. Though she is mindful of the benchmark index weights here, she is not benchmark[1]aligned. Hence, she doesn’t shy away from taking underweight/overweight positions at sector or stock level when she spots opportunities.

The process continues to be robust with research at its core. Roshi Jain adopts a hands-on approach to research, to get an in-depth understanding of the business and ferret out companies with robust business models, clean balance sheets, and competitive strengths. Though the bottom-up style is more prominent, top-down considerations aren't ignored either. Both relative and absolute valuation methods along with cash flow related metrics are used to pick stocks. The investment style can be broadly described as growth-at-a-reasonable-price. Though she is mindful of the benchmark index weights here, she is not benchmark aligned. Hence, she doesn’t shy away from taking underweight/overweight positions at sector or stock level when she spots opportunities.

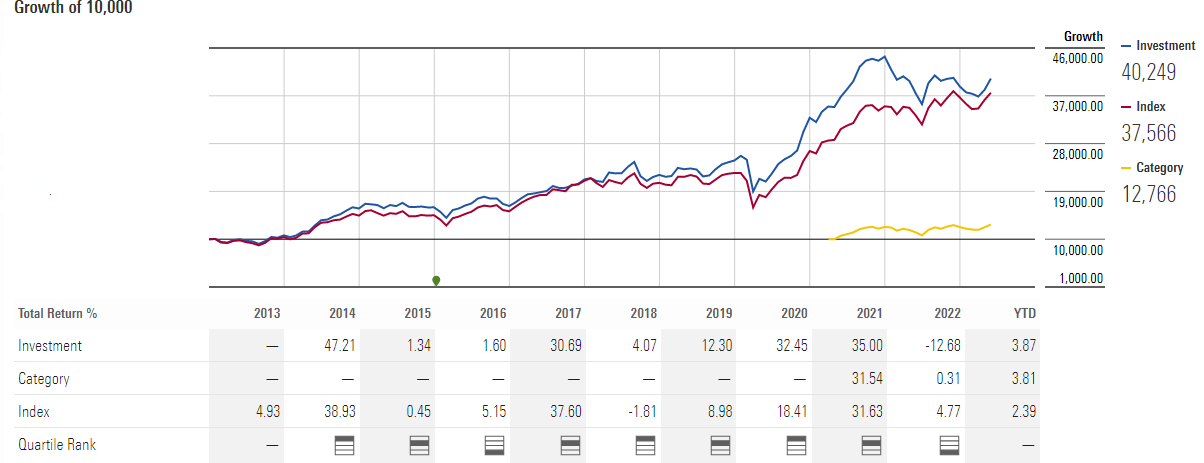

UTI Flexi Cap

- Date of Analysis: November 2022

- Star Rating: 3 stars

- Medalist Rating: Silver (Direct), Bronze (Regular)

- Fund Manager: Ajay Tyagi

- Top 3 stocks: LTI Mindtree, ICICI Bank, Bajaj Finance

- View Portfolio

- Analyst: Nehal Meshram

- Nehal Meshram's Note

- Performance

The fund has a strong investment culture driven by a well-defined investment process with a methodical and cohesive approach. Since Ajay Tyagi took the charge of this fund in 2016, his focus is on investing in high-quality companies that have a high return on capital employed and can generate a lot of free cash flow. Tyagi modified the fund's positioning from a large-cap bias to a multi-cap strategy, with 30%-40% in small/ mid-cap equities, following the Indian regulator's new categorisation requirement. The fund again witnessed a change in category (to flexi-cap) last year but its positioning remains unaltered.

The investment process determines firms that have generated higher operating profits and demonstrated long-term ROE. The team emphasises the trends and patterns discerned from historical performance rather than from forecasts. From a qualitative aspect, it focuses on management quality, business model, and competitive advantages.

When it comes to stock selection, Tyagi follows a bottom-up strategy, focusing on quality, growth, and valuation. He avoids highly volatile cyclical industries and searches for companies with a solid track record of earnings growth over the past five to 10 years, stable margins, and the ability to compound earnings higher than the market over the next five to 10 years with high predictability.

The investment process has been consistently plied, and the strategy mandate is in sync with Tyagi’s investment style. We believe the investment strategy has become the guiding force for portfolio construction; if the manager sticks to the investment process, the fund will generate healthy returns over the long run.

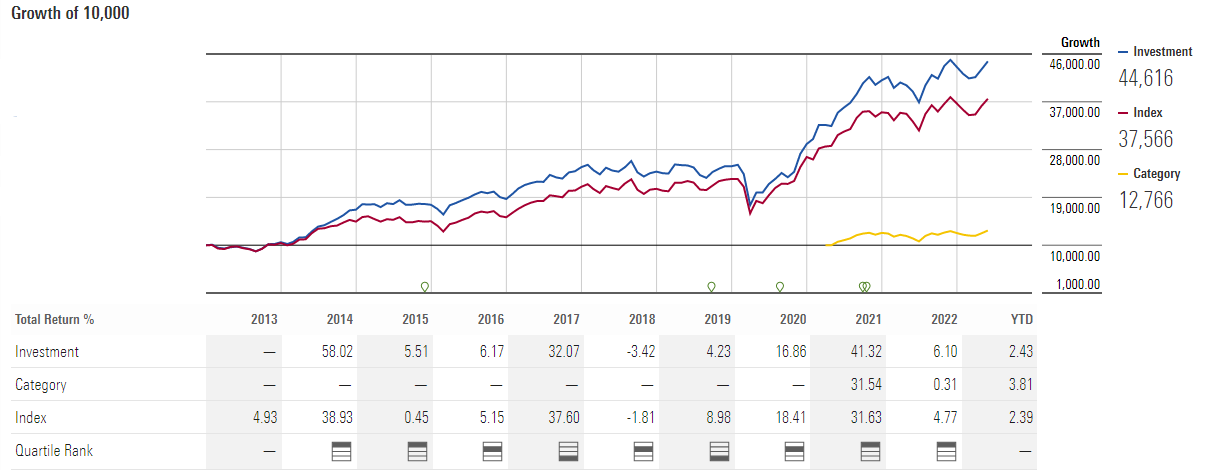

Franklin India Flexi Cap

- Date of Analysis: October 2022

- Star Rating: 4 stars

- Medalist Rating: Bronze (Direct), Neutral (Regular)

- Fund Manager: Anand Radhakrishnan

- Top 3 stocks: HDFC Bank, ICICI Bank, L&T

- View Portfolio

- Analyst: Himanshu Srivastava

- Himanshu Srivastava's Note

- Performance

Managers and analysts jointly draw up the investment universe. Analysts gauge companies using DCF models and parameters such as ROE, P/BV and P/E. Sector-based model portfolios created by analysts are compiled by the research head to create market-cap-based model portfolios that serve as guides to the portfolio managers. Radhakrishnan seeks companies with clean balance sheets. He looks for steady businesses with sustainable competitive advantages that can generate healthy ROEs and ROCEs. A contrarian streak is also perceptible in the manager’s stock picks.

Anand Radhakrishnan will pare/exit positions he believes are expensive. That said, the strategy is not without risks. A valuation-conscious approach and the manager’s inability to play momentum will hold the fund back during speculative or bull markets. The fund also struggled owing to a few investment calls that could have been best avoided. A more prudent approach would help in this regard. In fact, the investment team has taken measures to hone its security-selection criteria to avoid investment mistakes. Although the investment strategy is tagged with inherent biases along with higher volatility, Anand has been managing funds with similar approaches for a long time, and under him it has the potential to deliver superior performance over the long haul. Therefore, we reaffirm the Above Average rating for the Process Pillar.

Aditya Birla Sun Life Flexi Cap

Anil Shah primarily follows a combination top-down and a bottom-up approach. He studies the macro environment to identify reasonably valued sectors that offer good growth prospects and earnings visibility. He is benchmark-aware and prefers to play thematic bets through a basket of stocks rather than by using a concentrated portfolio with fewer stocks. This leads to a portfolio that’s relatively diversified compared with its Morningstar Category peers.

Shah considers a combination of absolute and relative valuations in picking stocks, with the former given more weight. A strong growth bias is apparent in Shah’s stock picks. He focuses on factors like ROCE, ROE, and earnings growth potential while selecting stocks. Management quality and corporate governance are also viewed as critical factors. Shah tends to take a valuation-conscious yet active bet as part of the portfolio based on the stock’s earnings potential. His investments in off-benchmark stocks typically carry a lower weight compared with benchmark names with a higher exposure. This is turn helps the manager in mitigating portfolio and liquidity risks.

The investment process seems fairly straightforward. However, Shah’s capability in terms of being able to allocate across market caps, sectors, and stocks efficiently stands out. We draw confidence from the fund’s in-house processes and view the stability on the team and the process as a positive.

DISCLAIMER

© 2023 Morningstar. All rights reserved. The Morningstar name is a registered trademark of Morningstar, Inc. in India and other jurisdictions. This research on securities (“Investment Research”), is issued by Morningstar Investment Adviser India Private Limited. Morningstar Investment Adviser India Private Limited (CIN: U74120MH2013FTC249024), having its registered office at Platinum Technopark, 9th Floor, Plot No 17 & 18, Sector - 30A, Vashi, Navi Mumbai, Maharashtra, 400705, is registered with SEBI as an investment adviser (registration number INA000001357), portfolio manager (registration number INP000006156), and research entity (registration number INH000008686).

Morningstar Investment Adviser India Private Limited has not been the subject of any disciplinary action by SEBI or any other legal/regulatory body. It is a wholly owned subsidiary of Morningstar Investment Management LLC, which is a part of the Morningstar Investment Management group of Morningstar, Inc. In India, Morningstar Investment Adviser India Private Limited has only one associate, viz., Morningstar India Private Limited, and this company predominantly carries on the business activities of providing data input, data transmission and other data related services, financial data analysis, software development etc.

The author/creator of this Investment Research (“Research Analyst”) or his/her associates or immediate family may have (i) a financial interest in the subject mutual fund scheme(s) or (ii) an actual/beneficial ownership of one per cent or more securities of the subject mutual fund scheme(s), at the end of the month immediately preceding the date of publication of this Investment Research. The Research Analyst, his/her associates and immediate family do not have any other material conflict of interest at the time of publication of this Investment Research. The Research Analyst or his/her associates or his/her immediate family has/have not received any (i) compensation from the relevant asset manager(s)/subject mutual fund(s) in the past twelve months; (ii) compensation for products or services from the relevant asset manager(s)/subject mutual fund(s) in the past twelve months; and (iii) compensation or other material benefits from the relevant asset manager(s)/subject mutual fund(s) or any third party in connection with this Investment Research. Also, the Research Analyst has not served as an officer, director or employee of the relevant asset manager(s)/trustee company/ies, nor has the Research Analyst or associates been engaged in market making activity for the subject mutual fund(s).

The terms and conditions on which Morningstar Investment Adviser India Private Limited offers Investment Research to clients varies from client to client, and are spelt out in detail in the respective agreement. The Investment Research: (1) includes the proprietary information of Morningstar, Inc. and its affiliates, including, without limitation, Morningstar Investment Adviser India Private Limited; (2) may not be copied, redistributed or used, by any means, in whole or in part, without the prior, written consent of Morningstar Investment Adviser India Private Limited; (3) is not warranted to be complete, accurate or timely; and (4) may be drawn from data published on various dates and procured from various sources. No part of this information shall be construed as an offer to buy or sell any security or other investment vehicle. Neither Morningstar, Inc. nor any of its affiliates (including, without limitation, Morningstar Investment Adviser India Private Limited, nor any of their officers, directors, employees, associates or agents shall be responsible or liable for any trading decisions, damages or other losses resulting directly or indirectly from the use of the Investment Research. Investments in securities market are subject to market risks. Read all the related documents carefully before investing. Wherever any securities are quoted, they are quoted for illustration only and are not recommendatory. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

The Morningstar Medalist Rating is the summary expression of Morningstar’s forward-looking analysis of investment strategies as offered via specific vehicles using a rating scale of Gold, Silver, Bronze, Neutral, and Negative. The Medalist Ratings indicate which investments Morningstar believes are likely to outperform a relevant index or peer group average on a risk-adjusted basis over time. Investment products are evaluated on three key pillars (People, Parent, and Process) which, when coupled with a fee assessment, forms the basis for Morningstar’s conviction in those products’ investment merits and determines the Medalist Rating they’re assigned. Pillar ratings take the form of Low, Below Average, Average, Above Average, and High. Pillars may be evaluated via an analyst’s qualitative assessment (either directly to a vehicle the analyst covers or indirectly when the pillar ratings of a covered vehicle are mapped to a related uncovered vehicle) or using algorithmic techniques. Vehicles are sorted by their expected performance into rating groups defined by their Morningstar Category and their active or passive status. When analysts directly cover a vehicle, they assign the three pillar ratings based on their qualitative assessment, subject to the oversight of the Analyst Rating Committee, and monitor and re-evaluate them at least every 14 months. When the vehicles are covered either indirectly by analysts or by algorithm, the ratings are assigned monthly.

For more detailed information about the Medalist Ratings, including their methodology, please go to the section titled “Methodology Documents and Disclosures” at http://global.morningstar.com/managerdisclosures.