I am 28 years, and in April began to invest Rs 6,000 in mutual funds via SIPs. I plan to continue doing so for around 20 years since this is my retirement kitty. Would I be able to accumulate a corpus of Rs 1 crore during this time?

What are your views on my funds: Axis ELSS, Mirae Asset ELSS, PPFAS, Franklin Feeder, DSP Midcap and Axis Small Cap.

- Vamshi

You are doing a lot of things right.

For starters, you are already thinking about retirement at such a young age, which is absolutely amazing. The younger you are when you start saving for retirement, the better your chances of accumulating wealth.

Secondly, you have considered equity mutual funds, an asset class that is essential to create wealth. Many put their money in fixed deposits and other fixed-return investments. While that is needed as a part of asset allocation, for a retirement goal it is insufficient.

Corpus

In order to meet your goal of Rs 1 crore in 20 years, we suggest you increase your SIP amount by at least 12-15% every year.

The amount that you have targeted as Rs 1 crore seems huge right now. But two decades down the road, will not be that impressive. Always factor in inflation when saving.

The value of Rs 1 crore today will not be the same 20 years down the road. If we consider inflation @5%, the value of Rs 1 crore will be around Rs 37.5 lakhs in today’s terms.

You should accordingly adjust your retirement goal.

Diversification

You have diversified well across fund houses.

Since you have an extremely long time frame, it is good to see your exposure to a mid and small cap fund. Your portfolio has no explicit allocation to large-cap funds, but we do note that there is a fair split between various market caps, going by the stocks held in the portfolios.

- Large cap: 35.7%

- Mid cap: 22.2%

- Small cap: 14.7%

- International equity: 21.9%

- Cash: 5.5%

You have added one more level of diversification – global exposure. This has been acquired through the Franklin U.S. Opportunities Fund as well as PPFAS, which allocates a small portfolio of its portfolio to global stocks.

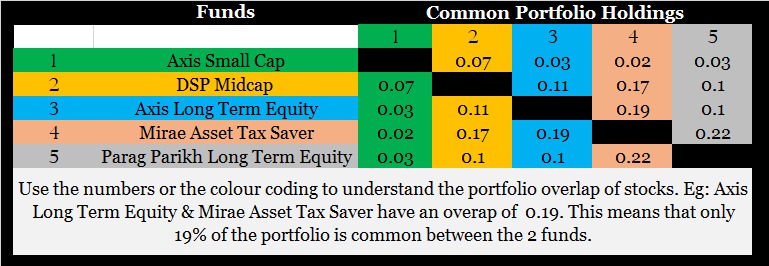

Also, the overlap of stocks is crucial. After all, it would defeat the purpose if two funds in your portfolio held predominantly the same number of stocks.

Do take a look at the stock overlap in your portfolio. Fortunately, there is very little overlap between the funds’ underlying holdings, making the portfolio well-diversified.

Asset Allocation

You have not mentioned any other investments, so we are assuming you have no exposure to debt at all.

It would be wise to put in some money in a debt fund or a fixed return instrument. As you inch closer to retirement, the asset allocation should move from being predominantly equity focused towards debt. Because as you near the date of your “goal”, the investments must be less volatile.

One of the biggest mistakes’ investors make is that they factor in a predominant equity heavy allocation in their portfolio estimations and do not take into account that one needs to sequentially move into fixed income to reduce event risk.

Let me explain. Let’s say you invested in equities in 2010 with a 10-year investment horizon and never rebalanced your portfolio at all. You are now in 2020, 10 years down the road. You would have completely missed your retirement target as the stock market fell quite significantly and displayed tremendous volatility. A 10-year CAGR return of the Nifty was 9.6% in February 2020 and was 3.6%, exactly a month later.

Other factors

Do consider an Emergency Fund so that your retirement corpus remains untouched. I suggest you read The need of an Emergency Fund to get started.

To evaluate mutual funds across categories, one can look at the performance charts and the analysis of select funds.

If you are concerned about reaching your goal, you should consider availing the services of an experienced financial adviser.

Registered readers can post their queries by accessing the Ask Morningstar tab. Our team will answer SELECT queries ONLY relating to mutual funds and portfolio planning.