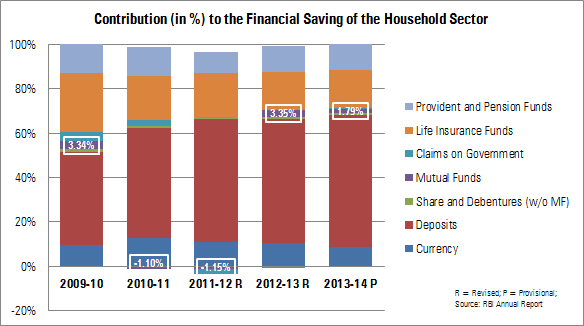

According to data obtained from the Reserve Bank of India’s Annual Report for 2013-14, household savings in deposits rise but dip in mutual fund.

The contribution of mutual funds in the financial savings of households has fallen to 1.79% in 2013-14 (projected figures).

In gross terms, households pulled out Rs 210 billion from mutual funds over the course of the year. This is compared to Rs 350 billion which was put in from financial savings of households a year ago. In that year, mutual funds had a positive contribution of 3.35% to household savings.

Households preferred to increase their savings in deposits and small savings.

Excluding mutual funds, the shares and debentures category saw an increase in exposure of householders.

The detailed break-up of various invested-in segments contributing to the financial savings of households are represented graphically as under. (The figures provided in boxes represent the contribution of mutual funds in household savings).