This post has been written by Ajit Dayal, the founder of Quantum Advisors Pvt. Ltd and Quantum AMC.

The Year 2017 has been humbling for a value investor.

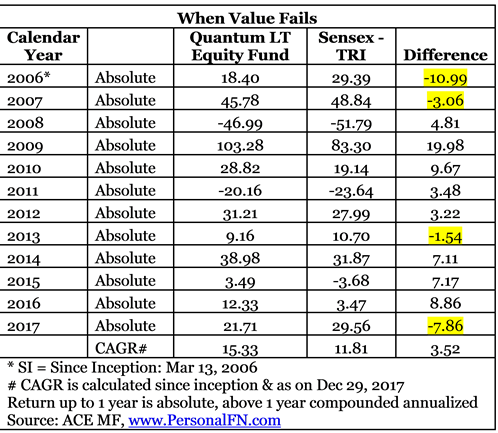

The “value investing style” that I believe in – and which is reflected in Quantum Long Term Equity Fund, or QLTEF, has had a good year in absolute terms (21.71%) but has been a poor relative performer when compared to its benchmark the BSE-30 Total Return Index (29.56%). As can be seen in the table below, in 4 of the past 12 time periods, the QLTEF has done worse than the index and in 8 it has done better. Barring the 9-month period of 2006, when BRIC hallucination was picking up momentum, the year 2017 was the worst relative performance for the fund since inception.

Furthermore, when compared to a peer group of well managed funds selected to be inducted in the portfolio of the Quantum Equity Fund of Funds (35.91%); the performance of the QLTEF has been very poor. CY2017 has been the worst year of relative performance for QLTEF v/s the Quantum Equity FoF since the inception of the latter.

So, is value dead? Have the gods of sanity and rationality (as perceived by a value investor) been sent on exile?

During the days when I was being trained by legendary value investor Tom Hansberger, our marketing colleague (Wes Freeman) would tell the clients of Hansberger Global Investors that “Value, like beauty, lies in the eyes of the beholder”.

Wes, with his emphatic southern drawl, temporally laid to rest the debate on “what is value?” but – after the charm of the throaty southern accent settled down, just as bourbon nestles on cubes of ice in a crystal glass, the debate over “value” and “growth” as alternate strategies to adopt in the world of investing raised its perpetually bobbing head.

Wes was right. There is no one definition of “value”; there is no one magic formula that captures what is “value”.

Some value investors focus on “the intrinsic earnings power of a business”; some look at the “intrinsic value of the underlying assets” when measured against its replacement cost if those assets were to be recreated today; some look for “unlocking value” suggesting that the value is known but it is suppressed and the catalyst for a re-rating of a stock is an action by management such as a sale or a demerger.

In some sense, a value investor is a sceptical optimist: a believer in the promising future hidden within the company but concerned about the ability of the management or the company to actually deliver on that optimism. You know there is a diamond in the mine but you are not sure if the diamond, when extracted, will find its way to the store and be recognised for the gem that it is. So, what you are willing to pay for that diamond is laced with a lot of “buts” and “ifs” and takes into account many risks, including the fact that external agencies (whether the USA’s FDA rules or the Government of India’s demonetization and the RBIs meek surrender of its independence) can snatch away the value of the gem by policy action.

Growth investors , on the other hand, are generally on an overdose of optimism like an athlete pumped up with an external dose of performance pills. There is the inherent opportunity within the company (every Indian needs to build a house and paint it so let’s buy shares of steel, cement and paint companies) and the faith that there will be a macro policy framework that everything can only go right. These macro policy frameworks – or the superlative management skills of that company – are examples of the steroid, of the performance pills.

A growth investor sees the world with rose-coloured glasses and creates financial spreadsheets that reflect this inherent optimism. Not only will the diamond be mined and sold to the highest bidder but the government may decide to give the miner of the diamond a few more acres of land to mine for gold nuggets for free along the way.

Usain Bolt: can the runner stumble?

A school friend explained to me the analogy of India’s macro-economic development and Usain Bolt, which I am modifying with a few tweaks of my own.

So you have a legendary sprinter in Mr. Bolt: that is a fact.

A growth investor believes that the government of India will build the best track for Mr. Bolt to run on and provide him with the ability to buy the best running shoes that are out there.

A growth investor will look for Mr. Bolt to perform exceptionally well have a long line of advertisers chasing Mr. Bolt for endorsements and, therefore, pay top money to own shares of Usain Bolt Limited.

A value investor looks at Usain Bolt and feels sorry for Mr. Bolt because he is fearful that there will be potholes of demonetization along the way and the winning shoes that he wanted to buy are stuck in some GST paper-filing wrangle. Mr. Bolt may have to run the race without shoes on a stony, crumbling track. A value investor will pay a lot less for the ability of Mr. Bolt to generate revenues from a mediocre performance. Usain Bolt Limited may not have that great earnings stream. Of course, once the government got out of the way, those revenues could pop up sharply but, for now….

What makes this value v/s growth analogy of Usain Bolt Limited more complex is the alternatives.

A growth investor has this overriding desire, this persistent itch to buy something.

If I don’t buy Usain Bolt Limited, the other option is to back Ajit Dayal who can only run 10 metres before he is exhausted.

Alternatives take us to the world of the relative: Fixed deposits from State Bank of India give me nothing and fixed deposits from the U.S. government on the global market give me even less…

From a growth investor’s perspective, on a relative basis, Usain Bolt looks fantastic – despite the potholes and the lack of shoes – and Ajit Dayal remains a bad bet.

A value investor is unsure why the growth investor is paying this premium to buy Usain Bolt Limited given the potholes of demonetization and the stones of GST. There is a possibility that Usain Bolt could fall down, get injured and Ajit Dayal may have to merely walk to win the race….things could go wrong in an imperfect world…and, who knows, the government may ask Mr. Bolt for his Aadhaar card just as the race is about to start….

A value investor shows his skepticism with a bunch of “what ifs” on the negatives and sits with his hands firmly folded waiting for a better investment opportunity.

A growth investor’s hands are itching and they have to do something!

TINA = There Is No Alternative.

Liquidity becomes a driving argument to own shares.

With fixed deposits doing what they are doing and property in negative rates of return and gold sort of dead, equity is a TINA…hence, local investors are pouring money into mutual funds.

Plus the pension system is allocating to equity.

Plus LIC is buying all the heaps of PSUs the government wishes to sell to reach its divestment target.

With markets scaling new highs and P/E ratios expanding due to higher share prices and muted growth in earnings, 2018 will be interesting for sure.

The original post appeared in Equity Master and can be accessed here.