Ankit Kanodia of Smart Sync Services decides to bust a bias investors have about debt on the company books.

There is no single financial statement that sets forth all the quantitative and qualitative information that rightly reflects the financial position of a company. In fact, the analyst often has to move beyond the balance sheet and perform further analysis to get a complete picture.

But when starting out, there is a preliminary checklist of sorts that every equity investor considers. And debt is the ugly four-letter word that often eliminates many.

I decided to run a screener with these parameters:

- ROE> 18%

- Market Capitalization > 500 crore

- 10-year growth of sales CAGR >10%

- 10-year growth of profits CAGR >10%

- Debt < 0.5

The results in the list of 61 companies mostly contained really good businesses that have created long-term wealth for their shareholders.

But, these are not the only companies that performed well over the past decade. There would be other impressive performers that never met the above conditions. For example, a company might be generating an ROE of 15% but Sales and Profit growth of > 20% CAGR. Similarly, there might be companies that fulfill all the criteria except have higher debt that mentioned. And yet, there is the possibility that these companies might have used the debt efficiently in a way that it gave them the advantage of leverage while avoiding the debt-trap.

Inverting the thumb rule

A high debt company is one where the business is incapable of generating enough cash for making the interest payment on the loan. On the other hand, if the company can service and repay its debt through internal accruals, it is comfortable with its debt.

A general thumb rule is that the interest coverage ratio is >5, the company is generating enough to pay off the interest on the debt.

This doesn’t guarantee that the company would not default, but it increases the probability of servicing the debt without much pressure at present.

I decided to look for companies that have a decent amount of debt (debt to equity ratio > 0.5) but have the financial muscle to service that debt.

So, I ran another screen with the following conditions:

- Debt to Equity > 0.5

- Interest Coverage Ratio > 5

- Market Capitalization > 500 crores

I got 49 companies on this list. And when I sorted the list in the order of maximum returns generated in the last 5 years, the top 20 names were:

- Minda Inds.

- Aarti Inds.

- Kama Hold.

- Black Rose Indus

- DFM Foods

- Fermenta Biotec.

- Jubilant Life

- Hester Bios

- SRF

- JK Paper

- Safari Inds.

- West Coast Paper

- V I P Inds.

- Apollo Tricoat

- Sudarshan Chem.

- Lumax Inds.

- Titan Company

- Balrampur Chini

- Ind.

- Sundram Fasten.

The above list was made on December 24, 2019 and takes into account the fall in the broader market over the last two years.

All the above 20 companies have given CAGR returns between 20% and 57% in the last 5 years. Most do have a very good business with long-term potential to grow consistently.

Not for a moment I am saying that it is a great investment opportunity. Just the ability to manage debt is not sufficient for a company to be termed as a great investment opportunity. There are several other important factors (moat, market leadership, amount of disruption in the industry, the business model, management track record, cash generation, valuation, sales and earnings increasing consistently, and so on).

Do I favour one against the other?

I have nothing against debt-free companies. If you can find debt-free companies with a solid business model and growing earnings at a reasonable valuation, there is nothing like it. But in your hunt for the holy grail, don’t miss good opportunities by relying too much on the screeners. By depending too much on the regular parameters of high ROE and low debt, you would be missing out on some really good businesses.

There is no doubt that the best businesses are those which hardly require any outside capital to grow themselves. In fact, these businesses generate so much cash year-on-year, that they have no other option but to return a significant part of the capital to the shareholders in the form of dividends and buybacks.

But there is one problem.

Almost everyone knows about them. Hence the valuation of those companies would not be attractive from the return potential. So, the odds of multiplying wealth from them would be low due to the high entry valuations.

That is about the best businesses. The worst businesses are those which are so heavily laden with debt that they can hardly survive. Between these extremes are some good businesses that have decent economics. They may not show up on your stock screener because they do not pass the stringent test conditions. But they are not inherently bad businesses. Therein lies the opportunity. If you can dig in and find something which the market as a whole does not understand or appreciate today, you have an edge.

Don't see debt as a burden that is hampering the company’s growth. Warren Buffett words “leverage just moves things along faster” shows that debt does act as a booster for any company like nitrous for a car. Whether the company will be able to use this booster to zoom past its hurdles or crash to the side is entirely dependent on the management or the driver at the helm.

Look at debt on the books of the company and ask the following questions:

- Is the debt on the books comfortable for the company to manage? (Interest coverage Ratio)

- How does the company plan to pay back its debt? (Internal accrual or by issuing new debt)

- Is the long-term debt used for working capital requirements or capital expenditure? (Long term debt for short term needs like working capital is a recipe for disaster)

- Is the company producing sizeable cash from operations to pay back the debt and also invest in Capex? (If Cash Flow from Operations is negative or close to zero, it is a sign of trouble)

- How has the management fared in terms of managing debt in the last few years? (Any default or delay?)

- Do you think the situation has changed for the better or worse in recent years? (Management has become more aggressive or conservative compared to the past)

A case study

Let us take the example of Minda Industries which sits at the top of the above list. Let me share some data about the company’s past performance.

That’s a staggering amount of debt getting increased on the books year after year. Debt from the year 2010 till 2019 has grown at a CAGR of 25%.

While the debt has grown at a CAGR of 25%, equity has grown at a CAGR of 38% in the same period. Hence, the debt to equity ratio did not move beyond 1 after 2012.

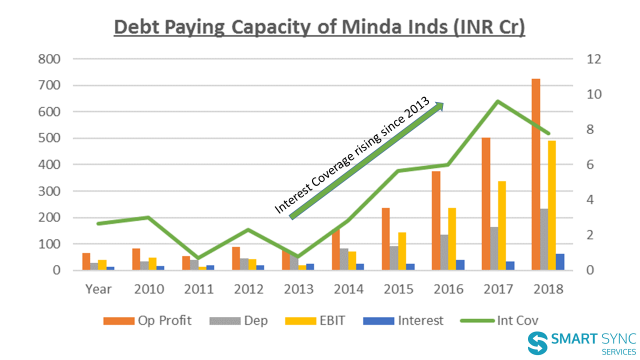

Now by taking other data from the screener, I calculated the interest coverage ratio for the same period.

Interest coverage ratio = EBIT/Interest

For my calculation, I have taken EBIT = Operating Profit Less Depreciation.

I have not included other Income in my calculation of EBIT.

Some people use EBITDA for interest coverage ratio, which gives a much higher interest coverage ratio.

However, let us be conservative and take EBIT for our calculation.

The following picture turns up:

If you look at the numbers, Interest coverage was pretty low (<5) until 2016. But from 2013 onwards, it is consistently rising and in a very comfortable position from 2016.

Now, assuming that

- You understand the business of Minda Industries.

- You are confident about the industry’s long term potential.

- You know that in the last 10 years sales have grown at a CAGR of 28% and profit has grown at a CAGR of 32%.

- In FY16 numbers, you see that the interest coverage ratio number is very comfortable and the stock is available at less than 15 times trailing earnings at that time.

Do you still not buy it because it does not appear on your screener as you had put a condition of debt to equity ratio of less than 0.5?

I think, not buying the stock at that time would be a costly mistake.

In May 2016, the stock was quoting at Rs 70, today it is at 350. A 5-bagger in three and a half years.

Minda Industries above is just one example, there have been many other examples from different industries where the companies have managed to do exceedingly well with some debt on their books which they have the ability to service comfortably. And we keep on ignoring them as we are blinded by our stringent condition of only looking for debt-free companies.

Key takeaways for an investor

- Screening tools are the starting point, not the final word.

- If you have not seen multiple market cycles, be flexible. Don’t be too rigid on your investment selection criteria.

- High-debt is bad, but taking some debt on books is not a crime.

- Look at debt of any company in an objective manner. Don’t get instantly biased when you see debt of 500 crore in the balance sheet.

- Look for cues where debt has been consistently managedwell by a business over long periods.

- Remember that opportunities can come from anywhere.

You can follow Smart Sync Services on Twitter