Panic and fear often lead to herd behavior that proves detrimental to investors as well as markets. The recent pandemic that has been impacting lives around the globe has also been impacting economies and markets. The negative impact of the COVID-19 has been pronounced across Indian markets too with a lot of sectors taking a massive hit and millions of jobs at stake.

On the debt side, markets have been witnessing significant changes as the they witness a flight of capital. Mutual Funds have been witnessing significant outflows, resulting in Franklin Templeton deciding to wind up 6 of their credit strategies due to significant redemption pressures and illiquidity in the lower rated credits. This further exacerbated the sentiment of investors towards certain fund categories which carry credit exposures. Funds in these categories witnessed significant outflows since the Franklin announcement.

While we constantly rate and review the mutual funds that we have an analyst rating on, we think that it's important to revisit our ratings in light of the current market situation especially w.r.t to portfolio liquidity and redemption pressures.

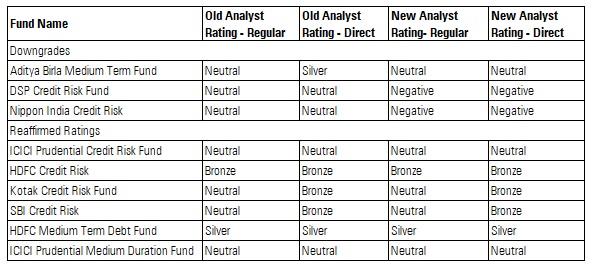

Ratings Review Summary Table

Rating Change

Aditya Birla Medium Term Fund- Regular Share class- Neutral & Direct Share class- Neutral

The Medium-Term fund is designed to remain tactically positioned and can invest in lower-rated papers with a view to generate alpha across the credit spectrum. A risk-off view led the AMC to invest to reduce its exposure toward lower ‘A’ rated papers, especially during the second half of 2019. Despite robust research infrastructure, the fund house has been facing the brunt of industry wide downgrades that’s affecting debt markets. The fund lost a significant volume of assets owing to a series of defaults and this continues to plague the fund. Some of the downgraded issuers have witnessed a resolution and have started to make regular payments, while others continue to await a resolution.

The fund’s exposure towards lower that AA rated papers had been reduced significantly based on their views on the current market situation. The fund used to hold over 25% on this segment of the market in 2018. However, this has been brought down to 15-20% levels starting the latter half of 2019. The fund held some exposure towards BBB and BB rated papers owing to their holdings in stressed/downgraded papers. They hold a small exposure of 0.6% as of March 2020 towards lower than B rated papers and this mainly stems from their exposure towards downgraded papers. Despite these efforts, the current economic situation has led to a steep fall in the markets and debt markets have also taken a massive hit. As a result of this, credit funds remain the worst affected and have been witnessing massive outflows. The Medium-Term Fund has been significantly impacted and has lost assets worth over Rs 2,300 crore since January 2020. The magnitude of redemption gives rise to concerns around the fund's liquidity profile.

Although Dangi is doing his best to ensure that liquidity levels remain positive, the current situation in the debt market remains out of favor for funds with a high-risk mandate. We therefore take a conservative view and assign a Morningstar Analyst Rating of Neutral across all share classes on this fund.

DSP Credit Risk Fund- Regular Share class- Negative & Direct Share class- Negative

Following Dhawal Dalal’s departure in July 2016, Pankaj Sharma became head of fixed income and took charge of this fund along with Laukik Bagwe. However, the fund again witnessed a change in hands, with Saurabh Bhatia replacing Sharma as he quit in February 2019, a time when the fund house was reeling from a credit crisis. The fund house also saw BlackRock exiting its stake in DSP group last year.

The manager looks to add value through an integrated team approach, which combines macroeconomic and strategic analysis with fundamental credit research. The credit analysis of the issuer includes a thorough analysis of the business, financial, management quality, and corporate governance, which helps mitigate the risks inherent in such an approach. However, the approach has had mixed results through recent credit cycles and doesn’t offer a clear advantage.

The concern also stems from the size of some individual lower rated bonds that has gone up significantly due to passive breach - resulting from huge redemptions from the fund. Overall, the last one year was

challenging for the fund as it witnessed few downgrades and eventually had to mark down the holdings. There is uncertainty on the fund’s positioning and execution capabilities.

With the recent Covid-19 outbreak, the impact on the Indian economy has been widespread and the fear among the existing mutual fund investors resulting in outflows from the fund. Under all these scenarios, the execution remained inefficient which points to an inefficient investment process. We have downgraded the Morningstar Analyst Rating to Negative to all its share classes.

Nippon India Credit Risk Fund- Regular Share class- Negative & Direct Share class- Negative

The fund house witnessed a change in ownership in October 2019, resulting in Reliance Mutual been renamed as Nippon India Mutual. The fund also underwent a portfolio manager change, as Sushil Budhia replaced Prashant Pimple on February 2020. Although the fund house has an experienced team, Budhia is relatively new to the fund management role and additional due diligence is needed to ascertain his skills.

The impact of the novel coronavirus on the Indian economy and the widespread fear among existing mutual fund investors have led them to move away from risky assets. The fund typically maintains a moderate duration and normally adopts a buy-and-hold approach for the underlying bonds. However, the fund has witnessed huge outflows, seeing a 70% drop in asset size (from September 2018) and close to a 50% drop on a year-to-date basis.

Though the fund has adopted a strategy of laddering the maturity of the portfolio in order to manage illiquidity risk, the current situation is still alarming given the portfolio has a minuscule allocation to AAA rated bonds. The concern also stems from the sizes of some individual lower-rated bonds that have gone up significantly owing to passive breach, resulting from large redemptions. Overall, the past year was challenging for the fund as it witnessed few downgrades and eventually had to mark down its holdings. The fund also created a segregated portfolio of securities of Yes Bank and Vodafone Idea following the rating downgrade.

The recent change in lead manager coupled with inefficient execution and huge redemptions during the tight liquidity situation in the lower-rated bond market, have led us to downgrade Nippon India Credit Risk's Morningstar Analyst Rating to Negative for all share classes.

Reaffirmed Ratings

ICICI Prudential Credit Risk Fund- Regular Share class- Neutral & Direct Share class- Neutral

The lockdown in the country to check the spread of coronavirus pandemic has bought business activity in the country to a standstill. This worsened the situation in the debt markets, thus triggering a flight to safety. Funds from the credit risk category, or those which are managed with a credit approach, are the worst hit as they faced huge redemptions from investors.

ICICI Prudential Credit Risk Fund too has been witnessing net outflows, which, cumulatively in the month of March and till April 29, 2020 stood at ~ Rs 4,500 crore. Consequently, its fund size fell from Rs 12,844 crore as of Feb 28, 2020 to Rs 8,275 crore as of April 29, 2020, a drop of 36% during this period.

The fund is run with credit as central theme. As of March 2020, AAA rated securities accounted for 12.27% of assets. Majority of investments, i.e. around 53.7%, was in AA/equivalent rated bucket (and within that, AA+, AA and AA- rated securities accounted for 11.7%, 30.2% and 11.8% respectively). Single A exposure hovered around 24.9%. That said, significant emphasis is laid on the concentration risk while constructing the portfolio. Hence, the portfolio is well diversified with single bond exposure typically maintained within 5%.

As of March 2020, the value of AAA exposure along with cash was around Rs 2,089 crore (or Rs 21 crore). This would have provided some flexibility to the fund in terms of meeting redemption pressure in April. However, the fund needs to be observed closely to for the emergence of any stress due to liquidity and redemption pressure. The fund has a Morningstar Analyst Rating of Neutral, and as of now we retain the same.

HDFC Credit Risk Fund- Regular Share class- Bronze & Direct Share Class-Bronze

Within the credit space, HDFC Credit Risk is conservatively managed with higher exposure in good-quality AA and AAA rated bonds, which put together makes a quality portfolio. The fund typically maintains 15%-20% in AAA, 40%-50% in AA, and 30%-40% in AA- and below rated instruments. Looking at the March 2020 portfolio, the allocation towards the credits have not changed dramatically. The current allocation in AAA rated bonds is about 26%. The fund is well diversified with about 75 instruments across sectors and the individual exposure is capped at 5%. The size of the bets decreases progressively as a company's financial strength and market cap decrease. To counterbalance the liquidity risk in the portfolio, they have strong AAA rated papers such as LIC, PFC, REC, NHAI, IRFC and Power Grid.

We think the manager’s core strength lies in managing credit strategies more efficiently and the fund's overall risk/reward looks appealing, hence we continue to hold Morningstar Analyst Rating of Bronze to all its share classes. However, given the huge redemption pressure and tight liquidity situation in the lower rated bonds market, we would closely monitor the fund flow and further developments in the bond markets.

Kotak Credit Risk Fund- Regular Share class- Neutral & Direct Share class- Bronze

Among its category peers, Kotak Credit Risk is conservatively managed, and its risk measures have stood the test of time. The portfolio is largely concentrated on the AA rated segment and is a well-diversified fund of about 50-60 securities, with each security limit capped at 5%. The portfolio manager does not compromise on the quality of the portfolio to generate higher yields and recently have been reducing allocation to single A rated instruments. It is a well-diversified fund with around 60 securities and the securities limit is capped at 5%. The exposure to AAA rated bonds is about 26% as of March 2020.

Kotak Credit Risk fund has witnessed heavy redemption and since 30th February - 27th April 2020 the fund size dropped by 21%. We draw our comfort from the experienced management team, robust investment process. However, given the huge redemption pressure and tight liquidity situation in the lower rated bonds market, we would closely monitor the fund flow and further developments in the bond markets.

We continue to hold our stance on this fund with a Morningstar Analyst Rating of Bronze to its Direct share class and Neutral to its Regular share class.

SBI Credit Risk Fund- Regular Share class- Neutral & Direct Share class- Bronze

The managers emphasis more on liquidity risk, and therefore, 15%-20% of assets are maintained in AAA rated bonds. The fund has been conservative relative to peers, maintaining higher weighting to AA rated instruments than single A and lower-rated instruments. It is also well diversified, with around 60-70 securities, and each security’s limit is capped at 5%, while for a single issuer in A rated instrument is capped at 3%.

Despite the change in guard, the execution has been above average, and the performance of the fund has been phenomenal across the market cycle. The managers have proven themselves in this testing time, when the other funds in the category took a battering because of defaults and rating downgrades, this strategy on the other hand saw lesser damage.

We have recently upgraded the fund’s People and Process pillar to Above Average. Therefore, we are retaining the Morningstar Analyst Rating of Bronze for its less expensive share classes and Neutral for its more expensive share classes.

The fund size has been quite stable since September 2018. Even in the recent times the fund has seen a decline in its asset size – 17% on YTD basis and -15% on MTD basis. Will keep a watch on the asset size given the liquidity scenario in the market.

HDFC Medium Term Debt- Regular Share class- Silver & Direct Share class- Silver

Mehrotra’s investment approach is reasonably simple and straightforward with an emphasis on safety and liquidity. He primarily invests in higher-quality fare and papers issued by strong and stable private-sector companies, public-sector undertakings, and government securities. Credit bets are taken, albeit with a measured approach and only in high-conviction names.

Manager Shobhit Mehrotra seeks to add value in HDFC Medium Term Fund through security selection rather than taking duration bets; the duration is typically maintained within a thin band. On the credit side, as on 31st March 2020, the fund had almost 46% of assets invested in AAA rated securities amounting to approx. Rs 650 crore. Additionally, cash accounts for 2.22% or Rs 31 crore. The exposure towards AA rated papers was 37% (approx. Rs 513 crs and the exposure towards A rated papers was 15% (approx. Rs 209 crore).

The impact of the novel coronavirus on the Indian economy and the widespread fear among existing mutual fund investors have led them to move away from risky assets. Since March, the fund’s Assets have dropped by approx. 17% (approx. Rs 230 crore).

The fund low asset size may make it difficult to withstand if faced with huge amount of redemptions. However, for now, we reaffirm a silver rating to both the fund’s share classes with a close eye on the redemption flows and credit quality of papers.

ICICI Prudential Medium Duration Fund- Regular Share class- Neutral & Direct Share class- Neutral

ICICI Prudential Corporate Bond was renamed ICICI Prudential Medium-Term last year. The fund also witnessed a change in its category as well as portfolio manager. After taking over the fund’s reins in November 2013, Rahul Bhuskute relinquished its management responsibility on 5 Jan 2018. Manish Banthia, who has been the comanager here since November 2016, is now in charge.

Manish Banthia continues to run this fund as a conservatively managed credit strategy. Manish Banthia, like Rahul Bhuskute, emphasises security selection and portfolio construction over making substantial adjustments to the duration on a regular basis. The focus is on investing in companies that have strong management teams with proven track records, the financial strength of the promoter group, and good corporate governance standard. The fund doesn’t invest in A-rated securities. As of March 2020, the AAA and cash accounted for 39% of the portfolio which amounts to approx. Rs 2,614 crore. Additionally, AA+ securities account for Rs 1,371 crore, which is 21% of the portfolio.

The fund is relatively stable in terms of outflows. In the months of March and April, the fund witnessed a net approximate outflow of Rs 1,112 crore. The fund size as of April 29, 2020 stood at Rs 5,515 crore. Within six months 8.9% of the portfolio will mature totaling Rs 591 crore. However, the fund is better positioned in terms of holding relatively liquid assets.

We reaffirm a neutral rating to both the fund’s share classes with a close eye on the redemption flows.

Kotak Medium Term Plan- Regular Share class- Bronze & Direct Share class- Bronze

Kotak M/T has moved to the medium-term duration Morningstar Category from the corporate bond category. Despite this, it remains an attractive offering. With no change in its mandate, the fund continues to invest in high-yielding bonds, with less volatility relative to its peers through its conservative approach.

Manager Deepak Agrawal has a flair for managing credit strategies, which has been exhibited in his more than 15 years with Kotak AMC. The manager seeks to identify duration bets through macroeconomic factors by incorporating views of internal and external economists. Credit analysis is divided into banking, NBFC, and manufacturing debt. They are further demarcated into three buckets based on business strength, management, and corporate-governance standards. Surveillance has shot up after the recent spate of downgrades in the market. The NBFC and housing finance sector, which was evaluated on a quarterly basis, is now tracked monthly.

The fund is constructed with a well-diversified portfolio of around 50-55 securities, and each security capped at 5%. As of March 2020, the fund has approx. 50% of its assets (approx. Rs 1,440 crore) in AAA rated securities and 32% in AA rated securities (approx. Rs 920 crore) and 18% (approx. Rs 536 crore) in A-rated securities. Since March, until 29th April the AUM has fallen by approx. by 38% (approx. Rs 1,095 crore).

An experienced management team, thorough process, and reasonable price add to the overall appeal--hence, it earns a Morningstar Analyst Rating of Bronze for all its share classes. Given the recent significant redemptions, the fund will be watched closely.

Disclaimer:

© 2020 Morningstar. All rights reserved. The Morningstar name is a registered trademark of Morningstar, Inc. in India and other jurisdictions. Research on securities [as defined in clause (h) of Section 2 of the Securities Contracts (Regulation) Act, 1956], and being referred to for the purpose of this document as “Investment Research”, is issued by Morningstar Investment Adviser India Private Limited. Morningstar Investment Adviser India Private Limited is registered with SEBI as an Investment Adviser (Registration number INA000001357), providing investment advice and research, and as a Portfolio Manager (Registration number INP000006156). Morningstar Investment Adviser India Private Limited has not been the subject of any disciplinary action by SEBI or any other legal/regulatory body. It is a wholly owned subsidiary of Morningstar Associates LLC, which is a part of the Morningstar Investment Management group of Morningstar, Inc. In India, Morningstar Investment Adviser India Private Limited has only one associate, viz., Morningstar India Private Limited, and this company predominantly carries on the business activities of providing data input, data transmission and other data related services, financial data analysis, software development etc.

The author/creator of this Investment Research (“Research Analyst”) or his/her associates or immediate family may have (i) a financial interest in the subject mutual fund scheme(s) or (ii) an actual/beneficial ownership of one per cent or more securities of the subject mutual fund scheme(s), at the end of the month immediately preceding the date of publication of this Investment Research. The Research Analyst, his/her associates and immediate family do not have any other material conflict of interest at the time of publication of this Investment Research. The Research Analyst or his/her associates or his/her immediate family has/have not received any (i) compensation from the relevant asset manager(s)/subject mutual fund(s) in the past twelve months; (ii) compensation for products or services from the relevant asset manager(s)/subject mutual fund(s) in the past twelve months; and (iii) compensation or other material benefits from the relevant asset manager(s)/subject mutual fund(s) or any third party in connection with this Investment Research. Also, the Research Analyst has not served as an officer, director or employee of the relevant asset manager(s)/trustee company/ies, nor has the Research Analyst or associates been engaged in market making activity for the subject mutual fund(s).

The terms and conditions on which Morningstar Investment Adviser India Private Limited offers Investment Research to clients varies from client to client, and are spelt out in detail in the respective agreement. The Investment Research: (1) includes the proprietary information of Morningstar, Inc. and its affiliates, including, without limitation, Morningstar Investment Adviser India Private Limited; (2) may not be copied, redistributed or used, by any means, in whole or in part, without the prior, written consent of Morningstar Investment Adviser India Private Limited; (3) is not warranted to be complete, accurate or timely; and (4) may be drawn from data published on various dates and procured from various sources. No part of this information shall be construed as an offer to buy or sell any security or other investment vehicle. Neither Morningstar, Inc. nor any of its affiliates (including, without limitation, Morningstar Investment Adviser India Private Limited, nor any of their officers, directors, employees, associates or agents shall be responsible or liable for any trading decisions, damages or other losses resulting directly or indirectly from the use of the Investment Research.

The various ratings assigned by Morningstar Investment Adviser India Private Limited to mutual fund schemes are (i) Gold, (ii) Silver, (iii) Bronze, (iv) Neutral and (v) Negative. A Gold rated mutual fund scheme is Morningstar Investment Adviser India Private Limited’s highest-conviction recommendation, which stands out as best of breed for its investment mandate, and is expected to outperform its relevant performance benchmark and/or peer group within the context of the level of risk taken over the long term (defined as a full market cycle or at least five years). A Silver rated mutual fund scheme is Morningstar Investment Adviser India Private Limited’s high-conviction recommendation and is expected to outperform its relevant performance benchmark and/or peer group within the context of the level of risk taken over the long term, although it does not necessarily rise to the standard of best in breed. A Bronze rated mutual fund scheme is one where Morningstar Investment Adviser India Private Limited has the conviction to award it a positive rating and expects it to beat its relevant performance benchmark and/or peer group within the context of the level of risk taken over the long term, as the mutual fund scheme has advantages that outweigh its disadvantages. A Neutral rated mutual fund scheme is one in which Morningstar Investment Adviser India Private Limited does not have a strong positive or negative conviction, and while it is not likely to deliver standout returns, it isn’t likely to seriously underperform its relevant performance benchmark and/or peer group either. A Negative rated mutual fund scheme is one which has at least one flaw that Morningstar Investment Adviser India Private Limited believes is likely to significantly hamper future performance and because of such faults, such a mutual fund scheme is believed to be inferior to most competitors and likely to underperform its relevant performance benchmark and/or peer group, within the context of the level of risk taken, over a full market cycle.