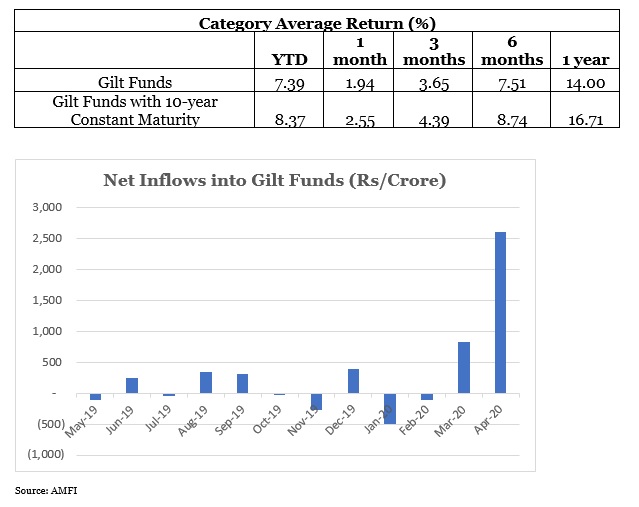

Gilt Funds or Government Securities funds have gained significant traction from investors over the last couple of months, especially in light of the flight to safety from credit risk funds. Needless to say, the strong returns posted by gilt funds in the recent past have also been the added lure.

But are gilt funds for everyone? What is the risk of investing in them? How long should one be invested in a gilt fund?

While it is fairly straightforward that there is no credit risk in gilt funds for Indian investors, there can be a fair degree of interest rate risk which investors need to be cognizant of.

Let’s first understand the basics of understanding interest rate risk and how investors can gauge interest rate risk.

Bond Prices and Yields

Bond prices follow an inverse relation with yields. i.e. If yields go down (as they have in the recent year), bond prices go up and thus there is a positive mark-to-market (MTM) impact on Gilt fund NAVs/returns.

On the flip side, if yields start moving upwards, there will be a negative MTM impact on gilt fund NAV/returns.

Why does this happen?

It’s quite intuitive actually. If you were to hold a bond that pays a coupon of 7%, and the interest rates are headed downwards to 6%, then a bond that pays 7% becomes more valuable, i.e. the bond price move upwards. The contrary holds too.

How to gauge interest rate risk in a portfolio

One magic number can give you all the information you need- Modified Duration.

Modified Duration (expressed in years), is the interest rate sensitivity of a bond/ portfolio. It defines how much is the impact of the interest rate movement on bond prices/portfolio NAV.

e.g. If a bond/portfolio has a Modified Duration of 6 years, it means if the yields were to move down by 1% (100 bps), the positive MTM impact would be 6*1% = +6% approximately and vice versa.

Modified Duration can be found on the Fund Factsheet and gives you a sense of the interest rate sensitivity of the portfolio.

Higher the Modified Duration, higher the interest rate sensitivity or risk.

Should one invest in gilt funds?

The recent strong performance of these funds has been due to the downward movement in the bond yields.

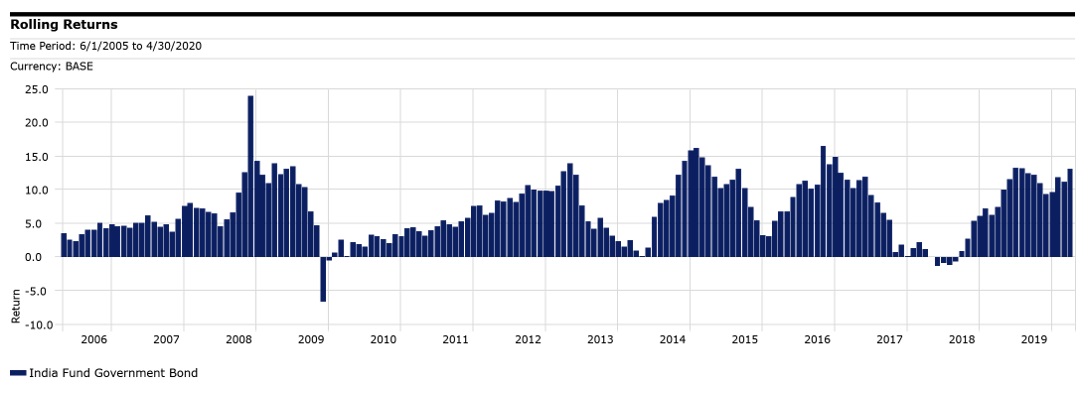

Investors should be cognizant that while recent performance has been strong, interest rates go through cycles as can be witnessed in the chart. When interest rates inch upwards, returns can drop quite sharply due to a negative MTM impact and could also be negative over the short term.

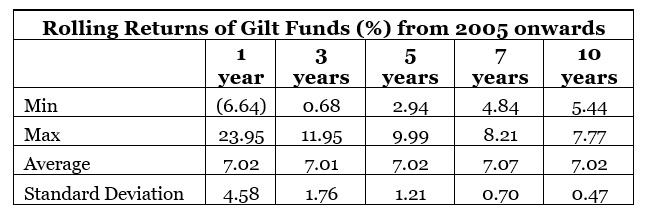

Analysis of rolling returns of the average returns of the gilt funds throws up exactly the expected results. Over the shorter-term returns can be quite volatile, but as your holding period increases, the range of returns narrows quite sharply with lower volatility.

1-Year Rolling Returns

One-year returns of gilt funds have been near zero, to negative to as high as 20%+ at different points in time. For instance, the period of 2009-11 where yields moved upwards, 1-year returns were muted. Similar trend can be witnessed during the sudden spike in yields in 2013. More recently, the spike in yields in 2017-18 witnessed similar period of poor returns for gilt funds over a 1-year basis.

5-year Rolling Returns

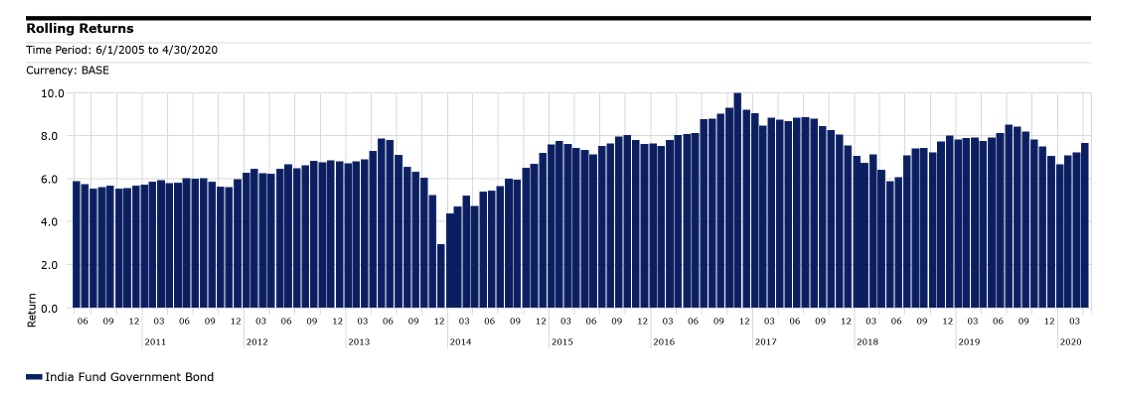

Over a 5-year investment horizon, the returns are much less volatile over different time periods, but still susceptible to event risk like the sharp spike in yields in the late 2013.

10-year Rolling Returns

The Bottom Line

- Either you should be able to time entry and exit into a gilt fund (which is very difficult and not recommended) or have a long investment horizon across interest rate cycles to truly benefit from a gilt fund.

- Interest rate risk will always be existent in a gilt fund, irrespective of how long you have been invested, since at any point in time an active manager will be running a reasonable duration in the portfolio. One way of negating that is investing in a fund that has a run-down strategy which matches your investment horizon, thus the manager will not actively manage the duration of the portfolio, rather let it run down and thus reducing the interest rate risk as time goes along.

- More importantly, gilt funds should never be a significant part of your fixed income portfolio, typically up to 10% is acceptable.