As the equity market reached a new low in March, investors gravitated towards gold.

Not surprising.

The superior returns given by Gold ETFs were an obvious carrot. But people have sought after gold for millennia. It symbolizes wealth throughout various corners of the earth. We wrote about it in The psychology of investing in gold.

Couple that with the ease of investing in gold, thanks to gold-backed funds, and the convenience factor is taken care of. Opportunities such as government-backed sovereign gold bonds are also given due consideration, due to the interest being exempt from capital gains tax.

Which brings us to: Should I invest in gold at this point?

Some are of the opinion that the upside is still quite significant. Others feel that it is a bit too late to jump on to the bandwagon. I shall refrain from telling you what to do; instead shall present you with pointers to help you resolve the issue.

(The data for the graphs has been taken from Gold.org and Morningstar Direct. Click on the graph to enlarge).

I want to invest in gold because the returns over the past 6 months have been phenomenal.

If that is your reason for investing in goal, take a step back.

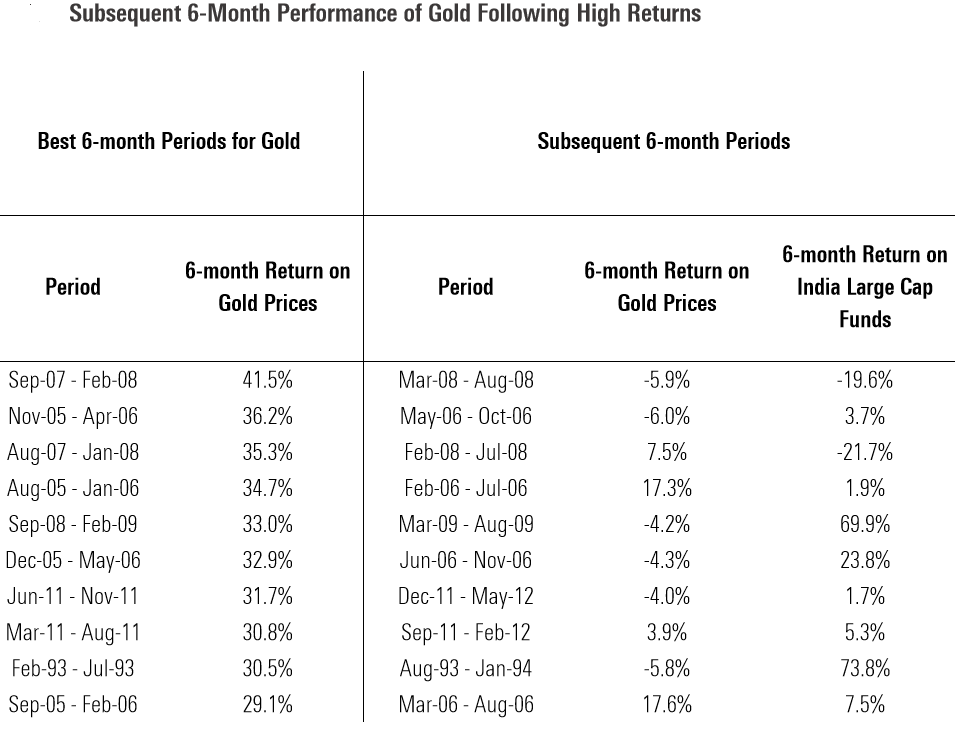

Have a look at the ten best 6-month returns provided by gold since 1992 (the start of globalization era), and its subsequent 6-month performance.

Gold gave positive returns only four out of ten times in the subsequent 6-month period. On the other hand, Indian large-cap funds outperformed gold six out of ten times in the subsequent 6-month periods. Had investors exited large-cap funds at the end of February 2008 only to invest in gold, they would have missed the rebound of 70% return provided by large-cap funds between March 2008 and August 2009.

Lesson: Investors who chase past returns won’t be able to reap in the rewards that they can get from other undervalued asset classes.

I want to invest in gold because it is a good hedge in a portfolio.

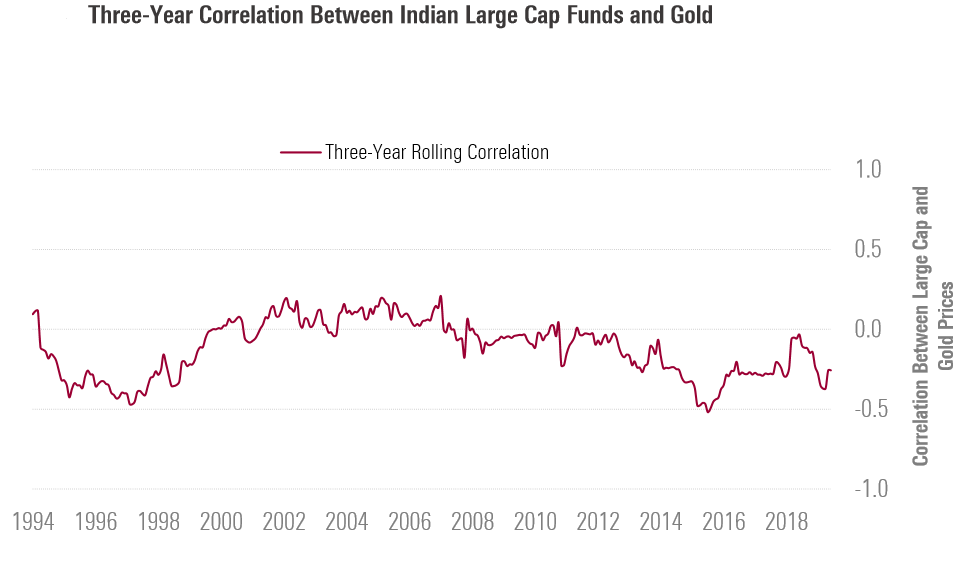

The image below illustrates the correlation between Indian large-cap equity funds and gold over the last 30 years on a 3-year rolling basis.

Correlation helps us determine how two investments move in relation to each other. A correlation of +1 means that two investments move in lockstep with each other, whereas a perfect negative correlation of -1 means that prices of two investments move in opposite direction. A correlation of 0 means that the movement of price of one investment has no effect on the price of another asset.

When we look closely at the correlation between equity and gold, we see that it goes down to as low as -0.5. When markets tumble down sharply in times of crisis, gold can provide a good support to the overall portfolio since it’s negatively correlated with equity.

Lesson: Gold can be considered a good hedge to your investment portfolio during stock market downturns.

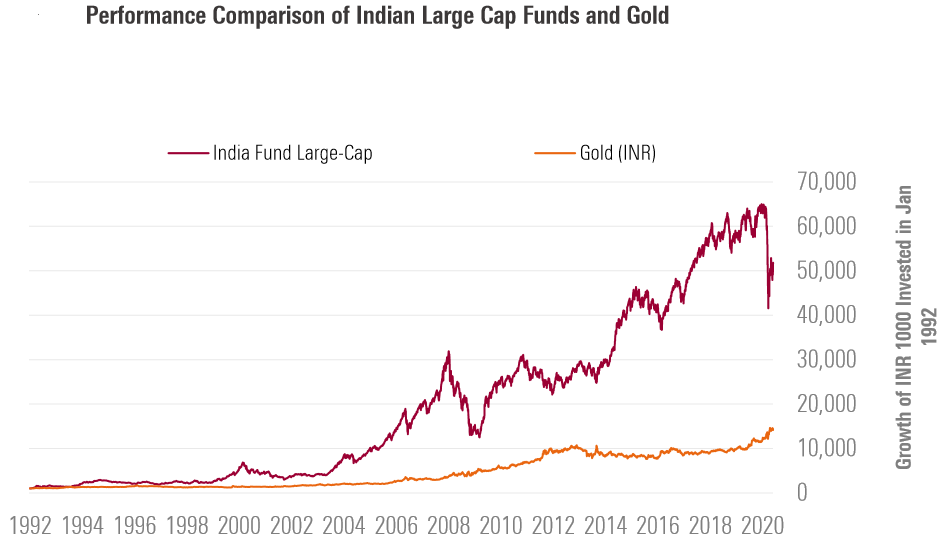

I want to make gold a significant part of my portfolio.

A well-diversified portfolio should mostly comprise of equity and fixed income. On the other hand, gold’s purpose should only be limited to be a hedge in the portfolio.

Stocks and bonds are valued based on the expected cash flows that they can provide in the future. For example, when we buy a bond, we expect a series of interest payments in the form of coupons along with the final lumpsum provided at the end of its maturity.

In the case of stocks, payments are in the form of dividends.

However, gold belongs to an asset class that doesn’t produce any cashflow in the future. So, our investments are based on the conviction that someone else will pay more for it eventually when we sell it in the future. This appreciation, however, doesn’t have any relationship with the economic growth unlike businesses that we invest in through stocks and bonds. Rather it depends on the supply and demand that the market will have for gold in the future. You can read more of this in Why gold is not a great investment.

Lesson: Do not blindly rush to make a significant part of your portfolio because the uncertainty and turmoil in the market are causing you to fear.

Gold does have a place in your portfolio – as a hedge, as a diversifier. When you have a portfolio in place, gold is a valuable addition. It does not stand the test of a stand-alone investment.

It has amazing appeal and desirability, but it is important to realize the different between gold and other investments. Worth remembering Warren Buffet’s thoughts shared at Harvard in 1998. Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.

Also Read:

The psychology of investing in gold

Why gold is not a great investment

How to make money in gold mining stocks