A reader informed us that he wants to accumulate a corpus of Rs 50 lakhs in 11 years.

Here are his SIPs.

- Axis BlueChip: Rs 4,000

- Axis Midcap: Rs 3,000

- SBI Smallcap: Rs 2,000

- Canara Robeco Equity Hybrid: Rs 4,000

- Parag Parikh Long Term Equity: Rs 4,000

- Franklin India Feeder US Opportunity: Rs 3,000

- Mirae Asset Emerging BlueChip: Rs 3,000

Let’s start by looking at the diversification of the portfolio from various aspects.

Diversification: The AMCs

Diversification is a risk management strategy that involves having exposure to different asset classes/securities within a portfolio, which respond differently to the same set of economic drivers. A diversified portfolio seeks to limit exposure to any single asset or security to lower risk. One should ideally diversify his/her portfolio across geographies, asset classes, and sectors to mitigate risks since concentrated exposures can hurt the fund in times of significant drawdowns in the asset class/sector.

It is good to note that you are well diversified across fund houses and investment styles.

Diversification: Market Cap

There is a fair split between large, mid and small cap stocks. Here is the breakup of the underlying fund holdings by market capitalization:

- Large Cap: 41.2%

- Mid Cap: 19.3%

- Small Cap: 8.9%

- International Equity: 18.5%

Fixed Income: 12%

Diversification: Geography

Glad to see global diversification.

Allocation to global assets offers diversification across geographies via exposure to international economic growth drivers, and also acts as a hedge against domestic currency risk. It reduces the risk associated with an investment in a single country, especially in times of downturns or market volatility, and also helps capitalize on growth opportunities in developed and emerging economies.

The international exposure here is through the Franklin US Opportunities Fund as well as the part exposure through the PPFAS Long Term Equity.

The latter invests into a mix of domestic and international stocks across market capitalisations. The focus is on picking fundamentally strong companies with good growth prospects at reasonable valuations. The fund has done exceptionally well over market cycles and is suited for investors who are looking for a multi-cap fund with an international flavor.

Diversification: Stocks

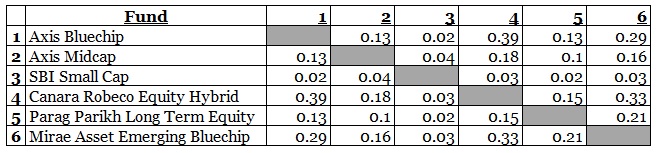

There is limited overlap between over the funds underlying holdings, making the portfolio well diversified. Use the numbers to understand the portfolio overlap of stocks. For example, Axis Midcap and Mirae Asset Emerging Bluechip have an overlap of 0.16. This means that only 16% of the portfolio is common between the two funds.

Diversification: The funds

To evaluate mutual funds across categories, one can look at the performance and the analysis of select funds.

Mirae Asset Emerging Bluechip is rated Silver. The fund manager’s distinctive stock-picking ability and skilled execution are the defining factors. Axis Bluechip and Axis Mid Cap have well defined stock selection processes with a focus on quality and growth. SBI Small Cap is another very compelling option.

Points to keep in mind

1. The systematic investment plans, or SIPs, are currently amounting to Rs 23,000 every month. Over 11 years, it is possible to accumulate Rs 50 lakh. But I would strongly suggest that he increase the amount every single year, even if it is as little as 5%. This would provide the buffer to enable him to comfortable meet his goal.

2. Please rebalance as you approach your goal. A gradual move from equity to fixed should be made. A few years prior the shift should start happening. This will help combat event risk in the portfolio.

3. Do consider an Emergency Fund so that your corpus remains untouched. I suggest you read The need of an Emergency Fund to get started.

Registered readers can post their queries by accessing the Ask Morningstar tab. Our team will answer SELECT queries ONLY relating to mutual funds and portfolio planning.