The objective of the quantitatively driven Morningstar International Fund Awards program is to recognise those funds and fund groups that have added the most value within the context of a relevant peer group for investors over the past year and over the longer-term. The program is distinct from the qualitative awards issued by Morningstar’s research team.

The winners will be announced on March 18, 2021. Register here.

Here are the nominees.

The awards are annual, so we believe it is appropriate to emphasise a fund’s one-year performance. However, we do not believe that it serves investors well to give awards to funds that have posted a strong one-year return but have otherwise not delivered good results for investors.

The awards methodology therefore emphasises the one-year period, but funds must also have delivered strong three- and five-year year returns after adjusting for risk within the awards peer groups in order to obtain an award. Further, they must have been at least in the top half of their respective peer groups in at least three of the past five calendar years. We believe this combination will ensure that the awards are given to funds which have earned strong one-year results, and have also shown they have the ability to earn strong long-term returns without undue risk.

MORNINGSTAR FUND CATEGORY AWARDS:

Equity:

- India Large-Cap Equity

- India Mid-Cap Equity

Fixed Income:

- India Short Duration

- India Medium to Long Duration

What is excluded

The smallest 10% of funds in each category are excluded from the awards based on the latest June end portfolio size. In lieu of this measure, analysts may also exclude funds with less than Rs 100 crore in assets at 30 June or the nearest date for which assets are available.

Scoring System

Each fund in a relevant grouping will be scored as follows:

- Return Score = 80% of total score

- One year: 30% of total score, based on 1-year return percentile rank in Morningstar Category

Three- and five-year: 50% of total score, of which

- 40% = 3-year return percentile rank in Morningstar Category

- 60% = 5-year return percentile rank in Morningstar Category

(Note: 3-year and 5-year scores are scaled to represent 40% and 60% of the long-term portion of the return score, respectively. The 3-year return score constitutes 20% of the total score, and the 5-year return score constitutes 30% of the total score.)

Risk Score =20% of total score

Of the risk score:

- 40% = 3-year Morningstar Risk percentile rank in Morningstar Category

- 60% = 5-year Morningstar Risk percentile rank in Morningstar Category

(Note: 3- and 5-year scores are scaled to represent 40% and 60% of the total risk score, respectively. The 3-year risk score constitutes 8% of the total score, and the five-year risk score constitutes 12% of the total score.)

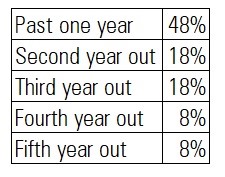

Based on above weights, the effective weight of each year in the calculation is as follows, including both risk and return (figures are rounded to nearest whole number):

The weights are designed to place due emphasis on the most recent year given that the awards are annual in nature, but are also meant to favour those funds that have delivered risk-adjusted outperformance on a sustained basis over the longer term.

Qualitative Review

Based on the above calculations, the 10 funds with the lowest scores in each Morningstar Awards Category will be reviewed by Morningstar’s qualitative research analysts in that market.

The analysts will complete the following checks:

- Funds that are deemed inaccessible to local market investors will be excluded.

- If an analyst has reason to believe that a fund cannot continue to outperform, he will submit his concerns to the heads of Morningstar’s European Research, and they can elect to remove the fund from consideration at their discretion.

- Any fund that is deemed to have deviated from its stated mandate will be removed from consideration.

- Any fund that has not outperformed its Morningstar category median in at least three of the past five calendar years will be removed from consideration unless Morningstar's qualitative analysts believe a fund has exceptional merit that the criteria fails to capture.

Award Selection

Upon the completion of this review, the fund with the lowest score in each eligible Morningstar Category or grouping thereof will receive the award for that Morningstar Category or Category grouping.

MORNINGSTAR FUND HOUSE CATEGORY AWARDS

The Morningstar Fund House Awards recognise those fund families that have delivered sustained outperformance on a risk-adjusted basis across their fund line-ups.

Award Categories

Morningstar Best Equity Fund House Award: Fund houses with at least five equity funds with Morningstar Ratings available for sale in a given market are eligible.

Morningstar Best Fixed-Income Fund House Award: Fund houses with at least five fixed-interest funds with Morningstar Ratings available for sale in a given market are eligible. Money markets are not eligible for inclusion.

Morningstar Best Overall Fund House Award: Fund houses with at least five equity funds and five fixed-interest funds with Morningstar Ratings available for sale in a given market are eligible. Money markets are not eligible for inclusion.

Eligible Funds

Only those funds with five-year Morningstar Ratings are eligible for inclusion in the scoring (see below). Thus, funds without five-year records or funds in unrated Morningstar Categories are excluded from the scoring process.

Scoring System

For each of the above awards, Morningstar will calculate House Scores using the following methodology:

- Determine the five-year Morningstar Risk-Adjusted Return (MRAR) for each share class of each fund run by a given house, and the percentile rank of that return score within its Morningstar Category.

- Determine the average percentile rank of each fund's MRAR by taking the mean MRAR percentile rank of all its classes.

- Determine the mean percentile rank of each fund house's MRAR by taking the mean of its funds' MRAR percentile ranks (the lower a group's mean percentile rank, the better its performance).

Qualitative Review

Our qualitative analysts in India will review the scoring results and may disqualify a firm if there are extenuating circumstances. These might include (but are not limited to) the loss of a group of talented managers, substantial increases to fund expenses, non-availability of the house's funds to retail investors in the relevant market, or being taken over by another group. Each disqualification must be approved by the heads of Morningstar’s European Research. The review is intended to prevent giving an award on the basis of performance that we believe is unlikely to be repeated due to structural factors.

Awards Selection

The remaining fund firms with the lowest score in each of the above groups will receive the relevant Morningstar Fund House Award. There will only be one award in each of the categories listed above. If there are fewer than three eligible groups in any of these categories, no award will be made in that category.