The mutual fund industry has 38 fund categories with more than 1,000 schemes. Within each category, there are funds which are run with different style and mandates. Thus, shortlisting funds can be overwhelming. Typically, many investors tend to follow the herd when it comes to choosing funds.

Here are some of the common mistakes that investors make:

- Choose funds looking at short term historical performance, without considering the circumstances in which the returns were generated and suitability in their portfolios.

- Invest into funds without understanding fund mandates and underlying risks.

- Focus on short term volatility rather than look at the longer-term returns.

- Not being patient with temporary fund manager downturn in performance.

- Shuffle between funds in search of instant gratification.

- Being irrational about underperformance of certain funds rather than focusing on the big picture of the entire portfolio performance.

Performance drives investments

Fund selection can be done in many ways but investors around the world look to chase returns. Studies done on investor return globally show that investor returns have been lower than fund returns anywhere between 50-125 basis point. (100 basis = 1%.) Our data shows that the investor returns in India are much lower than fund returns. When investor return is less than total return, it means that more investors participated in the downside returns and less in the upside returns. This sometimes happens when investors chase returns and assets flow into a fund at its peak of performance. This effect can be exacerbated when investors aim to break even and refuse to sell a losing fund.

Investor returns are often lower than fund returns.

A study done on the Indian equity fund flows shows that an astounding 85-90% of flows have been into funds that performed well based on the recent one-year return. In 2020, one fund house received net equity inflows greater than all 39 fund companies combined.

Can you solely rely on fund performance?

We did a study of actively managed diversified funds outperformance to their benchmark over a ten-year period from July 2009 to June 2019 and found that out of 120 months, only eight months accounted for the entire outperformance of funds versus benchmark. Thus, if you did not stay invested in those funds for those eight months, you would have missed out on the returns. Funds will go through different parts of the cycle. You must stay invested in that fund to make the most of that outperformance. Investors should not try to time investments in actively managed equity funds.

We all know that asset allocation is the building block of efficient investment portfolios but fund selection can add significant alpha to the portfolio. Often, historical performance is the most common method for fund evaluation.

Looking at the performance tells you something, but it doesn’t tell you a lot of things unless you dig deeper to understand the drivers of that performance. We use a proprietary Morningstar Risk-Adjusted Return (MRAR) which gives more weight to downside variation and does not make any assumptions about the distribution of excess returns. MRAR is an evolved form of Sortino or Sharpe ratio which helps you choose funds that are less volatile and consistent.

Morningstar Direct offers a lot of quantitative tools such as portfolio diversity, sector diversity, equity liquidity, Environmental, Social and Governance (ESG) metrics, factor profiles to get insights into a fund.

The search for a fund should not just end with quantitative analysis. It should be looked at from a qualitative lens as well.

Some of the qualitative analysis you could use are:

- Evaluate the people and process driving that strategy.

- Studying fund manager historical styles can give you insights on the consistency of the process and how repeatable it has been.

- Skill or luck? Evaluating the performance attribution of funds can give you better insights into the source of alpha as well as linking it back to the investment style.

- Build a portfolio of diverse managers style. (growth and value)

People

- How long the manager has managed the fund. How relevant has been his experience?

- Understand his/her temperament and the investment philosophy. Does he/she stick to the mandate and understand the strengths.

- The number of funds managed by the manager. One fund manager may find it difficult to manage multiple funds. Thus, the lower the better.

- Understand the team's depth. Experience of other managers within the team and number of analysts. Look at the key man risk. Is the fund management process-oriented or people-oriented?

Process

- What is the strategy (top-down or bottom-up) and how does it translate into the portfolio?

- Understand the security selection and idea generation process.

- Is the manager doing what he/she is saying and doing it over a period of time? More importantly, is he/she sticking to conviction when markets are not in favour of that strategy?

- Is the portfolio consistent with the articulated process?

- How has the portfolio changed over time?

- Look at the performance attribution of the scheme: Has the major source of return come from one sector? If yes, then it is unlikely that the fund’s performance will be repeated in the future.

Diversification

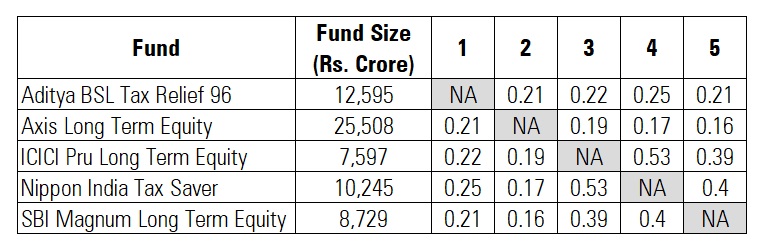

If you already have five funds in your portfolio and wish to add a sixth fund, you need to look at the underlying overlap of stocks with the existing funds. Common holding analysis tool offered by Morningstar help you in assessing the similarity of two fund’s portfolios.

From the above table, you can see that Aditya BSL Tax Relief 96 and Axis Long Term Equity have 21% common holding. Similarly, Aditya BSL Tax Relief 96 and ICICI Prudential Long Term Equity Fund have 22% overlap of stocks. ABSL Tax Relief 96 has 25% overlap with Nippon India Tax Saver. One should select a fund that has a low overlap with another fund.

Use these tools to screen and filter funds.