The Indian mutual fund industry witnessed an increased interest in Environmental, Social and Governance, or ESG, funds with the launch of several new ESG funds in 2020. In 2020, six ESG funds were launched in India. As a result, net inflows in ESG funds increased from Rs 22 crore in March 2020 to Rs 678 crore in March 2021.

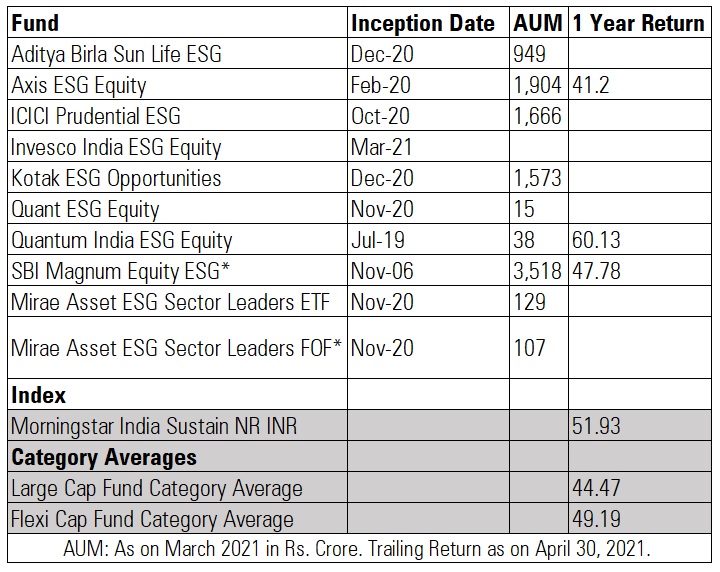

ESG Funds in India and their performance

The category average return (49.70%) of ESG funds has been on par with the Flexi Cap category which delivered 49.19% during a one year period as on April 30, 2021. ESG category outperformed the Large Cap category during the same period.

* SBI Magnum Equity ESG Fund was repositioned as an ESG strategy in 2018

* Mirae Asset ESG Sector Leaders FOF invests in the Mirae Asset ESG Sector Leaders ETF

Globally, led by Europe we are witnessing increasing interest towards ESG investing from asset owners, asset managers as well as investors. The Covid led crisis has only accelerated the demand for sustainable investing. While still early days in India from an ESG perspective, with the launch of ESG funds we are headed in the same direction. In the years to come, we expect ESG considerations to become an integral part of the overall investing framework for asset managers.

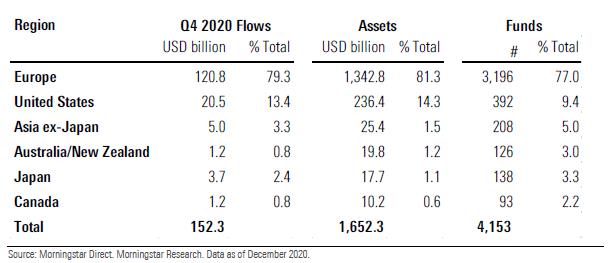

Global Fund Flows in ESG

Driven by increased investor interest in environmental, social, and governance issues and sustainable investing, sustainable funds notched up a record-breaking quarter in terms of flows, assets, and product launches. Global inflows into sustainable funds were up 88% in the fourth quarter of 2020 to $152.3 billion. Continuing to dominate the space, Europe accounted for almost 80% of these inflows. The United States took in 13.4%, up slightly from 12% in the last quarter, while flows in the rest of the world also grew, clocking in at $11.1 billion for Canada, Australia and New Zealand, Japan, and Asia combined. This is up from $9 billion in the second quarter. Assets in sustainable funds hit a record high of $ 1,652 billion as of the end of December, up 29% from the previous quarter.

The strong inflows speak of the growing investor interest in ESG issues, especially in the wake of the coronavirus crisis. The disruption caused by the COVID-19 pandemic has highlighted the importance of building sustainable and resilient business models based on multistakeholder considerations. The average outperformance of sustainable funds in the first quarter globally has also helped alleviate some investors concerns about a potential return trade-off in sustainable strategies.