From reaching a high of 62,245 on October 19, 2021, the Sensex has corrected 8% so far on the back of Foreign Institutional Investors (FII) selling spree. FIIs have sold $13 billion worth of shares since the beginning of the financial year.

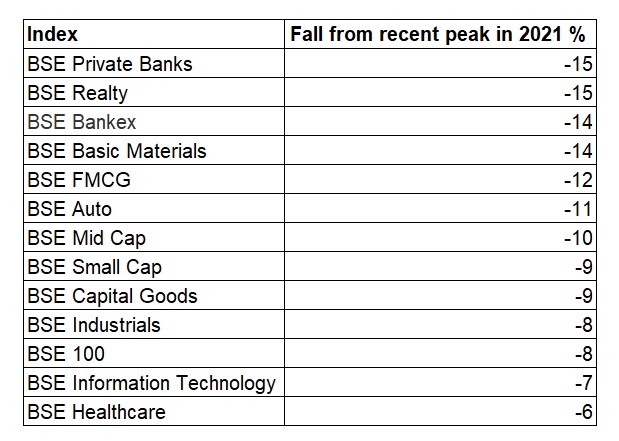

From October 2021, there has been a correction across the board. The BSE Private Bank Index has corrected the most (-15%) in the recent past. Here’s a look at how different sectoral indices have performed as of November 29, 2021, from their recent peak (Oct-Nov) in 2021.

Why the stock market has slumped

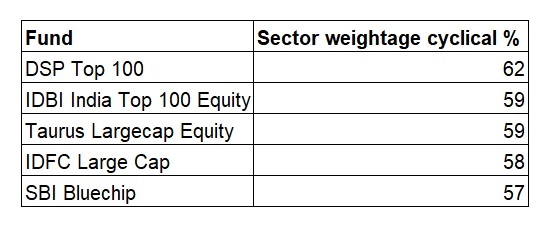

Large Cap

In the Large Cap Funds category, 64% of funds (21 out of 33 funds) are holding more than 50% of their net portfolio exposure to cyclical, which include basic materials, consumer cyclical and financials as of October 2021.

Basic Materials: This sector includes companies that manufacture chemicals, building materials, and paper products.

Consumer Cyclicals: This sector includes retail stores, auto and auto parts manufacturers, companies engaged in residential construction, lodging facilities, restaurants, and entertainment companies.

Financials: Companies that provide financial services, including banks, savings and loans, asset management companies, credit services, investment brokerage firms, and insurance companies.

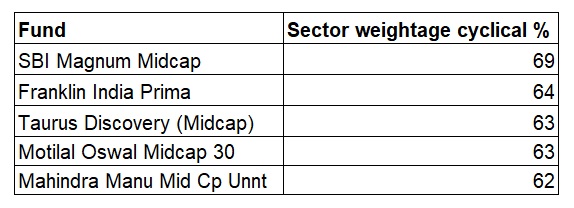

Mid Cap Funds

Almost 68% (19 out of 28) of Mid Cap funds have over 50% of their portfolio exposure to cyclical. Here are five schemes that have the highest exposure towards cyclical.

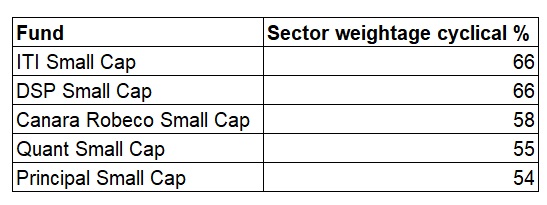

Small Cap

In the Small Cap category, 10 out of 26 funds have over 50% of their sector weightage towards cyclical. The remaining 16 funds on average are holding 43% of weightage towards cyclical. Here are five funds that had over 50% allocation towards cyclical.

(All sector weightage is as of October 2021.)

Capex will help

Arvind Chari, Chief Investment Officer - Quantum Advisors, says that cyclicals typically do well in an economic revival which is evident by growing exports on the back of revival in global demand.

“Globally, there has been a fiscal expansion to spur demand, which is leading to higher exports from India. Despite supply chain problems, exports are significantly higher than before. During expansion, cyclical products get exported. It could be metals, chemicals, garments, textiles. Companies that are engaged in these products will see improvement in earnings. If implemented well, the government's Production Linked Incentive (PLI) can lead to $25-30 billion capex over the next two years."

Arvind also believes that real estate and the ancillary sectors could benefit.

"Interest rates are at a decade low. So the affordability is relatively better. During the pandemic, people have realised that they need bigger houses. This spurs demand for cement and ancillaries like furnishing, paint, electricals, etc. All the tailwinds are in place for a sustained revival. That said, there are some risks like inflation and higher oil prices, but India has tackled them before. We are playing cyclicals which are available at a certain discount to the market.”

Quantum Long Term Value Fund has almost 63% weightage of cyclical which include basic materials, consumer cyclical and financial services. The fund’s top pick in financial services is Housing Development Finance Corporation.

Financials and industrials look good

Trideep Bhattacharya, Co-Chief Investment Officer- Equities, Edelweiss AMC, says that economy-facing sectors like select financials, industrials and of course, direct and indirect plays on the real-estate sector is a fertile hunting ground for him.

“Based on our analysis of capex intentions of the corporate sector, combined with decade-low interest rates, we believe, India could witness a strong capex cycle over next 2-3 years, something that we haven’t seen since demonetisation times. Also, the structural reforms by the Indian government over the last 2-3 years could potentially increase India’s GDP growth by a percentage or two over the medium-term. We keep looking out for stock ideas across sectors that are direct or indirect plays on the same. The ensuing market correction provides us with attractive opportunities in these areas over time.”

Edelweiss Mid Cap Fund has 3.30% weight to real estate, 18.60% exposure to financials, 15.06% to industrials.

Atul Bhole, Senior Vice President & Fund Manager, DSP Investment Managers, says that he is finding opportunities in financials, particularly private financiers. “Financials space was already underperforming even before this correction. Valuations have become more attractive while businesses are seeing a huge improvement in profitability. Though there are fresh worries from new variant and another wave hitting, we believe the correction provides very good buying opportunity given the way macro-economic parameters are economic shaping up.”

DSP Top 100 Equity, which manages assets worth Rs 2,882 crore as of October 2021 has 43% weightage to financial services, which include banks, NBFCs and insurance firms.

Ashutosh Bhargava, Fund Manager and Head Equity Research, Nippon India Mutual Fund says, "Our bias is still towards domestic cyclicals where earnings momentum and upgrades are strong. That includes financials and industrials."

Rahul Singh, Chief Investment Officer - Equities, Tata Mutual Fund, says that multiple sectors are doing well at the same time ranging from defensive export-led sectors like IT/pharma to domestic cyclicals like real estate and industrials.

"A diversified approach towards sectors is more suitable at this point in time. On a risk-reward basis, however, banking & financial services and industrials/capital goods appear slightly better placed given the stage of the cycle and relative valuation comfort vs. the market."

Stock specific market

What should investors focus on going ahead? Shreyash Devalkar, Senior Fund Manager – Equity, Axis Mutual Fund, says that investors should focus on earnings rather than FII trend. He believes that valuations have not become very attractive despite the fall from peak and alpha could be generated through stock-specific calls.

“Banks, FMCG and to some extent pharma companies got re-rated relatively lesser than other sectors on a price to book basis during and post-Covid. Their valuation has remained the same despite the fall in markets. The rest of the sectors got re-rated substantially over pre-covid and post-covid basis. Buying should be based on the outlook from here on. We are heading into that zone where stock-specific bets will generate alpha. The recent fall in the market has not changed relative valuation. The sectors which were relatively expensive continue to remain expensive even now. similarly, the sectors which were relatively cheaper during the peak continue to remain cheap."

Shreyash is bullish on the IT sector and believes that one should be choosy when it comes to pharma.

"We are looking at individual stories across sectors. Based on the commentary from companies, the outlook for IT sectors remains encouraging. The pharma sector is stock-specific. Only during a short period of time these stocks behave in a homogenous manner. During 1-year, 3-year basis, individual stocks give a wide set of returns.”

Shridatta Bhandwaldar, Head – Equities, Canara Robeco AMC, believes that domestically oriented sectors like discretionary, financials, industrials, housing value chain, cement, etc can be a good opportunity assuming no incremental lockdowns or large COVID wave. “After a very broad-based rally, selection will play a more important role than allocation from a market perspective over the next 12-18months.”

(Data source: Morningstar Direct.)