The Indian market has corrected 14% so far from its peak of 61,765 achieved in October 2021 on the back of continued FII selling. In 2022, the Sensex reached its peak of 61,308 on January 17. The index has corrected 13% so far as of June 27, 2022.

Consequently, most equity fund categories are in red. From January 1, 2022, to June 27, 2022, S&P BSE Small Cap Index has witnessed a drawdown of -24.56%. S&P BSE Midcap TR has seen a drawdown of -19.22% while S&P BSE 100 has seen a drawdown of -15.68%.

The true test of a fund manager is generating superior returns relative to peers and benchmark during both - bull and bear markets while adhering to his/her investment mandate.

We looked at which funds from Large, Mid and Small Cap categories that have protected the most downside or had the least drawdown during this volatile period YTD as of June 23, 2022. What is Maximum Drawdown? It is measured as portfolio’s maximum loss in a peak-to-trough decline before a new peak is attained. Maximum Drawdown is usually quoted as the percentage between the peak and the trough. It is an indicator of downside risk over a specified time period.

For example, if a portfolio has an initial value of 5,00,000 that increases to 7,50,000 over a period of time, before dropping to 4,00,000. It then rebounds to 6,00,000 before dropping again to 3,50,000. Subsequently, it more than doubles to 8,00,000.

The maximum drawdown, in this case, is as follows:

3,50,000 - 7,50,000/ 7,50,000 = 53.33

Downside can be protected in two ways: superior stock selection or high cash holding during a falling market.

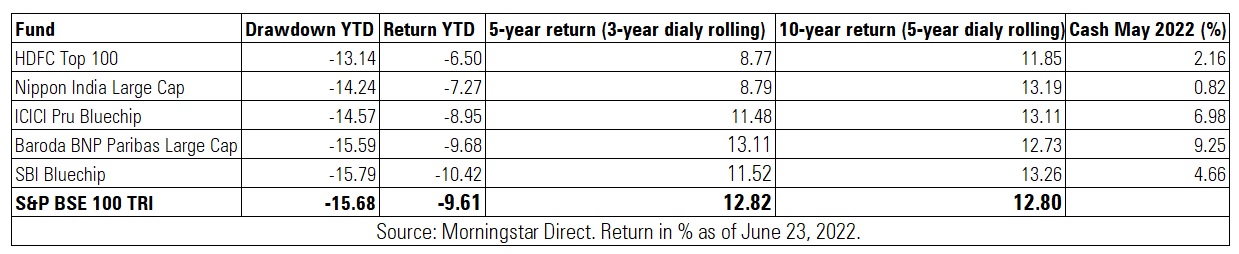

Large Cap

Launched in 1996, HDFC Top 100 Fund saw the least drawdown YTD (June 23, 2022) at -13.14% against the benchmark S&P BSE 100 TRI which fell by -15.68%. However, the fund has seen the highest drawdown among the category over a ten-year period, which is at -41%. The fund has underperformed its benchmark over a five- and ten-year period as of June 23, 2022.

Only seven funds have outperformed the BSE 100 Index over a ten-year period as of June 23, 2022, while 25 funds have underperformed. Funds that have outperformed are Mirae Asset Large Cap Fund, PGIM India Large Cap Fund, Axis Bluechip Fund, SBI Bluechip Fund, Canara Robeco Bluechip Equity Fund, Nippon India Large Cap Fund, and ICICI Prudential Bluechip Fund.

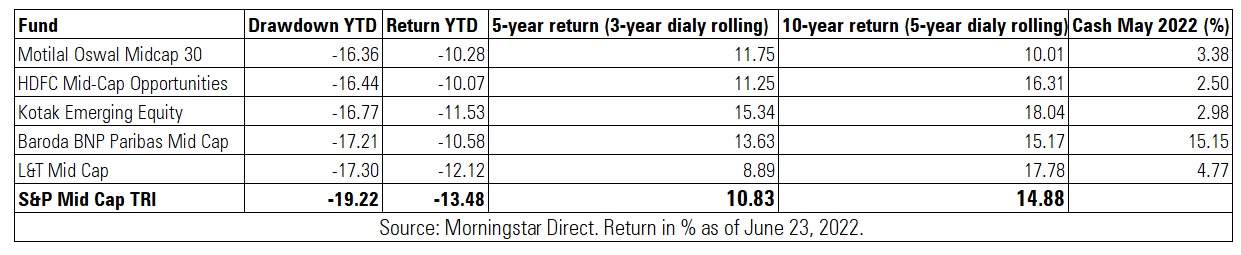

Mid Cap

Motilal Oswal Midcap 30 witnessed the least drawdown of -16.36% YTD, while the S&P Mid Cap fell by -19.22%. However, the fund has not been able to beat its benchmark over a ten-year period.

HSBC Mid Cap Fund has seen the highest drawdown YTD as of June 23, 2022, at -24.96%.

HDFC Mid-Cap Opportunities Fund saw the second least drawdown at -16.44% YTD as of June 23, 2022. The fund has outperformed its benchmark over a five- and ten-year period.

Over a ten-year period as of June 23, 2022, 13 funds have outperformed while eight have underperformed. Funds that have outperformed over a ten-year period are Kotak Emerging Equity Scheme, L&T Mid Cap Fund, Edelweiss Mid Cap Fund, Axis Midcap Fund, DSP Midcap Fund, Invesco India Mid Cap Fund, HDFC Mid-Cap Opportunities, Tata Mid Cap, Taurus Discovery (Mid Cap), Franklin India Prima Fund, UTI Mid Cap Fund, ICICI Prudential Mid Cap Fund and Baroda BNP Paribas Mid Cap Fund.

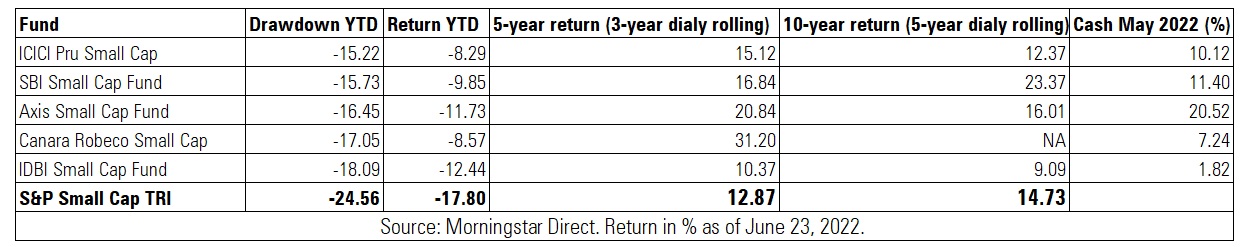

Small Cap

ICICI Prudential Smallcap Fund witnessed the least drawdown of -15.22% YTD against the benchmark S&P BSE Small Cap which fell by -24.56%. This Fund has outperformed its benchmark over a five-year period but underperformed over a ten-year period.

Over a ten-year period, seven funds have outperformed S&P BSE Small Cap TRI while eight funds have underperformed. Funds that have outperformed their index over a ten-year period are SBI Small Cap Fund, Nippon India Small Cap Fund, DSP Small Cap Fund, Kotak Small Cap, HDFC Small Cap, Axis Small Cap Fund, and Franklin India Smaller Companies Fund.