We tend to let price dictate our investments. The current IPO frenzy is an example to explain this point. Investors appear to be focusing on recent listing gains before making decisions, which is nothing but recency bias.

This leads to pro-cyclical behaviour—buying after (and often because) something's gone up or selling after (and often because) something's gone down. This phenomenon is universal across investments, and not just stocks. We also know this behaviour as performance chasing.

Focus on fundamentals, not just stock price

How can investors know when to stay put and when to sell? The answer lies in focusing on fundamentals while keeping a close eye on valuations. Doing so would give us a better understanding of the drivers of return, which in turn helps us decide when to stay the course and when to chart a new one.

Stocks at rarely bought at fair valuations. You either buy overvalued or undervalued stocks. Hence, making a fair assessment of market valuations helps in restricting portfolio drawdowns as the exposure to an overvalued asset will be limited.

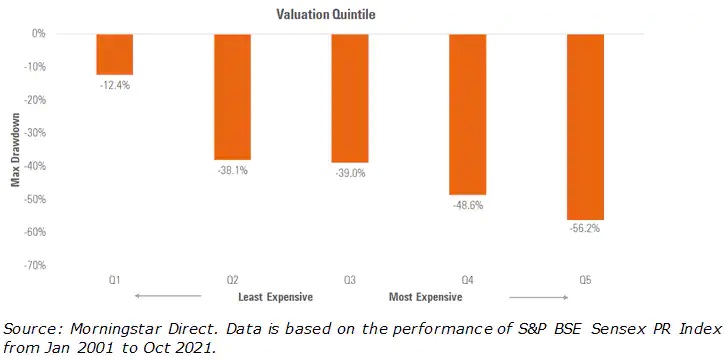

For instance, let’s consider Indian equities. We looked at the price/earnings multiple of the S&P BSE Sensex over two decades and segmented them into five different buckets or quintiles in ascending order.

Quintile 1 refers to the group with the lowest P/E ratios (least expensive valuation zone) and quintile 5 refers to the highest P/E ratios (most expensive valuation zone).

Then, we looked at how much markets have fallen from their respective peaks (maximum drawdown, peak to trough fall) five years ahead of these respective P/E multiples by considering them as investment starting dates.

For example, an investment made on December 31, 2002 (P/E of 14.4x – Quintile 1) witnessed a maximum drawdown of -12.4 percent in the subsequent five-year period. But an investment done on Dec 31, 2007 (P/E of 27x – Quintile 5) witnessed a maximum drawdown of -56.2 percent in the subsequent five-year period.

This clearly explains the role that valuation plays in limiting portfolio drawdowns. Being valuation-driven investors, we are acutely aware of how valuation or, more specifically, the change in valuation will impact returns. Ignoring these impacts may have serious consequences for investors.

Are equity markets overvalued now?

Talking of Indian equities, markets have now posted a remarkable 18-month rally after falling sharply early last year on fears that COVID-19 would present lasting challenges for the global economy. But the domestic economic recovery has been sharp. The supportive environment is evolving quickly, and the economy is expected to bottom out in Q2 2021-22.

The economic activity is expected to exceed pre-pandemic levels in FY 2022 with the GDP expected to grow at 9.5 percent. Technically, the economy would then move from the recovery phase to the expansionary phase.

From an investor’s perspective, we saw the classic recovery plot, with equity investors front-running the economic recovery (the large-cap index trailing price-to-earnings ratio expanded from under 18 times to over 34 times) while corporate earnings started to pick up and took the driver’s seat (as earnings accelerate, the P/E ratio is expected to deflate). In a forward-looking sense, many market participants are still encouraged by the economic recovery, with strong corporate earnings and cheap interest rates.

Others are beginning to question the durability of the recovery, likely impact of the new COVID variant, high inflation driving central banks to reduce monetary stimulus, and expensive market valuations. Focusing on fundamentals, with an eye on valuation and its impact on implied prospective return, is the right approach, in our opinion.

What should investors do with equity now?

Deep fundamental research can help us identify those opportunities where the winds may shift and incorporate the additional return into our expectations.

The exceptional returns that markets have delivered in the last 18 months may not be repeated in the near future. Rather, investors should focus on risk-adjusted performance and not on absolute performance as it can result in performance chasing behaviour. Focus on risk-adjusted returns—to make a better judgement about how the portfolio is able to navigate different market pathways while achieving investment goals. Also, keep an eye on how much equities your portfolio allows you, based on your risk tolerance and profile. This prevents you from over-buying and over-selling.

The article was first published on Moneycontrol.