Which asset classes are negatively correlated to equity, in order of correlation? I want to know so that I can diversify accordingly.

Any pair of assets with less than perfect correlation (i.e. less than +1) with each other provide the benefit of diversification in the overall portfolio.

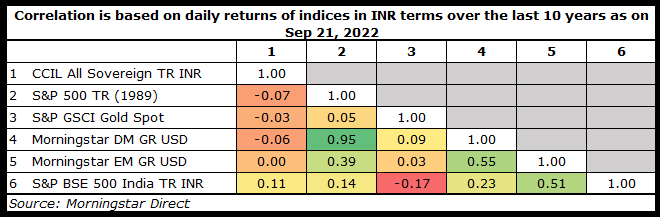

One can see from the table that domestic fixed income (row 1) has a low to negative correlation with most asset classes (refer column 1).

Domestic equities (row 3) have a negative correlation with gold and a low correlation with developed and emerging market equities (refer column 3).

Click on the image to enlarge.

This is why multi-asset portfolios, comprising a mix of asset classes, can be expected to minimize portfolio volatility, lower the risk of drawdown and optimize the risk-adjusted performance of the portfolio.

Here are some practical pointers

Investors should ideally follow an asset allocation-based approach for investing towards one’s goal. While fixed-income lends stability to the portfolio, equities play a crucial role in wealth generation over the long run with the potential to deliver superior inflation-adjusted returns compared to fixed-income.

It is advisable to get your risk appetite assessed before deciding upon the asset allocation.

Diversification is an important aspect to look at while building your portfolio, as it cushions the portfolio against any adverse movements since different asset classes, (equities, fixed-income, gold, real estate) and even securities within an asset class respond differently to the same set of economic drivers.

From a diversification standpoint, one should also consider an allocation to international equities (10-25% of your equity allocation) which offer diversification across geographies with exposure to diverse economic growth drivers and offer a hedge against the depreciation of the rupee.

Investors should also evaluate the sector and style diversification (value/growth) at a portfolio level, and also the extent of overlap in the equity funds in your portfolio to assess the true degree of diversification that the portfolio equity funds offer. Ideally one should look to diversify your portfolio across 2 or more funds (depending on desired sub-asset class exposure and investable corpus) to reduce concentration to the calls of a single fund manager and/or fund house.

Do read my earlier article: Is asset allocation only between equity and debt?

Articles authored by senior investment analyst Mohasin Athanikar

Registered readers can post their queries by accessing the Ask Morningstar tab. Our team will answer SELECT queries relating to mutual funds, portfolio planning and personal finance. While we provide broad guidelines, we suggest you consult a financial adviser before making investment decisions.

ASK MORNINGSTAR archives