This year, we bring you the 16th edition of the Morningstar Fund Awards, a programme that recognizes excellence in the Indian fund industry. The objective of the Morningstar Awards for Investing Excellence program is to recognize funds and asset managers that have not only delivered strong risk-adjusted returns in the past but are also deemed capable of serving investors well going forward. In India, these awards are selected using a combination of past performance and risk and Morningstar’s forward-looking rating for funds, the Morningstar Medalist Rating™, including its Parent pillar component.

There are two types of Morningstar awards which are announced in India: the Morningstar Category Awards and the Morningstar Asset Manager Awards.

Let us now look understand the fund award methodology and check the short listing and screening process of the awards.

Morningstar Category Awards

The Morningstar Fund Awards recognizes funds that have added the most value for investors within the context of their relevant peer group in 2023 and over longer time periods. The methodology emphasizes the 1-year period, but funds must also have delivered strong 3-year and 5-year returns after adjusting for risk within the awards peer groups to obtain an award. Further, any fund that has not outperformed its Morningstar category median in at least three of the past five calendar years is removed from consideration, unless Morningstar's qualitative analysts believe a fund has exceptional merit that the criteria fail to capture.

Insurance funds, closed-end funds and funds in unrated Morningstar categories are exempted. In addition to that, smallest 10% of funds in each category or funds with less than INR 1000 million in assets at last known date are excluded.

Then, each fund in a relevant grouping is scored as follows:

Return Score = 80% of total score

One year: 30% of total score, based on 1-year return percentile rank in Morningstar Category

Three- and five-year: 50% of total score, of which:

- 40%: 3-year return percentile rank in Morningstar Category

- 60%: 5-year return percentile rank in Morningstar Category

(Note: 3-year and 5-year scores are scaled to represent 40% and 60% of the long-term portion of the return score, respectively. The 3-year return score constitutes 20% of the total score, and the 5-year return score constitutes 30% of the total score.)

Risk Score: 20% of total score

Of the risk score:

- 40%: 3-year Morningstar Risk percentile rank in Morningstar Category

- 60%: 5-year Morningstar Risk percentile rank in Morningstar Category

(Note: 3- and 5-year scores are scaled to represent 40% and 60% of the total risk score, respectively. The 3-year risk score constitutes 8% of the total score, and the five-year risk score constitutes 12% of the total score.)

Based on above weights, the effective weight of each year in the calculation is as follows, including both risk and return (figures are rounded to nearest whole number):

- Past one year: 48%

- Second year out: 18%

- Third year out: 18%

- Fourth year out: 8%

- Fifth year out: 8%

The weights are designed to place due emphasis on the most recent year, given that the awards are annual in nature, but are also meant to favor those funds that have delivered risk-adjusted outperformance on a sustained basis over the longer term.

Forward-looking Views and Qualitative Review - In Morningstar categories or groupings of Morningstar categories where the Morningstar Medalist Rating is available, share classes carrying a positive rating - Bronze, Silver or Gold at the time of the selection - are given priority in the ranking. This is intended to ensure that highly ranked funds have not only delivered strong risk-adjusted returns in the past but are also capable of serving investors well going forward.

If no positively rated share classes meet the eligibility and accessibility criteria, then Neutral-rated share classes may be considered as winners. Share classes that carry a Morningstar Medalist Rating of Negative at the time of the selection are excluded.

Furthermore, the potential winners in each category awards are subjected to a qualitative review that entails the following checks:

- Accessibility: fund's share classes that are deemed inaccessible to local market investors will be excluded. All institutional share classes will be removed unless they are readily available to retail investors.

- Morningstar Medalist Rating Stability: for awards relying on the Medalist rating, the analysts assess the stability of the rating by looking at its evolution in the past six months. Funds that have seen ratings changes may be excluded.

- Performance Sustainability: if the analysts have concerns that a fund cannot continue to outperform (excessive fees, upcoming change in fees, upheaval at the parent company, loss of one or several key investment professionals, change in investment strategy, deviation from its stated mandate, extreme portfolio characteristics compared with category peer, among others), then it may be excluded, subject to approval by the Head of Manager Research, Europe and Asia-Pacific.

Upon completion of this review, the fund in each eligible Morningstar Category or grouping receives the award for that Morningstar Category or Category grouping.

Morningstar Asset Manager Awards

These awards are given to the asset managers that have strong-performing fund lineups on a risk-adjusted basis. These awards also strive to highlight asset managers that show a resolute focus on serving the interests of investors.

Only those funds with five-year performance record are included in the quantitative scoring. Thus, funds without five-year records or funds in unrated Morningstar Categories are excluded from the scoring process. Additionally, there is a minimum number of eligible funds to participate.

The Awards selection is based on quantitative score and our Morningstar Parent Pillar Rating assigned either by the algorithm or the analysts. Our goal is to leverage our analysts' insights on asset managers where possible, with the aim to steer investors towards firms that have served them well over time and that put their interests first.

For this award, Morningstar calculates House Scores using the following methodology:

- Determine the five-year Morningstar Risk-Adjusted Return (MRAR) for each share class of each fund run by a given firm, and the percentile rank of that return score within its Morningstar Category.

- Determine the average percentile rank of each fund's MRAR by taking the mean MRAR percentile rank of all its classes.

- Determine the mean percentile rank of each fund house's MRAR by taking the mean of its funds' MRAR percentile ranks (the lower a group's mean percentile rank, the better its performance).

Parent Rating and Qualitative Review – In India, given Morningstar Medalist Rating is available, the selection incorporates the Parent pillar rating, assigned by algorithmic techniques or by an analyst’s qualitative assessment. Firms carrying a positive Parent pillar (High or Above Average) are given the priority in the ranking over Neutral-rated firms. Firms carrying a Parent rating of Below Average or Low at the time of the selection are disqualified unless our analysts find mitigating circumstances not currently captured by the parent pillar rating.

Furthermore, the potential winner will be subject to a qualitative review by Morningstar India’s qualitative analysts, who have the option to disqualify a firm if there are extenuating circumstances. These might include (but are not limited to) the loss of a group of talented managers, substantial increases to fund expenses, non-availability of the house's funds to retail investors in the relevant market or being taken over by another group. Each disqualification must be approved by the heads of Morningstar’s European Research. The review is intended to prevent giving an award on the basis of performance that we believe is unlikely to be repeated due to structural factors.

The firm that meets all the criteria will receive the Morningstar Asset Manager Award.

This year there will be one Best Asset Manager Award instead of three in the previous years.

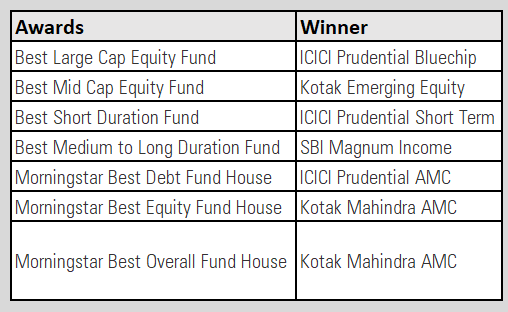

But before we announce the nomination list for this year’s awards, let us go back in time to recognize the winners of last year’s i.e. 2023, awards.

Click here for the full coverage of last year’s winners of the Morningstar India Fund Awards.

Watch out this space as we will soon announce the nominees of Morningstar Fund Awards, India 2024

The winners of the Morningstar Fund Awards, India, will be declared on March 20, 2024.

Please click

here for the full disclaimer.