As we mentioned in A step-by-step guide to getting insured, a crucial factor to look at when narrowing down on an insurance company is its claim settlement ratio. Think about it. The very purpose of insurance will be defeated if the claim is not provided for when required. This assumes all the more relevance when the beneficiaries are dependent on the insurance proceeds. In such a situation, a claim being denied will be a huge financial setback.

So what does a claim settlement ratio actually tell you? It refers to the total number of death claims settled by an insurance company. The calculation is done by dividing the total number of death claims received by the total number of them settled.

For instance, if a life insurance company receives 1000 death claims and settles 980, the claim settlement ratio of that company would be 98%. The higher the claim settlement ratio of the company, the more favourable it would be for individuals.

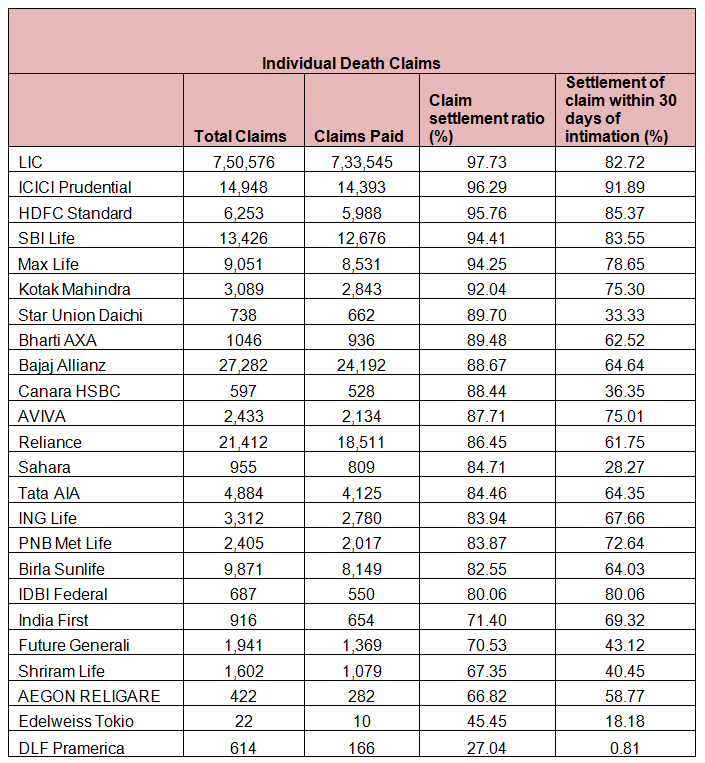

According to data provided in the annual report of the Insurance Regulatory Development Authority, or IRDA, six life insurance companies had a claim settlement ratio of above 90% in FY2012-13. Reproduced below, you can access this data on the IRDA website.

What also matters is the duration of the claim settlement - how fast you get your proceeds on intimating the insurance company. A look at the table shows that ICICI Prudential settled almost 91% of their claims in a period of less than 30 days. HDFC Standard life, SBI Life and LIC followed with above 80% of the claims being settled within 30 days.

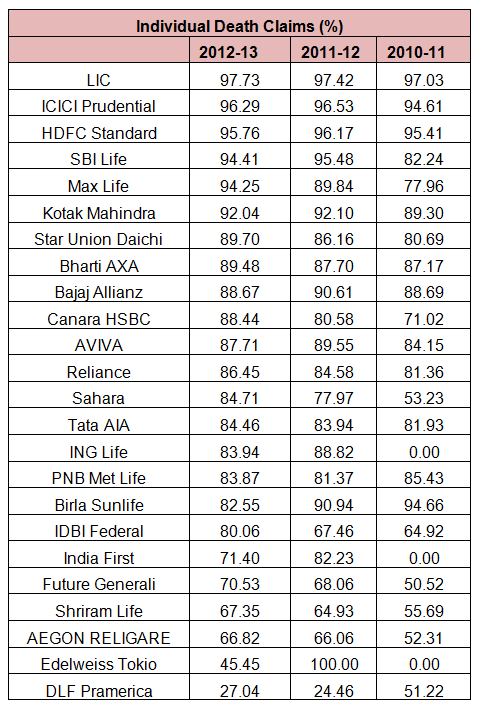

We suggest you also look at how consistent the insurance company has been with regards to its claim settlement. This is because this ratio is not static but changes every year. The table below shows the claims settlement ratio over the past three financial years.

Drawbacks

The ratio declared is the sum total of all claims honoured by the company for all its life insurance policies and products. So what we see is the average and not the exact ratio for each type of policy – term insurance, endowment cover, money back policy, child plan, online plan or offline, group insurance or individual cover, and so on and so forth.

Also, what we see is the figure in percentage terms, not the actual number. So it is not clear how many claims the company actually rejected. Let’s say an insurance company rejects 100 out of 1,000 claims, giving it a claim settlement ratio of 90%. The next year it gets 10,000 claims but rejects 500. Its claim settlement ratio goes up to 95% but it has rejected more claims.

There are other factors too.

A claim within a year or two of taking the policy calls for a detailed investigation. If there are many such claims, then it would affect the claim settlement ratio. Also, if the sum assured is very high, then the insured undergoes varies medical check-ups before the insurance policy is issued. So these claims are processed faster giving no reason why the claim should be repudiated. It could also be the case where policy holders have held back facts. Misstated, incorrect and insufficient data provided by individuals at the time of buying the policy could lead to claims being rejected. This is no fault of the company.

To be on the safe side, look at the claim settlement ratio over a number of years when making your selection.